Animoca’s Billion-Dollar Nasdaq Play Could Open Crypto to Wall Street

Web3 giant signs non-binding agreement with Nasdaq-listed company for potential acquisition that would create combined entity valued at billions.

By Amoo Jubril

November 3, 2025 at 1:42 PM

Last updated

November 3, 2025 at 1:44 PM

KEY FACTS

- Animoca Brands entered into non-binding term sheet with Nasdaq-listed Currenc Group on November 3, 2025, for potential acquisition via Australian scheme of arrangement where Animoca shareholders would own 95% of combined entity.

- The transaction remains conditional on due diligence completion, board approvals, shareholder votes from both companies, and Australian court approval, with no definitive agreement yet reached.

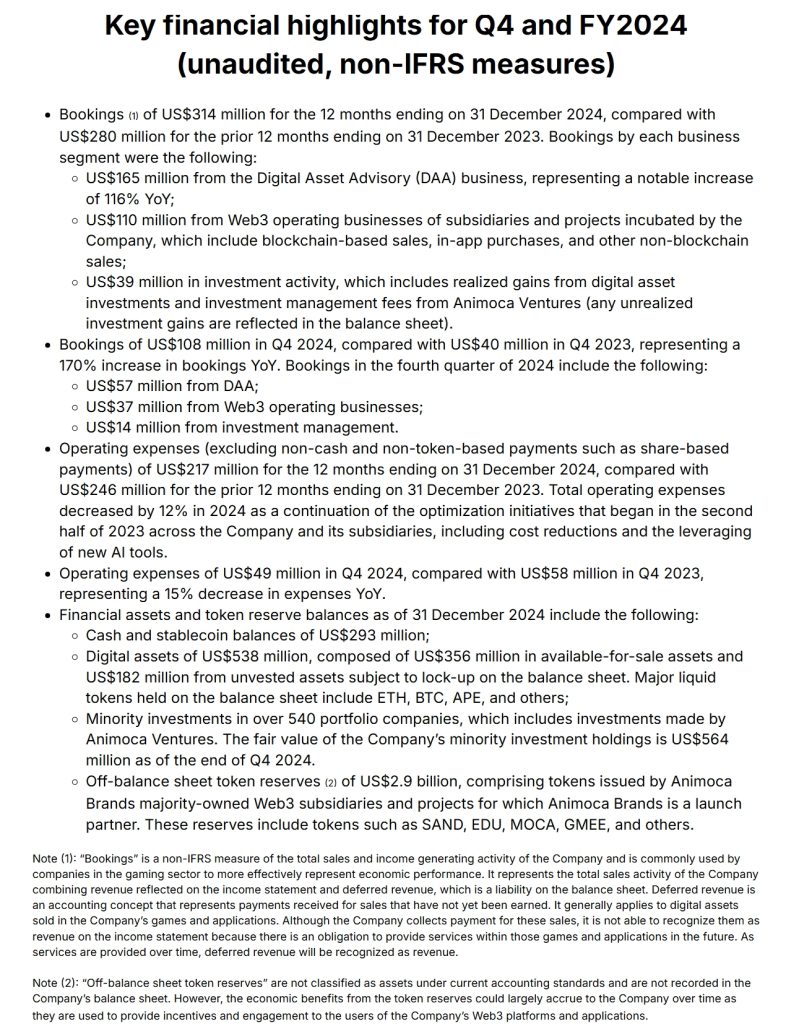

- Animoca's 2024 financials show Digital Assets Advisory division generated $165 million (up 116% YoY), surpassing traditional gaming revenue while the company holds $293 million in cash and $2.9 billion in token reserves.

Animoca Brands Corporation Limited has entered into a non-binding term sheet with Nasdaq-listed Currenc Group Inc. on November 3, 2025.

The agreement outlines a potential acquisition where Currenc would acquire 100% of Animoca Brands’ issued shares through an Australian scheme of arrangement.

Under the proposed structure, all Animoca Brands shares would be exchanged for newly issued Currenc shares.

The transaction remains conditional and non-binding, with both parties required to complete due diligence and obtain board approval before proceeding to definitive documentation.

If implemented, Animoca Brands shareholders would collectively own 95% of Currenc’s issued shares, subject to final agreement on convertible instrument treatment.

The remaining 5% would be held by existing Currenc shareholders.

Animoca’s Ownership Structure and Transaction Terms

Yat Siu, Animoca Brands’ Co-Founder and Executive Chairman, along with his controlled entities, would receive a newly created class of Currenc ordinary shares.

All other Animoca Brands shareholders would receive standard new Currenc ordinary shares for their holdings acquired under the scheme.

The Potential Transaction faces multiple conditions precedent requiring agreement between both parties.

These include approval by Currenc shareholders, approval by Animoca Brands shareholders, court approval in Australia, and other customary closing conditions.

Following implementation, Animoca Brands would become part of a combined group listed on Nasdaq. Currenc may undertake a corporate restructuring exercise before the transaction closes.

The Term Sheet may be terminated in certain circumstances. As no definitive agreement has been reached, no assurance exists that any transaction will be agreed upon or implemented.

Animoca’s Strategic Pivot and Financial Performance

Animoca Brands’ most recent year-end financial report, released in March 2025, revealed a significant strategic shift.

The company’s Digital Assets Advisory division generated $165 million in 2024, representing a 116% year-over-year increase.

This advisory unit provides web3 projects with token advisory, tokenomics, marketing, listing advisory, node operation, and trading services. The division has surpassed Animoca’s traditional revenue source from gaming and NFTs.

The company generated $110 million in bookings from web3 businesses, while $39 million came from investment gains and venture management fees.

This represents approximately 40% year-over-year drop from the $182 million reported previously.

Meanwhile, Animoca strengthened its balance sheet in 2024. The company held $293 million in cash and stablecoins, $538 million in digital assets, and $2.9 billion in off-balance-sheet token reserves.

Minority investments totaled $564 million across 540 companies. The figures reflect a 67% increase in cash reserves and a 165% rise in digital asset holdings compared to the previous period.

The number of portfolio investments increased from 450 to 540.

However, Animoca’s private investment holdings dropped 18%, falling from $690 million to $564 million due to token unlocks, equity exits, and asset write-downs.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Amoo Jubril

Writer

Amoo Jubril

Writer

I’m a blockchain-focused content writer helping crypto brands build trust through storytelling that’s simple, authentic, and community-driven

Author profileTrending Today

TRIA

TRIA

$0.02

Bitcoin

BTC

$76,546.44

Zama

ZAMA

$0.03

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$33.7

Tether Gold

XAUT

$5,064.72

River

RIVER

$15.57

Solana

SOL

$98.21

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft