Bitcoin Falls to $69K on 15th Anniversary of First $1 Price — Down 50% From ATH as Bear-Market Risks Mount

The leading cryptocurrency trades 50% below its all-time high as analysts warn prolonged consolidation poses greater risk than further price declines

7 hours ago

Last updated

7 hours ago

KEY FACTS

- Bitcoin drops to $69K, down 50% from its October 2025 ATH above $126K

- CryptoQuant warns time capitulation poses greater risk than further price declines

- Technical indicators show oversold conditions but bearish trend remains intact

Bitcoin has returned to the $69,000 level, coinciding with the 15th anniversary of the day it first reached $1. The leading cryptocurrency by market cap traded at $68,869.76 at press time, recording a 2.49% decline over the past 24 hours and a 12.26% drop over the past week.

The pullback has pushed Bitcoin’s market capitalization down to approximately $1.37 trillion. Daily trading volume, however, climbed 17.26% during the same period. Since reaching an all-time high above $126,000 on October 6, 2025, Bitcoin has experienced a roughly 50% drawdown.

Over its 15-year journey from $1, Bitcoin has registered a 6,886,876% increase. The asset has evolved from an experimental digital currency into the world’s most recognized cryptocurrency, attracting institutional investors and retail traders alike.

Bitcoin ETF Inflows Contrast With Weekly Outflows

According to Lookonchain, Bitcoin exchange-traded funds recorded a net daily inflow of 3,286 BTC, equivalent to $227.77 million. On a weekly basis, however, ETFs registered a net outflow of 6,069 BTC, valued at $420.76 million.

CryptoQuant reported that Bitcoin remains approximately 50% below its all-time high. The analytics firm added that deeper drawdowns of 70–80% remain possible based on comparisons with previous bear market cycles.

The firm emphasized that the greater risk facing Bitcoin is no longer price but time. According to CryptoQuant, Bitcoin is increasingly vulnerable to time capitulation, where prolonged weak or sideways price action gradually exhausts investor conviction.

CryptoQuant noted that modern market structure, characterized by ETFs, institutional flows, and dominant derivatives markets, makes extended consolidation phases more likely than sharp, fast recoveries.

The firm stated that Bitcoin does not need to collapse further to remain in a bear market. Staying at depressed levels for an extended period can suppress demand, drain liquidity, and reinforce bearish sentiment.

Bitcoin On-Chain Data Signals Shift Toward Accumulation Phase

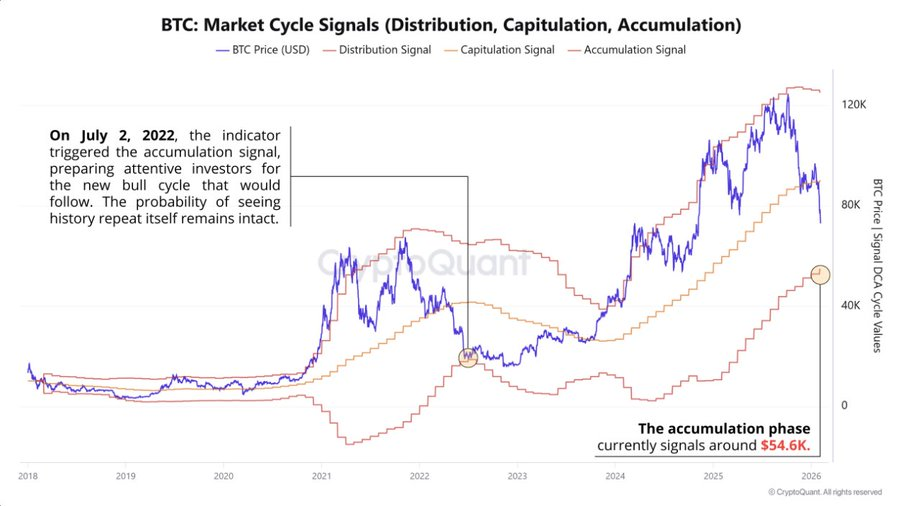

CryptoQuant also reported that one of its key cycle indicators is signaling a critical transition phase for Bitcoin. The firm noted that this indicator previously identified the bottom of the last bear market.

According to the analytics platform, Bitcoin’s current price is converging toward the indicator’s lower band. Historically, this convergence marks the beginning of an accumulation phase.

The accumulation signal is currently clustered around the $54,600 level. CryptoQuant stated this suggests the market may be approaching a zone where long-term investors typically begin systematic accumulation.

Referencing analysis by on-chain analyst GugaOnChain, CryptoQuant stated the convergence does not guarantee an immediate reversal. Instead, it points to a shift from capitulation toward early accumulation, where volatility remains elevated but downside momentum begins slowing.

Meanwhile, analyst Rekt Capital stated that history appears to have repeated itself. He noted that Bitcoin has experienced a key crossover that, in past cycles, consistently preceded strong downside moves. This pattern has now occurred for the fourth consecutive market cycle.

BTC Technical Indicators Signal Oversold Conditions Amid Bearish Trend

Bitcoin is trading at $68,922.63 on the daily chart, down 1.66% at the time of analysis. The primary trend remains strongly bearish since the peak around $110,000–$115,000, with clear lower highs and lower lows.

The Relative Strength Index stands at 29.91, placing Bitcoin in oversold territory. The MACD line reads -945.99 against a signal line of -4,792.46, with the histogram at -5,698.45, confirming extreme bearish momentum.

Critical support sits at $68,000–$69,000. Immediate resistance levels include $72,000–$73,500 and $78,000–$80,000. A breakdown below $68,000 could target $65,000–$66,000, with major macro support at $54,000–$56,000.

Volume spiked during the recent selloff, while bounce volume remains notably lower. This pattern suggests lack of buyer conviction. The bearish continuation scenario carries a 65% probability, with a relief rally to $75,000–$78,000 at 30% probability.

Price trajectory remains bearish. A sustained move above $80,000 with strong volume would be required to signal any meaningful trend reversal.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

LayerZero

ZRO

$1.78

Superform

UP

$0.05

Pudgy Penguins

PENGU

$0.01

Bitcoin

BTC

$68,576.17

Hyperliquid

HYPE

$29.44

BankrCoin

BNKR

$0

Solana

SOL

$82.43

Sui

SUI

$0.92

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft