Bitcoin Erases All 2026 Gains as Price Fall to $87K and Risk Appetite Fades

Nearly $490 million exits U.S. Bitcoin ETFs as whale selling intensifies and technical indicators point to potential $80K test

2 hours ago

Last updated

2 hours ago

KEY FACTS

- Bitcoin dropped to $87,960, erasing all 2026 gains as $490 million exited U.S. ETFs in one day

- Whale deposits exceeding $400 million to exchanges and negative derivatives data signal intensifying selling pressure

- Technical analysis shows bearish structure intact with $80,000 as the next major support if $86,411 breaks

Bitcoin has wiped out all its 2026 gains, falling to $87,960 after opening the year at approximately $88,000. The cryptocurrency experienced an 8.79% decline over the past week and a 1.73% drop in the last 24 hours. Risk appetite across financial markets has deteriorated sharply.

Nearly $490 million exited U.S.-listed Bitcoin ETFs in a single day. The CMC Fear & Greed Index dropped to 32, firmly in “Fear” territory. Both the Nasdaq and S&P 500 have also erased their 2026 gains, turning negative for the year.

Analysts warn Bitcoin could soon test critical support between $80,000 and $84,000. Geopolitical tensions and broader market volatility continue to weigh heavily on investor sentiment across asset classes.

BTC Faces Mounting Pressure as Whales Deposit Over $400 Million to Exchanges

According to Amr Taha on CryptoQuant, Binance derivatives data reveals sustained selling pressure since mid-January. Net Taker Volume, which measures buyer or seller aggression, has remained predominantly negative throughout this period.

On January 20, Net Taker Volume recorded approximately negative $319 million. This marked the second instance this month where the metric fell below negative $300 million. The previous occurrence on January 16 preceded Bitcoin’s decline from above $95,000 to below $90,000.

Large wallet activity has compounded bearish momentum. Data from Amr Taha’s Whale Screener showed deposits exceeding $400 million worth of Bitcoin into spot exchanges on January 20. A similar spike of roughly $500 million occurred on January 15, preceding a sharp drop from $96,000.

One notable whale, identified as bc1q8g, deposited 2,000 BTC worth $178.7 million into Binance. This whale had purchased the same amount at $109,759 three months prior. Selling at current prices would result in a $40.8 million loss.

The CEO of ARK Invest, Cathie Wood said when asked about Bitcoin and Crypto Volatility on CNBC, she said:

“We’re pretty well through the down cycle here,” ARK Invest CEO Cathie Wood said on CNBC. “Bitcoin may still test the $80,000–$90,000 range, but I think that test will be successful. This would be the shallowest four-year cycle decline in Bitcoin’s short history, and then we’re off again.”

Bitcoin Faces Regulatory Delays, ETF Outflows, and Trump Tariff Reversal

Progress on the Senate’s crypto market structure bill has stalled due to partisan disagreements and bank lobbying. Eric Trump accused Wall Street banks of blocking reforms. The White House has signaled resistance to industry-friendly provisions.

These delays threaten institutional adoption timelines. Bitcoin’s correlation with traditional risk assets has resurfaced as equities declined. The January 27 Senate Agriculture Committee markup hearing for the CLARITY Act remains a key event to watch.

Meanwhile, price volatility spiked following Trump’s Davos speech. Bitcoin initially surged $2,000, adding nearly $60 billion to the crypto market. However, just two hours later, the price dropped $3,200. Approximately $148 million in long positions were liquidated within 90 minutes.

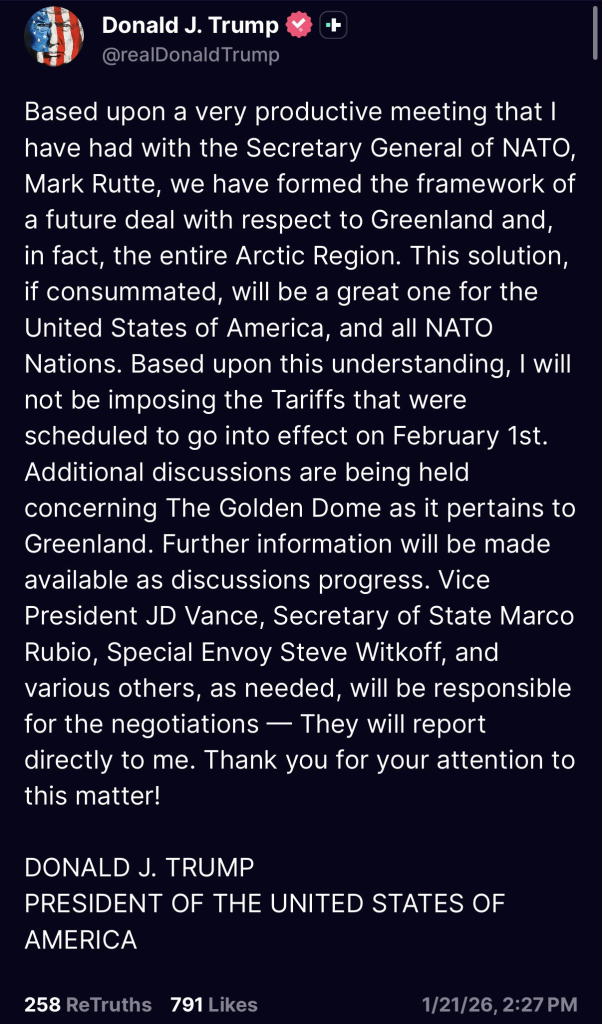

President Trump who has now announced that the planned 10% tariffs on European Union imports scheduled for February 1 will not be implemented. Following the announcement, gold and silver prices fell sharply, reflecting a shift away from safe-haven assets. Markets are now interpreting the decision as a potential bullish catalyst, easing trade-related uncertainty and supporting risk-on sentiment.

Bitcoin ETF flows reflect this instability. One-day net outflows reached 3,862 BTC, worth approximately $345.58 million. Seven-day net flows showed outflows of 6,382 BTC, according to Lookonchain.

According to analyst RektCapital, Bitcoin continues to maintain its multi-week higher low structure. A weekly close above $90,500 would be necessary to preserve bullish potential. Failure to reclaim this level keeps downside risk elevated.

A confirmed downtrend remains in place since the October 2025 peak near $110,000. Lower highs and lower lows have established bearish structure. A break below $86,411 would open the path toward $80,000.

Technical Analysis

Bitcoin is trading at $90,373.88, positioned near the lower Bollinger Band at $87,798. The middle band sits at $92,440, while the upper band reaches $97,081. Price action near the lower band suggests oversold conditions on the daily timeframe.

The MACD indicator prints a deeply negative histogram reading of negative 297. No bullish crossover appears imminent. The Vortex Indicator confirms bearish configuration with negative VI at 1.0967 dominating positive VI at 0.8983.

The seven-day RSI has fallen to 26.89, firmly in oversold territory. This reading suggests potential for a short-term relief rally. However, any bounce faces significant overhead resistance.

Key resistance levels include $92,440 at the Bollinger Band middle and $98,000 at the short-term holder cost basis. This $98,000 level acts as the critical bull-bear pivot. Fibonacci retracement shows immediate support at $86,411 (swing low), with a break potentially targeting $80K.

The overall trajectory remains bearish until Bitcoin reclaims the $98,000 resistance with strong volume. Near-term bounces should be viewed with caution given current momentum readings.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Sentient

SENT

$0.02

Seeker

SKR

$0.04

FIGHT

FIGHT

$0.03

Rain

RAIN

$0.01

ETHGas

GWEI

$0.02

Elsa

ELSA

$0.2

The Sandbox

SAND

$0.16

Axie Infinity

AXS

$2.5

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft