Bitcoin Slips Below 50-Day EMA but Holds $91k — Can Bulls Still Push to $100k?

Whale accumulation and BlackRock purchases clash with miner selling as Bitcoin tests critical support levels

January 8, 2026 at 10:36 AM

Last updated

January 8, 2026 at 10:36 AM

KEY FACTS

- Bitcoin falls below 50-Day EMA while maintaining support above $91,000 amid weakening bullish momentum

- BlackRock purchases $250M in BTC as whale wallets accumulate over 6,000 BTC despite Riot Platforms' record $161M sell-off

- Critical support at $88,000-$89,000 will determine next major move with 60% bearish probability in short term

Bitcoin has fallen below its 50-Day Exponential Moving Average (50D EMA), a critical technical indicator for short- to medium-term trend direction. The leading cryptocurrency currently trades at $90,852.52, marking a 1.91% decline over the past 24 hours. Despite this drop, BTC still maintains a 3.92% weekly gain.

When price trades below the 50D EMA, it typically signals weakening bullish momentum. Market analyst Ted Pillows warned that failure to reclaim the area above this moving average could push prices lower. He identified the $89,500–$90,000 range as a potential liquidity sweep zone where stop orders may trigger.

Bitcoin ETFs recorded a daily net outflow of 970 BTC, equivalent to $89.25 million. However, weekly inflows remained positive at 8,185 BTC, valued at $753.45 million. This divergence suggests institutional interest persists despite short-term selling pressure.

Bitcoin Miners Sell While Whales Load Up

Riot Platforms sold 1,818 BTC worth $161.6 million in December 2025, its largest monthly sale on record. The miner offloaded holdings at an average price of $88,870, reducing its total position to 18,005 BTC. Riot announced a strategic pivot toward AI and data center operations, ending its monthly Bitcoin reports.

The sale adds immediate supply pressure to the market. Post-halving profitability challenges have squeezed mining operations, raising questions about institutional confidence in the sector.

Meanwhile, large investors continue accumulating at current levels. According to Lookonchain, whale address 0xFB78 expanded its long position to 2,830 BTC valued at $259.55 million. The whale deposited an additional 20 million USDC into Hyperliquid, potentially for further long exposure. The position currently carries an unrealized loss exceeding $2 million.

Three additional wallets, possibly controlled by the same entity, accumulated 3,000 BTC worth $280 million within a 10-hour window. Buy orders totaling $140 million have been placed between $90,000 and $92,000, suggesting whales are prepared to accumulate at lower prices.

BlackRock purchased 3,040 BTC valued at approximately $250 million, adding to institutional demand signals. Bitcoin’s resilience to Riot’s sell-off, combined with $1.2 billion in ETF inflows during January 1–7, demonstrates underlying market demand.

Bitcoin Faces Regulatory Uncertainty as CLARITY Act Nears Senate Markup

Markets remain cautious as the CLARITY Act approaches Senate markup on January 15. Kalshi prediction markets currently assign a 46% probability of passage by May, while ongoing disputes over DeFi oversight and stablecoin regulation continue to weigh on sentiment.

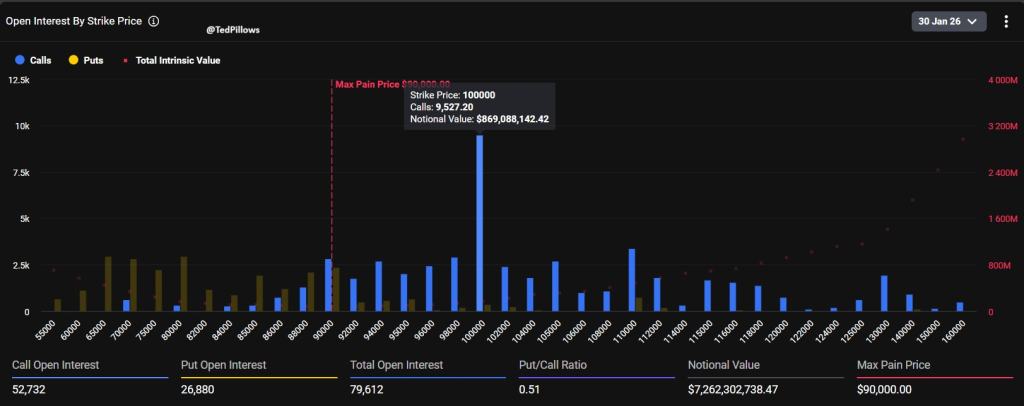

Regulatory delays could prolong institutional hesitancy in the near term. However, the $100,000 Bitcoin target remains the most popular January bet, with a notional value of $869 million in open interest.

Bitcoin Tests Key Support After Failed $94,000 Breakout

Bitcoin trades at $90,852.52 following a 2.85% decline and a failed breakout at $94,000. The rejection created a long upper wick pattern on the daily chart, confirming seller presence at higher levels.

Immediate resistance stands at $93,751.84, with critical resistance at the $94,000 failed breakout level. Major overhead resistance remains at $106,601, marked by the 200-day Simple Moving Average.

Key support zones include immediate support at $89,067.83 at the 20-period SMA. Critical support sits in the $88,000–$89,000 range, coinciding with Fibonacci 38.2%–50% retracement levels. Secondary support rests at $85,010.73 at the lower Bollinger Band.

The MACD indicator shows a bearish crossover developing. The MACD line reads 715.55 against a signal line of 600.79, with the histogram at negative 114.76. Momentum is weakening despite remaining in positive territory.

The 7-day RSI registered 80.65, indicating extreme overbought conditions that justified the current pullback. Volume analysis reveals significant selling during the $94,000 rejection, with declining volume during the subsequent pullback.

A series of lower highs has formed since the October peak, establishing a consolidation range between $88,000 and $95,000. The short-term trend remains bearish, while the medium-term outlook stays neutral-to-bearish.

The next 48–72 hours are critical. A decisive break or bounce at the $88,000–$89,000 zone will determine the next major directional move. Current probability favors the bearish scenario at 60%, with a bullish recovery chance at 30%.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$76,630.73

TRIA

TRIA

$0.02

Hyperliquid

HYPE

$33.45

Solana

SOL

$99.08

River

RIVER

$13.47

Pudgy Penguins

PENGU

$0.01

Zama

ZAMA

$0.03

Bittensor

TAO

$197.32

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft