Bitcoin Spot Volume Surges to $300B as ETF Demand Weakens – Are Bulls Quietly Targeting $125K?

Offshore exchanges drive $300B spot volume surge while institutional ETF outflows continue, setting up potential breakout above $125K

October 30, 2025 at 3:35 PM

Last updated

October 30, 2025 at 3:48 PM

KEY FACTS

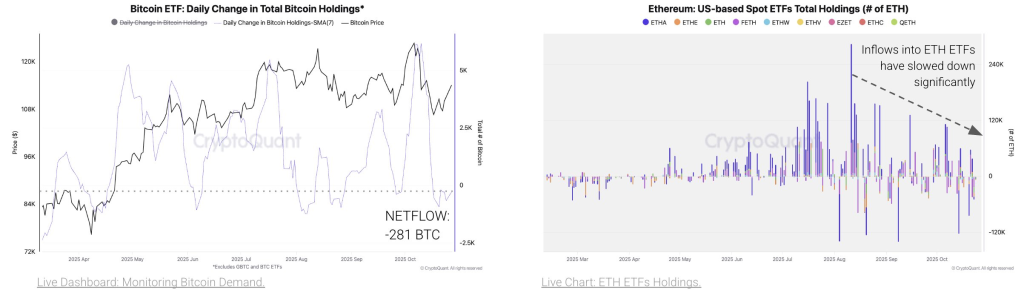

- Bitcoin spot trading volume reached $300 billion in October, with Binance contributing $174 billion, while US spot Bitcoin ETFs recorded $754.53 million in net outflows over the past week.

- Over $20 billion in short positions face liquidation if Bitcoin reaches $128,000, creating a liquidity pocket that could accelerate upward momentum toward the $125,000 target.

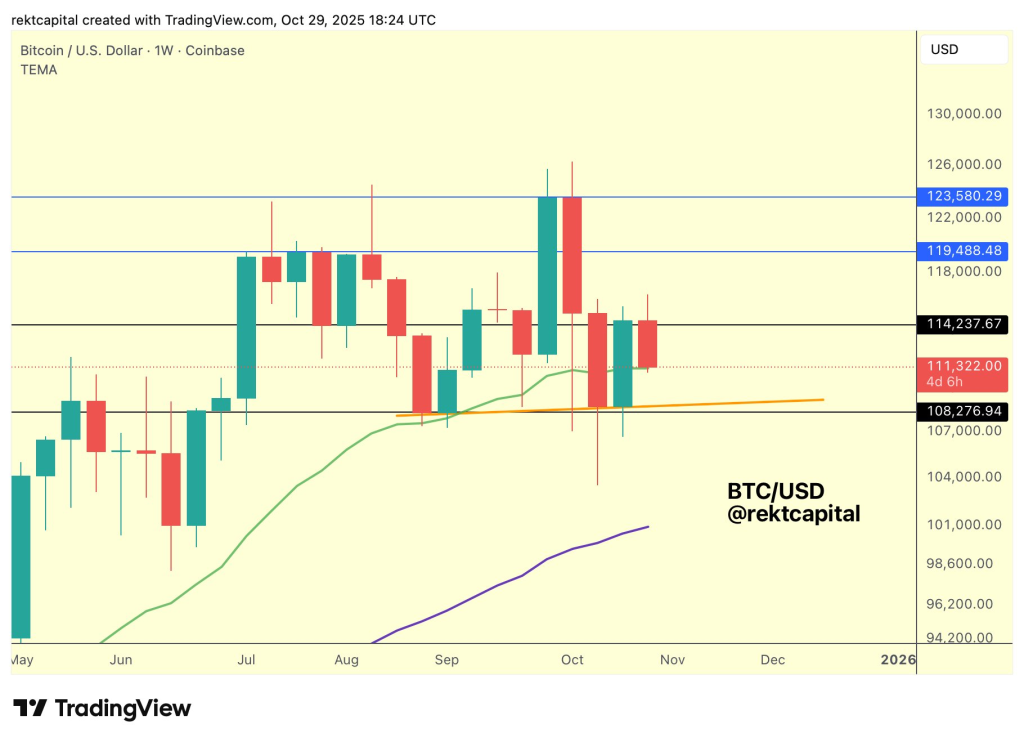

- Bitcoin is retesting its 21-week EMA support level at $114,500, with technical indicators suggesting potential for a new impulse wave if the level holds with strong volume.

Bitcoin spot trading volume reached $300 billion in October, marking massive growth in market participation.

According to on-chain data from CryptoQuant, Binance alone contributed $174 billion to the Bitcoin Spot volume total, signaling heightened activity across offshore exchanges.

Despite this strong activity from both retail traders and institutional players, the US spot Bitcoin ETFs recorded a 7-day average net outflow of 281 BTC during the same period.

But bulls are still confident of a Bitcoin rally towards the $125,000 local high, which is expected to open the floodgate for a mega bull run.

US ETF Outflows Continue Despite Rising Bitcoin Spot Activity

Over the past week, Data from SosoValue shows that the US spot Bitcoin ETFs registered cumulative net outflows of approximately $754.53 million.

Most of the 12 major BTC funds experienced sell-off, extending a consistent pattern of withdrawals.

Source: CryptoQuant

Sporadic rebounds occurred on certain days, showing modest inflows that suggest short-term tactical buying.

However, these movements do not indicate a structural reversal in the current outflow trend.

The Federal Reserve’s recent 25-basis-point rate cut improved liquidity across risk markets. Chair Powell emphasized future cuts remain data-dependent, signaling cautious monetary policy ahead.

Following the FOMC decision yesterday, Bitcoin reversed from highs to $107,000. Analysts note a recurring pattern suggesting preparation for a new all-time high above the previous $126,270 peak reached on October 6, 2025.

Source: X/wacy_time1

Smart Money Positions for Bitcoin Upside as Liquidity Pockets Form

On-chain data from Lookonchain reveals growing confidence among high-value market participants. Smart trader 0xc2a3 holds long positions exceeding $114 million in BTC and Liquidation data shows over $20 billion in short positions vulnerable if Bitcoin reaches $128,000.

This concentration creates a liquidity pocket where forced buybacks could accelerate upward momentum.

Arthur Hayes, Co-Founder of BitMEX and CIO at Maelstrom Fund, interpreted the Bank of Japan’s stance as confirming abundant global liquidity.

“Due to rising uncertainty in domestic political circumstances, as well global economic weakness as indicated by the Fed’s continuing rate cuts, we feel it is best to maintain policy as is with the intention to further propel inflation (unspecified measure therof) to our 2% target” -Bank Of Japan(BOJ)

Hayes said this means $BTC to ¥200M is on the horizon which is equivalent to $130,000 per BTC.

Similarly on the Geopolitical level, a new US-China trade deal reportedly nears completion, with signatures expected next week. Treasury Secretary Bessent called it a major win for American farmers, boosting export prospects and easing trade tensions.

This development adds to improving market sentiment for risk assets. The potential trade agreement provides additional fundamental support for Bitcoin’s bullish outlook.

Technical Analysis

Bitcoin currently retests its 21-week exponential moving average, a level historically viewed as the bull market backbone. This zone acts as dynamic support during extended uptrends.

A sustained close above $114,500 would confirm the recent dip as a volatility flush rather than structural breakdown. On-chain and derivative data show leverage reset and cooling funding rates.

Reduced funding rates lower the likelihood of cascading liquidations. This environment provides room for fresh long positions to build without immediate liquidation risk.

Source:X/Rektcapital

If Bitcoin reclaims the 21-week EMA with solid volume, momentum indicators like RSI and MACD could pivot upward. Such a move would signal the start of a new impulse wave.

Key resistance stands at $114,500, with breakout targets at $125,000 and potential extension to $128,000. Support remains at the 21-week EMA and $108,000 zone.

The technical setup aligns with bullish projections toward the $125,000 target zone. Current price action suggests consolidation before the next directional move higher.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2025 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$88,185.37

zkPass

ZKP

$0.17

Ultima

ULTIMA

$5,095.26

Toncoin

TON

$1.45

Hyperliquid

HYPE

$24.66

Solana

SOL

$125.24

Pudgy Penguins

PENGU

$0.01

Zcash

ZEC

$426.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft