Visa Unveils Stablecoins Advisory as Market Surpasses $300B

Payments giant unveils advisory service for banks and credit unions as institutional interest in digital dollars accelerates following U.S. regulatory clarity

December 15, 2025 at 8:28 PM

Last updated

December 16, 2025 at 5:32 AM

visa

KEY FACTS

- Visa launched a Stablecoins Advisory Practice to help banks and credit unions evaluate digital dollar adoption

- The global stablecoin market hit $309 billion in December 2025, with Tether holding 60% market share

- Navy Federal Credit Union, VyStar, and Pathward are early clients, with hundreds more expected to follow

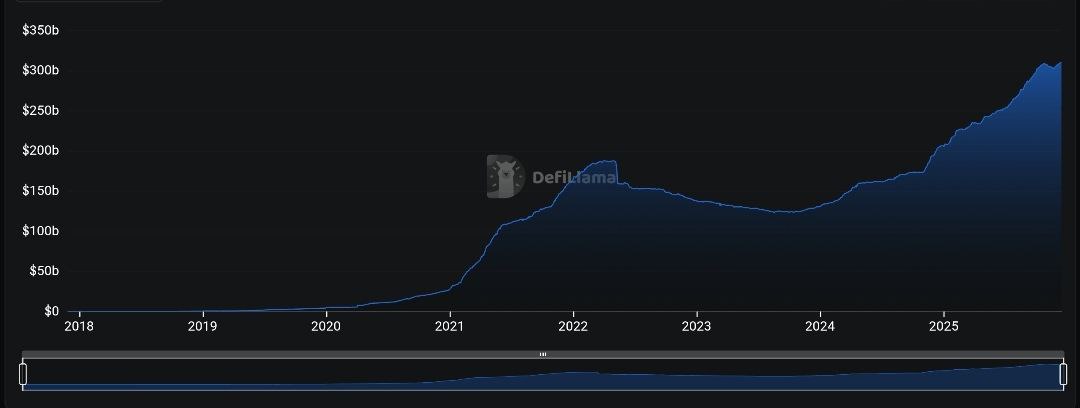

Visa has unveiled a dedicated Stablecoins Advisory Practice as the global stablecoin market reached $309 billion in December 2025. The payments giant aims to help banks, credit unions, and fintech firms navigate digital dollar adoption for payments and cross-border transactions.

The initiative arrives amid surging institutional interest in stablecoins for B2B settlements and international transfers. Visa’s advisory arm will guide clients through strategy development, technical architecture, and operational readiness before they commit resources.

Navy Federal Credit Union, VyStar Credit Union, and Pathward are among the early clients. Visa expects the roster to grow into the hundreds as demand accelerates across the financial services sector.

The service allows institutions to evaluate whether stablecoins align with their operational needs and customer demands. Rather than pushing blanket adoption, Visa emphasizes informed decision-making for each client.

From Pilots to Payments: Visa’s Expanding Stablecoin Infrastructure

The advisory practice builds on Visa’s prior blockchain efforts. In 2023, the company piloted USDC settlement on blockchain networks. It now supports over 130 stablecoin-linked card programs across 40 countries worldwide.

Visa is also testing a system enabling businesses to fund cross-border payments directly with stablecoins. This model eliminates the need for pre-depositing cash. The company plans to expand this capability in 2026.

Cuy Sheffield, Visa’s head of crypto, has stated that the future of payments will combine traditional rails with on-chain settlement. He emphasized that stablecoins extend rather than threaten existing payment systems.

The U.S. GENIUS Act, signed into law in July 2025, has provided regulatory clarity that accelerated institutional adoption. PayPal, Mastercard, Citigroup, JPMorgan, and Standard Chartered have all expanded their stablecoin strategies following the legislation.

Tether‘s USDT dominates the market with a 60.10% share and $186.23 billion market cap. Circle‘s USDC follows at $78.31 billion, representing 25.28% of the market. The global stablecoin market currently stands at roughly $310 billion, as per DefiLlama data.

Smaller stablecoins including Ethena’s USDe, Sky Dollar, Dai, and PayPal USD collectively hold $45.31 billion. This growing diversity reflects increasing competition among issuers.

Global Expansion and Institutional Infrastructure Take Shape

Beyond U.S. borders, Visa has partnered with Yellow Card Financial to enable stablecoin payments across 20 African countries. Circle has collaborated with Onafriq to connect stablecoins to hundreds of wallets and bank accounts.

Meanwhile, Mastercard now allows cardholders to make on-chain crypto purchases directly. Sony Bank plans to launch a regulated dollar-pegged stablecoin within its digital entertainment ecosystem.

Major financial institutions have already established stablecoin-related services. Goldman Sachs, Wells Fargo, and McKinsey offer advisory and research capabilities. Anchorage Digital and GFT Technologies provide infrastructure solutions.

Visa’s advisory practice positions the company as a central facilitator for regulated, large-scale stablecoin adoption. The service helps institutions balance customer needs with regulatory compliance and technical preparedness.

The advisory offerings span the full implementation lifecycle. Clients receive support from initial strategy through final deployment, reducing the risk of costly missteps during adoption.

Credit unions represent a key target demographic for the new practice. These institutions often lack the internal expertise to evaluate emerging payment technologies independently.

Following this launch, analysts expect accelerated stablecoin adoption among traditional financial institutions throughout 2026. The combination of regulatory clarity and established advisory support removes significant barriers to entry.

Visa’s recent move highlights how stablecoins are steadily becoming part of mainstream finance. Digital dollars are now seen less as a novelty and more as a practical tool for payments.

The stablecoin market continues to draw interest from major investors. Visa’s advisory efforts may help banks and fintech companies figure out how to weave digital dollars into their day-to-day operations over the next year.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Kamaldeen Mustapha

Editor

Kamaldeen Mustapha

Editor

Kamaldeen Mustapha is a Web3 writer and editor with over five years of experience in cryptocurrency, DeFi, NFT, and GameFi. He has contributed to leading brands such as PlaytoEarnDiary, RoversX, and Vibranium Audits. Kamaldeen specializes in creating clear, well-researched, and SEO-optimized content, including news, guides, technical explainers, and market updates, helping Web3 companies build credibility and visibility in the digital asset space.

Author profileTrending Today

Bitcoin

BTC

$76,396.71

Zama

ZAMA

$0.03

TRIA

TRIA

$0.02

Tether Gold

XAUT

$5,072.18

Ethereum

ETH

$2,276.06

Hyperliquid

HYPE

$33.88

Solana

SOL

$98.14

Pudgy Penguins

PENGU

$0.01

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft