Bitcoin Stabilizes Near $89K While Whales, Dolphins, and U.S. Investors Reduce Exposure

On-chain metrics reveal four bearish indicators converging as ETFs record $1.61 billion in weekly outflows

January 26, 2026 at 8:09 PM

Last updated

January 26, 2026 at 8:09 PM

KEY FACTS

- Bitcoin consolidates at $89,380 while whales, dolphins, and U.S. investors actively distribute holdings according to on-chain data.

- Bitcoin ETFs recorded $1.61 billion in outflows over seven days as four bearish indicators converge.

- Key resistance sits at $90,500-$93,500 with critical support at $87,000-$88,000 determining the next major move.

Bitcoin is consolidating around the $89,000 to $90,000 range as on-chain data reveals significant distribution activity from major market participants. The leading cryptocurrency trades at $89,380.34, posting a modest 0.23% gain over 24 hours but remaining down 6.12% for the week.

Four key indicators are converging to paint a bearish picture, according to CryptoQuant analyst EgyAsh. U.S. institutional demand remains weak while overall demand has turned negative. Both Dolphins and Whales have entered distribution phases, actively reducing their holdings.

The price decline has pushed Bitcoin to a 15.23% decrease over the past year. Market observers are closely monitoring whether current support levels will hold amid the selling pressure from large holders.

Bitcoin Whales and Dolphins Shift to Distribution as Demand Turns Negative

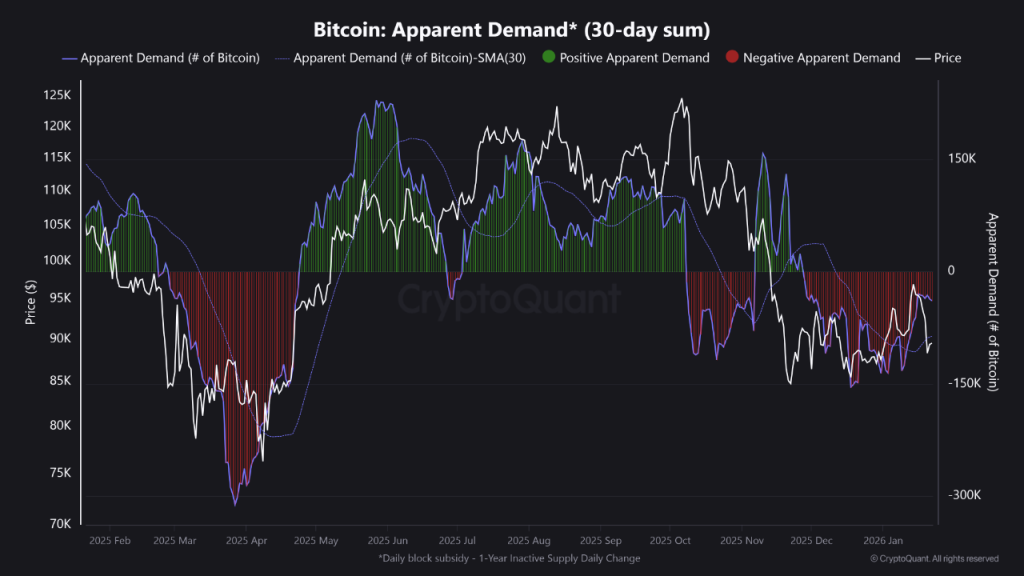

The Bitcoin Apparent Demand chart reveals a stark transition from the high-demand green period of mid-2025 to sustained negative demand in January 2026. Long-term holders are distributing coins faster than the market can absorb them.

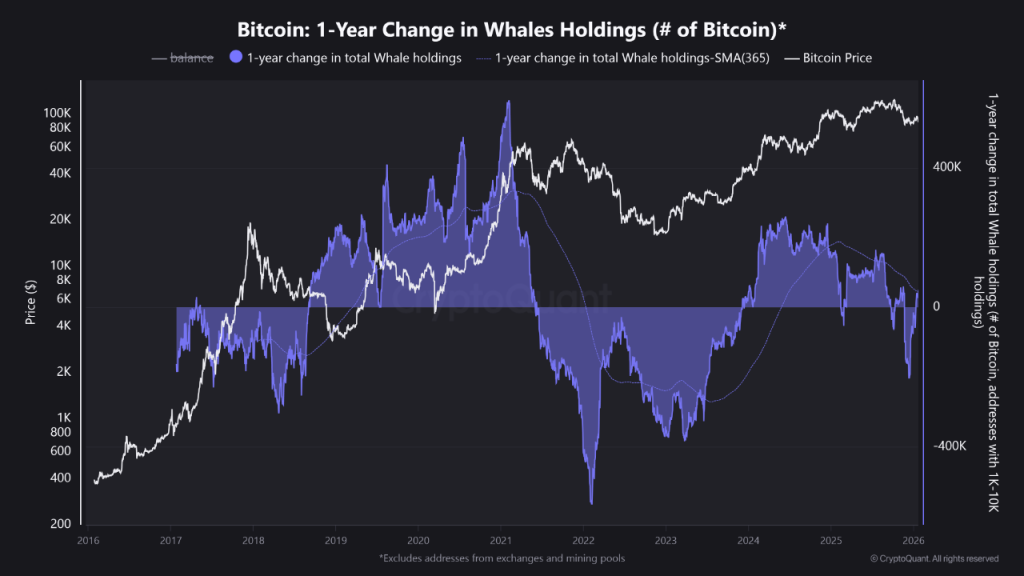

Whale addresses holding between 1,000 and 10,000 BTC accumulated heavily throughout 2024 and early 2025. However, the one-year change in their holdings has now turned negative. Historically, such shifts signal that the largest market participants are exiting positions.

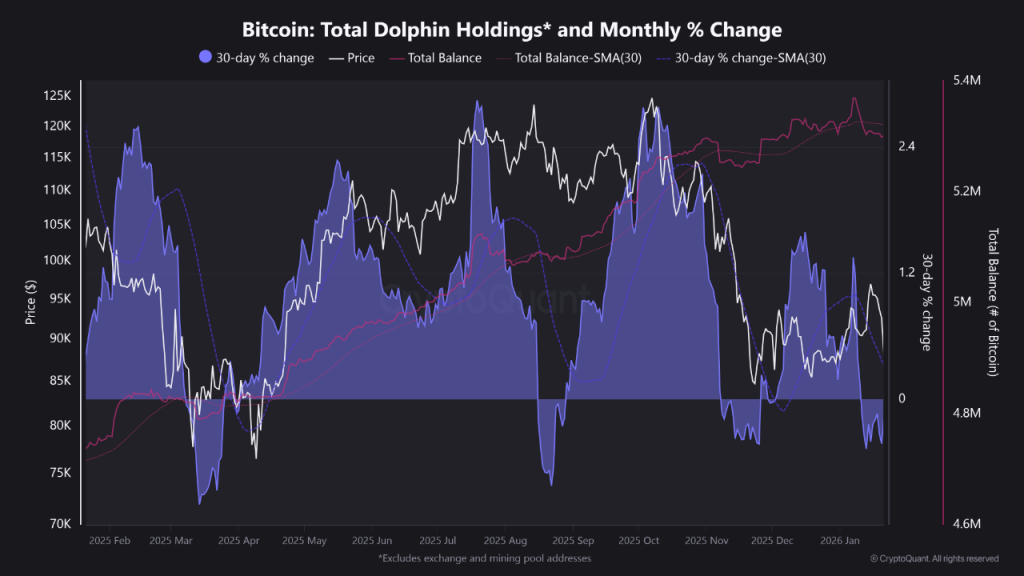

Dolphin holdings follow a similar pattern. After aggressive accumulation during the 2025 rally, the 30-day percentage change has dipped into negative territory. These medium-to-large investors have shifted from holding to profit-taking.

The Coinbase Premium Index has been sitting in deep negative territory. U.S.-based investors and institutions are offloading positions or showing reduced appetite compared to global markets.

Bitcoin ETFs also recorded outflows. One-day net flow reached negative 433 BTC, valued at $38.53 million. The seven-day net flow stood at negative 18,050 BTC, totaling $1.61 billion in outflows, according to Lookonchain data.

Bitcoin Analysts Watch $90,500 as Key Resistance Level

Analyst Rekt Capital noted that Bitcoin has successfully retested its higher low. The cryptocurrency is now contending with reclaiming the mid-range level around $90,500.

A weekly close above $90,500 would confirm the move as a volatile retest. Such confirmation would signal readiness to sustain price action in the upper weekly range between $90,500 and $93,500.

CMC analyst Innovator of Afrika observed Bitcoin trading within an $88,000 to $92,000 range. Buyers are actively defending the lower boundary while resistance between $95,000 and $100,000 limits upside momentum.

Technical indicators including RSI and moving averages show neither overbought nor oversold conditions. The market appears to be awaiting a catalyst that could define the next major directional move.

BTC Chart Shows Bearish Structure With Key Support at $87,000

Bitcoin displays classic corrective behavior following rejection from the $120,000 psychological resistance in Q4 2025. The daily chart reveals a well-defined downtrend characterized by lower highs and lower lows.

The primary trend remains bearish with a clear structural breakdown from October 2025 highs. Price has formed a series of lower highs from $120,000 to $115,000, then $108,000, and finally $98,000.

Critical support sits at $87,000 to $88,000, marked by the lower Bollinger Band and multiple daily wick rejections. A break below this zone would likely trigger a cascade toward the $82,000 to $84,000 structural support.

Immediate resistance lies at $92,000 to $93,500, where the SMA(20) at $92,205 and EMA(9) at $90,763 create barriers. The 0.382 Fibonacci retracement at $96,500 represents the first meaningful recovery target.

All major moving averages point downward with price trading below the EMA(9), SMA(20), and middle Bollinger Band. The Bollinger Bands have contracted during late January consolidation, suggesting an imminent volatility expansion.

RSI readings in the neutral 40-50 range confirm market indecision. No bullish divergence has formed between price and RSI, meaning no early reversal signals exist currently.

The short-term outlook remains bearish to neutral. Bitcoin must reclaim and hold above $92,000 with volume to shift momentum. Until then, rallies may face selling pressure within the larger downtrend structure.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$76,630.73

TRIA

TRIA

$0.02

Hyperliquid

HYPE

$33.45

Solana

SOL

$99.08

River

RIVER

$13.47

Pudgy Penguins

PENGU

$0.01

Zama

ZAMA

$0.03

Bittensor

TAO

$197.32

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft