Ethereum Bounces at $2,900 as Macro Fears Hit Markets — Is a $3K Breakout Loading?

ETH recovers to $2,959 as government shutdown odds hit 75% and precious metals surge to record highs

6 days ago

Last updated

6 days ago

KEY FACTS

- Ethereum reclaims $2,900 with 2.05% daily gain but faces $3,000 resistance amid macro uncertainty

- ETH ETFs record $488M weekly outflows while gold hits historic $5,000/oz amid safe haven demand

- Technical analysis shows 65% bearish probability with $2,750 target if $2,880 support breaks

Ethereum has reclaimed the $2,900 level amid growing macroeconomic uncertainty, with the second-largest cryptocurrency posting a 2.05% gain in the past 24 hours. The asset now trades at $2,959.78, pushing its market cap to $356.8 billion. However, trading volume dropped by 32.1% over the same period, raising questions about conviction behind the move.

The weekly picture remains less favorable, with ETH down 1.56% over seven days. Price action shows the asset recovering from lows near $2,800 earlier this week. The $3,000 psychological barrier now stands as the key level bulls must conquer.

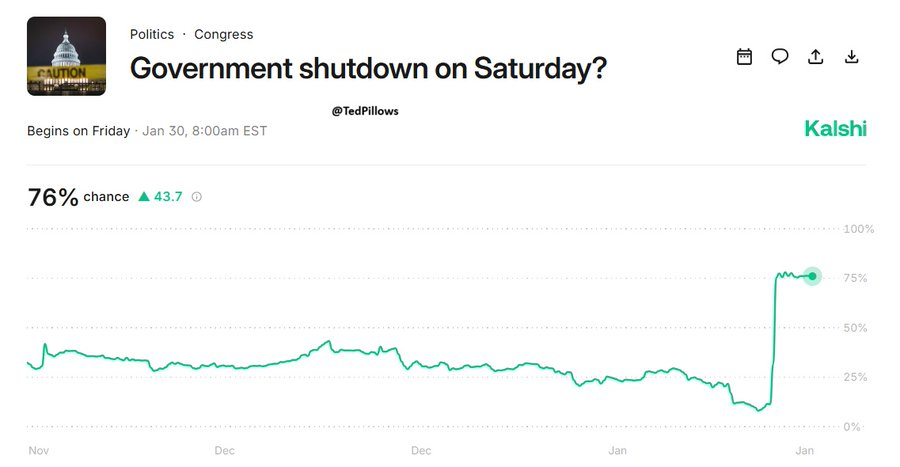

Market participants face mounting concerns over potential government instability and escalating trade tensions. According to prediction market Kalshi, odds of another U.S. government shutdown by January 31st have risen to 75%. This comes less than three months after the longest shutdown in history, which lasted 43 days.

ETH Faces Headwinds as Trade Tensions Fuel Safe Haven Rally

President Trump announced in the last 48 hours that he would impose 100% tariffs on Canada if the country strikes a deal with China. The threat has added to existing market jitters across both traditional and digital asset classes.

Meanwhile, precious metals continue their historic rally. Gold officially crossed $5,000 per ounce for the first time ever, lifting its market cap to a record $35 trillion. Silver followed with an unprecedented surge to $115 per ounce, gaining more than 60% this month alone.

The flight to traditional safe havens contrasts sharply with crypto’s mixed performance. Ethereum ETF flows reflected this uncertainty, recording a one-day net inflow of 39,499 ETH worth $115.73 million. However, the seven-day picture shows net outflows of 166,623 ETH valued at $488.21 million, according to Lookonchain data.

BlackRock and Grayscale led the outflow rankings on both daily and weekly timeframes. The data suggests institutional investors remain cautious despite the short-term bounce.

Reduced Leverage and ETH Staking Demand Cushion Downside

A January 23 report from Bybit and Block Scholes highlighted reduced leverage across crypto markets. Aggregate altcoin open interest remains well below late 2025 peaks. This subdued leverage helped markets avoid a disorderly selloff despite macro shocks.

Lower leverage reduces cascading liquidation risks that typically amplify downturns. The structural shift provided a stable base, allowing Ethereum to recover from its weekly low without triggering forced selling. A sustained increase in open interest could signal returning speculative risk ahead.

Institutional interest in Ethereum staking continues to grow, with applications for staking-enabled exchange-traded products increasing. The trend persists even as staking yields have fallen below 3%, according to the same Bybit report.

This represents structural, long-term demand that locks up supply and reduces sell-side pressure. Staking provides a fundamental cushion during price declines, as entities hold ETH for yield rather than trade it.

Technical Analysis

Ethereum trades at $2,947.15 on Binance, sitting below both the 9-EMA at $2,978.94 and the 20-SMA at $3,100.61. The price hugs the lower Bollinger Band at $2,776.59, with the upper band at $3,424.64. This positioning indicates sustained selling pressure.

The primary trend remains bearish with clear lower highs and lower lows since the Q3 2025 peak near $4,800-$5,000. A descending channel pattern persists from August 2025, connecting lower highs at $4,800, $4,200, $3,800, and $3,450.

Immediate support sits at $2,900-$2,880, aligning with recent swing lows. A break below this zone targets $2,750-$2,780, a major demand zone from December 2025. The $2,600 level represents structural support and the last defense before deeper bear territory.

Resistance levels stack up at $3,000-$3,100, where the psychological barrier meets the 20-SMA. Stronger resistance exists at $3,300-$3,450 near the upper Bollinger Band. The $3,800-$4,000 zone marks the failed breakdown area from November 2025.

RSI estimates between 35-45 remain below neutral 50, indicating weak momentum without deep oversold conditions. MACD stays below the zero line with no bullish crossover confirmed. Volume continues declining on recent candles compared to the November-December selloff.

A consolidation rectangle between $2,880 and $3,100 has formed over the past two to three weeks. This pattern statistically favors downside continuation with a measured move target near $2,650. Bulls require a daily close above $3,100 with strong volume to shift momentum. The bearish scenario carries 65% probability, targeting $2,750 initially, while bulls face only 35% odds of reaching $3,300.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$76,630.73

TRIA

TRIA

$0.02

Hyperliquid

HYPE

$33.45

Solana

SOL

$99.08

River

RIVER

$13.47

Pudgy Penguins

PENGU

$0.01

Zama

ZAMA

$0.03

Bittensor

TAO

$197.32

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft