Ethereum Eyes $5,750 as MVRV Ratio Repeats Bull-Market Pattern from Previous Cycles

3 Mins

November 3, 2025 at 6:16 PM

Last updated

November 3, 2025 at 6:16 PM

Ethereum Market Value to Realized Value (MVRV) ratio has declined from 1.85 to 1.50 since August 2025, marking a cooling phase in investor profit margins. The metric suggests short-term profit-taking activity may be reaching its conclusion.

ETH currently trades at $3,724, representing a 3.23% decrease over the past 24 hours. According to data from CryptoQuant, Ether’s realized price sits around $2,560, reflecting the average cost basis across all investors.

Historical data shows that when MVRV readings sit below 1.00 , it’s consistently marked accumulation zones, while levels above 2.25 have signaled overheated market conditions.

The current 1.50 reading places Ethereum in a neutral-to-bullish territory that could see ETH trade around $5,750 before the end of 2025.

Ethereum Whale Accumulation Accelerates Amid Exchange Outflows

Despite Ethereum currently trading in a tight range between $3,500 and $4,000 for couple of months , Lookonchain data shows that significant whale accumulation is still ongoing.

Several high-value wallets collectively added over 120,000 ETH during the past two weeks.

In the last 24 hours alone, Wallet address 0xc097 withdrew 13,037 ETH valued at $35.5 million from Binance.

Similarly, Abraxas Capital extracted 44,612 ETH worth $123 million from Binance and Kraken over a 14-hour period, moves often seen when large holders seek to reduce short-term sell pressure.

Large stakers are simultaneously moving coins off exchanges toward self-custody solutions.

This exchange outflow pattern typically reduces short-term sell pressure. The movement occurs amid subdued volatility, suggesting confidence among large holders rather than panic repositioning.

Derivatives Markets Signal Healthy Long Positioning

Coinglass derivatives data also show steady growth in open interest across major exchanges.

Funding rates remain positive yet moderate, avoiding the extreme levels associated with overleveraged markets.

ETH perpetual futures volumes climbed nearly 18% week-over-week, an increase that follows the Federal Reserve’s latest rate cut decision.

Source: Coinglass

Meanwhile, prominent market figures are weighing in on broader macro conditions. Thomas Lee, CIO of Fundstrat Capital, noted a “trifecta wall of worries” affecting equities despite strong underlying fundamentals.

Raoul Pal, Founder and CEO of Global Macro Investor and Real Vision, also shared insight on the current market dynamics.

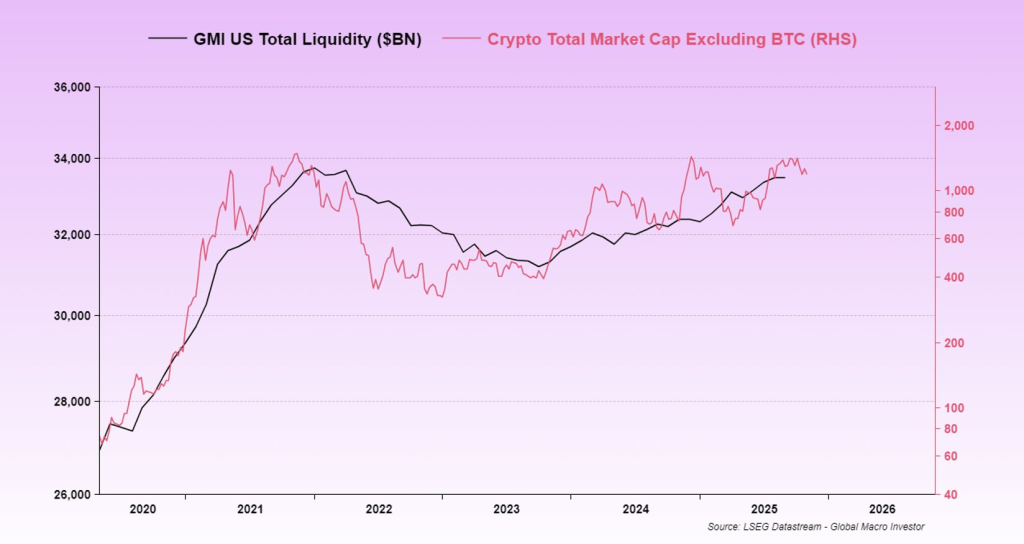

Pal affirmed that Crypto is driven by liquidity and for the TOTAL2ES market cap to break higher, the market need liquidity to make new highs, which the U.S Gov shutdown and TGA delayed it.

“The Liquidity Flood is building and the Gov reopening will be the start of a multi-vector liquidity injection from the TGA, to the PBOC balance sheet, from bank reserves to the end of QT”, he concluded

Technical Analysis: HTF Liquidity Shows Ethereum Eyes $5,750 Target

The Ethereum Fear and Greed Index registers 44, placing sentiment in neutral territory. Current price stands at $3,699 according to index data.

ETH recently cleared the final high-timeframe two-week leveraged liquidity cluster. No major leveraged liquidity remains to the downside in this timeframe.

The asset grinds at key support levels with major short-side liquidity above current prices. Market observers suggest Ethereum may have bottomed within its current range.

With the realized price at $2,560 providing a cost-basis floor and MVRV ratios echoing previous bull-market patterns, the path toward $5,750 remains viable.

Sustained momentum combined with continued whale accumulation and healthy derivatives positioning supports this upside target.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

TRIA

TRIA

$0.02

Bitcoin

BTC

$76,546.44

Zama

ZAMA

$0.03

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$33.7

Tether Gold

XAUT

$5,064.72

River

RIVER

$15.57

Solana

SOL

$98.21

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft