Ethereum Holds Near $1.9K as It Eyes Sixth Straight Monthly Loss — More Downside Ahead?

ETF outflows mount to $180 million as Fear & Greed Index signals extreme bearish sentiment, but institutional forecasts still target $3,110 recovery

3 hours ago

Last updated

3 hours ago

KEY FACTS

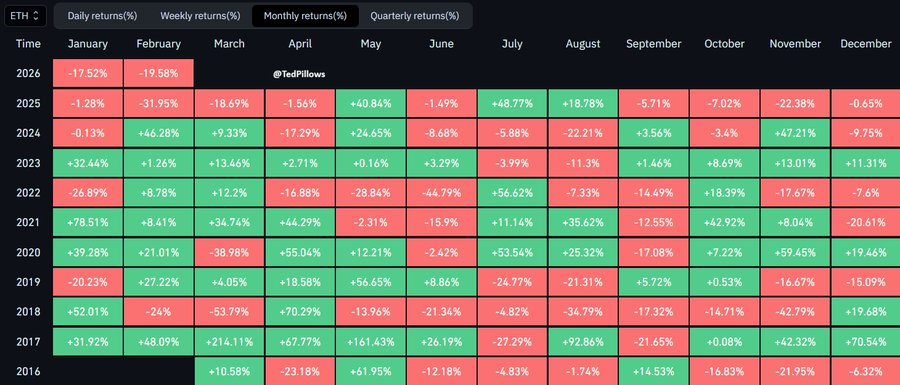

- Ethereum trades at $1,980 facing its sixth consecutive red monthly close with 11 negative months out of the last 14 periods

- ETF outflows reached $180 million in seven days while the Fear & Greed Index signals extreme fear with 60% probability of another loss

- Institutional forecasts target $3,110 as Tom Lee suggests crypto winter could end by April 2026

Ethereum trades near $1,980 as the second-largest cryptocurrency prepares to close its sixth consecutive month in negative territory. The asset has posted 11 red monthly closes out of the last 14 periods, placing it among the most prolonged bearish stretches in recent memory.

The coin recorded a modest 0.99% gain in the past 24 hours. However, the weekly performance remains negative at 2.86%. Market capitalization currently sits at $239.12 billion following a slight 0.85% recovery.

According to Lookonchain, Ethereum ETFs faced significant capital flight across both daily and weekly timeframes. Net outflows reached 22,492 ETH worth $44.42 million in a single day. The seven-day figure climbed to 91,151 ETH, representing $180.02 million in withdrawn capital.

The Crypto Fear & Greed Index currently registers in the “Extreme Fear” category. Data from the indicator points to roughly 60% probability of another red monthly close for March 2026.

ETH Bear Market History and Institutional Positioning

Ethereum’s current downturn mirrors patterns observed during the 2018 bear market. Historical records confirm the asset endured up to seven consecutive red monthly closes during that period. The present six-month streak remains one month short of that benchmark.

Major financial platforms have issued recovery projections despite the bearish conditions. A consolidated average forecast from industry players, including Binance, places Ethereum’s expected price at $3,110. This target sits approximately 57% above current trading levels.

When factoring recovery forecasts into probability models, the likelihood of March closing red drops to approximately 40%. This shift represents a change in the risk-reward calculation for the asset.

Fundstrat’s Tom Lee stated in an interview with Faroukh Sarmad of Decrypt that the crypto winter is either ending or likely concludes by April. He cited extreme pessimism across crypto communities combined with traditional finance skepticism toward Bitcoin as late-cycle capitulation signals.

The macro backdrop appears to be shifting in favor of risk assets. Inflation is cooling while ISM readings remain above 50. A potentially more dovish Federal Reserve leadership in 2026 could improve liquidity conditions.

Meanwhile, institutional accumulation continues. BitMine reportedly holds over 4.3 million ETH while staking a large portion. The firm generates yield plus fiat income of roughly $1 million daily with $600 million in liquidity reserves.

ETH Price Levels and Chart Indicators

Ethereum’s daily chart confirms a primary bearish trend since November 2025. The asset peaked around $3,500 before establishing a series of lower highs and lower lows. Price has broken multiple support levels without meaningful recovery.

Bollinger Bands show significant volatility expansion during the February selloff. The upper band sits at $2,651, the middle band at $2,156, and the lower band at $1,661. Price currently trades near the lower band region.

The MACD indicator registers deeply negative readings with the signal line at -223. However, early divergence appears to be forming. The histogram displays slightly green bars at the far right, suggesting a potential bullish crossover.

Immediate support lies at $1,950-$1,980, representing the current consolidation floor. A break below this zone targets the $1,850-$1,900 panic selling base. Major support at $1,660-$1,700 coincides with the lower Bollinger Band.

On the upside, $2,150-$2,200 serves as immediate resistance where the 20-day SMA meets previous breakdown levels. Intermediate resistance appears at $2,400-$2,500, with strong resistance at $2,650-$2,750.

Fibonacci retracement from the $3,500 high to $1,850 low places the 0.236 level at $2,240. Current price action remains below all meaningful retracement levels. Volume analysis shows capitulation-style selling followed by a large green volume bar on the bounce.

The short-term trajectory leans bearish with potential for a relief rally. A MACD crossover could trigger a bounce toward $2,150-$2,200. Failure to reclaim the 20-day SMA would confirm continued downside toward $1,700.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$67,195.96

Hyperliquid

HYPE

$29.08

River

RIVER

$9.13

Pi Network

PI

$0.19

Solana

SOL

$84.29

Morpho

MORPHO

$1.51

Ethereum

ETH

$1,981.38

Monad

MON

$0.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft