Ethereum Struggles Below $3,300 as U.S. Institutional Demand Weakens

Coinbase Premium Gap hits lowest level since February 2025 as $357M in futures liquidations amplify selling pressure

January 9, 2026 at 7:11 AM

Last updated

January 9, 2026 at 7:11 AM

KEY FACTS

- Ethereum trades at $3,116 with Coinbase Premium Gap at -2.285, the lowest since February 2025, signaling weak U.S. institutional demand.

- Major players continue accumulating: Bitmine holds $13B in ETH, BlackRock bought $149M worth over three consecutive days.

- Technical analysis shows bearish short-term outlook with key support at $3,032 and resistance at $3,252.

Ethereum remains trapped below the $3,300 resistance zone as U.S. institutional demand continues to deteriorate. The second-largest cryptocurrency by market cap trades at $3,116.60, down 1.3% in 24 hours and 4.45% over the past week.

According to CryptoQuant, the Coinbase Premium Gap, a key metric measuring U.S. institutional versus global retail demand, has plunged to -2.285 on its 14-day simple moving average. This marks the lowest reading since early February 2025. The negative premium signals weaker buying pressure on Coinbase compared to offshore exchanges like Binance.

Ethereum’s market capitalization now stands at $376.38 billion. Trading volume reached $23.86 billion, reflecting a 7.01% increase over the past 24 hours. Despite the price struggles, ETF flows tell a different story.

Ethereum ETFs recorded net inflows of 25,608 ETH worth $79.16 million in a single day. Weekly inflows totaled 127,633 ETH, valued at $394.51 million, according to Lookonchain data. ETF assets under management remain stable at $18.27 billion.

Institutional ETH Accumulation Persists Amid Broader Demand Decline

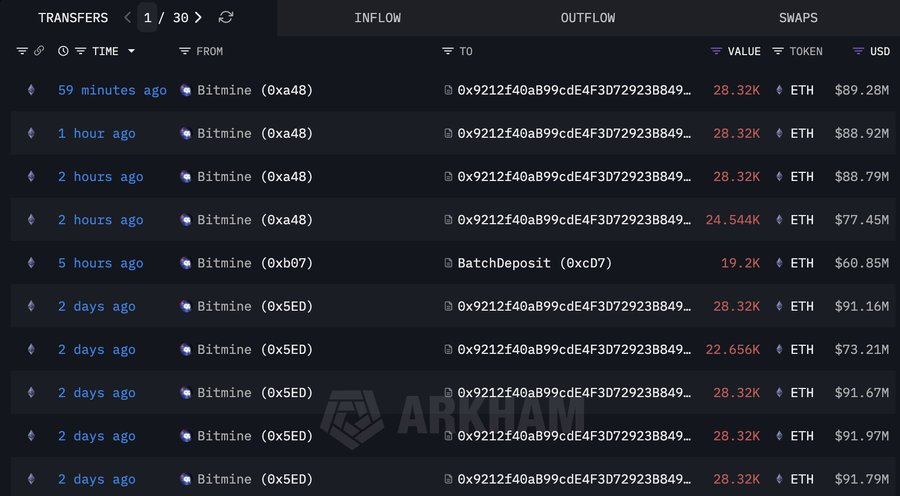

Institutional activity presents a mixed picture amid the broader demand weakness. Tom Lee’s Bitmine staked another 128,704 ETH worth $405 million in the past five hours. The firm now holds 936,512 ETH in staking positions valued at $2.87 billion.

Bitmine purchased an additional 32,977 ETH worth $104 million last week. The company’s total Ethereum holdings now stand at 4,143,502 ETH, valued at approximately $13.06 billion.

BlackRock has accumulated both Bitcoin and Ethereum for three consecutive days. The asset manager acquired 9,619 BTC worth $878 million alongside 46,851 ETH valued at $149 million. BlackRock also deposited 2,164 BTC and 26,723 ETH to Coinbase Prime.

Meanwhile, 21Shares announced a $0.010378 per share ETH staking reward payout on January 9. Grayscale distributed $0.083178 per share on January 6. Some recipients may sell these rewards, adding minor sell-side pressure.

ETH Liquidations and Leverage Amplify Downside Pressure

Crypto futures markets experienced $357 million in liquidations on January 8. Ethereum positions accounted for $77.5 million of the total, with 84% being long positions. High leverage between 25x and 100x amplified forced selling.

ETH briefly dipped to $2,988 during the liquidation cascade. The 0.84% decline outpaced Bitcoin’s 0.32% drop, highlighting Ethereum’s higher sensitivity to market volatility.

The sustained negative Coinbase Premium reading poses challenges for bullish momentum. Historically, strong Ethereum rallies have coincided with positive premium readings. The current divergence between price stabilization efforts and declining on-chain demand suggests a fragile market structure.

Until the Coinbase Premium Gap returns to positive territory, a sustained breakout above $3,300 appears unlikely. The ongoing weakness increases the risk of range-bound trading or further downside pressure.

ETH Price Holds Key Fibonacci Levels as Indicators Flash Mixed Signals

Ethereum trades at the critical 50% Fibonacci retracement level of $3,111.87. The 61.8% Fibonacci support at $3,032.87 represents the key level for bulls to defend. A break below this threshold could signal trend reversal.

The 20-day SMA sits at $3,034.70, providing immediate support. The 50-day SMA at $3,252.29 acts as overhead resistance. The 200-day SMA at $3,615 remains the major long-term barrier.

The MACD indicator shows bullish divergence with the MACD line at 37.86 above the signal line at 26.87. The histogram reads positive at 10.99. However, elevated MACD levels suggest potential for pullback.

RSI stands at 59.5, indicating neutral territory with room for upside movement before reaching overbought conditions above 70. Volume declined during the current consolidation, showing selling pressure.

Key resistance levels include $3,200, the 50-day SMA at $3,252, and $3,400. Support levels sit at the 20-day SMA, the 61.8% Fibonacci level, and $2,800, representing November lows.

The short-term outlook remains cautiously bearish. The most likely scenario involves rejection at current levels followed by a retest of $3,030-$3,050 support before the next directional move.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$76,630.73

TRIA

TRIA

$0.02

Hyperliquid

HYPE

$33.45

Solana

SOL

$99.08

River

RIVER

$13.47

Pudgy Penguins

PENGU

$0.01

Zama

ZAMA

$0.03

Bittensor

TAO

$197.32

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft