Strategy Buys 397 More BTC as Holdings Surge Past 641,000 BTC

Michael Saylor's company continues Bitcoin accumulation but at reduced pace as it dismisses M&A opportunities in growing Bitcoin treasury sector

By Amoo Jubril

November 3, 2025 at 3:42 PM

Last updated

November 3, 2025 at 3:43 PM

KEY FACTS

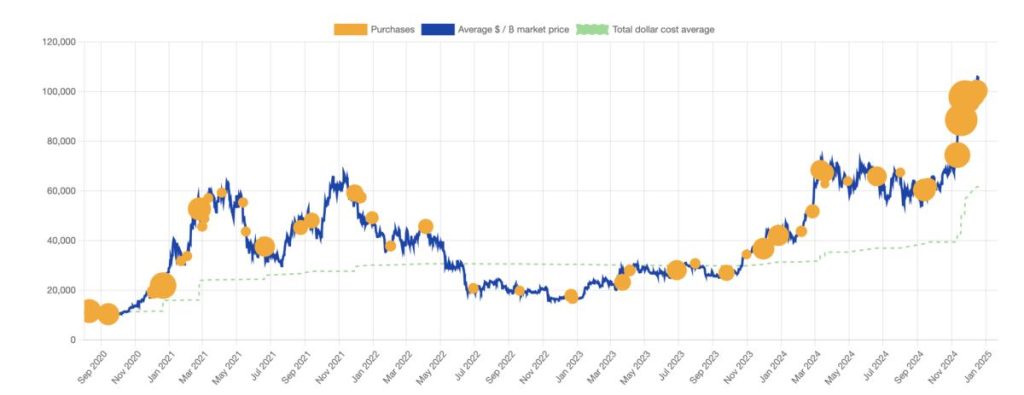

- Strategy purchased 397 Bitcoin for $45.6 million at $114,771 per coin, bringing total holdings to 641,205 BTC worth $47.49 billion.

- The company's buying pace has slowed significantly, with October purchases totaling just 778 BTC compared to September's 3,526 BTC.

- Chairman Michael Saylor ruled out acquiring rival Bitcoin treasury companies, citing deal uncertainty and lengthy timelines as key concerns.

Strategy acquired 397 Bitcoin worth $45.6 million last week at an average price of $114,771 per coin, bringing its total holdings to 641,205 BTC, according to a Monday SEC filing.

The purchase, which concluded November 2, represents a continuation of the company’s accumulation strategy but at a notably reduced pace.

Strategy’s total Bitcoin holdings were acquired for $47.49 billion at an average price of $74,047 per coin.

The company reported a Bitcoin yield of 26.1% year-to-date, according to chairman Michael Saylor’s Monday post on X.

Strategy funded the purchases through at-the-market offerings of common and preferred securities.

Strategy Buying Pace Slows Amid Market Conditions

October’s purchases totaled just 778 BTC, marking a significant decline from September’s 3,526 BTC acquisition. September’s buying represented a 78% jump from previous activity.

Between August 11 and November 2, Strategy acquired 11,817 BTC for approximately $1.34 billion across multiple transactions.

The largest single purchase occurred August 26 through September 1, when the company bought 4,048 BTC for $449.3 million.

The most substantial recent acquisition period ran July 28 through August 3, when Strategy purchased 21,021 BTC for approximately $2.46 billion at an average price of $117,256 per coin.

Strategy’s weekly purchases have varied considerably.

The company bought 3,081 BTC during August 18-24 for $356.9 million, followed by 1,955 BTC for $217.4 million September 2-7.

Smaller transactions included 525 BTC on September 8-14, 850 BTC September 15-21, and 196 BTC September 22-28. October saw minimal activity with just 220 BTC purchased on October 13.

Saylor Rules Out Acquisitions of Rival Bitcoin Companies

On oct 31st, Strategy chairman Michael Saylor stated during the company’s third-quarter earnings call that Strategy has no plans to acquire other Bitcoin treasury companies. He cited uncertainty and lengthy deal timelines as key concerns.

“Generally, we don’t have any plans to pursue M&A activity, even if it would look to be potentially accretive,” Saylor told investors Thursday. He noted such transactions typically stretch six to nine months or a year.

“The plan, the strategy, the focus is to sell digital credit, improve the balance sheet, buy Bitcoin and communicate that to credit and equity investors,” Saylor stated, outlining the company’s core priorities.

Strategy continues funding Bitcoin purchases primarily through at-the-market offerings of various security classes including STRF, STRK, STRD and MSTR programs. The company has not engaged in mining or asset swaps for acquisitions.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Amoo Jubril

Writer

Amoo Jubril

Writer

I’m a blockchain-focused content writer helping crypto brands build trust through storytelling that’s simple, authentic, and community-driven

Author profileTrending Today

TRIA

TRIA

$0.02

Bitcoin

BTC

$76,546.44

Zama

ZAMA

$0.03

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$33.7

Tether Gold

XAUT

$5,064.72

River

RIVER

$15.57

Solana

SOL

$98.21

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft