XRP Jumps to $1.90 on Major Banking Partnership and RLUSD Listing Momentum

Ripple's DXC Technology deal integrates XRP into core banking systems managing $5 trillion as Binance lists RLUSD stablecoin

January 23, 2026 at 8:01 AM

Last updated

January 23, 2026 at 8:01 AM

KEY FACTS

- Ripple partners with DXC Technology to integrate XRP into banking platform managing $5 trillion in deposits

- Binance confirms RLUSD stablecoin listing with XRP trading pair as Evernorth plans $1B XRP treasury

- XRP trades at $1.93 with key resistance at $2.00 and support at $1.88 amid Bollinger Band squeeze

XRP surged to $1.90 following Ripple’s landmark partnership with DXC Technology and Binance‘s confirmation of the RLUSD stablecoin listing. The token currently trades at $1.92, marking a 1.1% gain in the past 24 hours despite a 7.13% weekly decline.

Ripple and DXC Technology announced a deal to integrate XRP and blockchain settlement into the Hogan core banking platform. The platform manages over $5 trillion in deposits globally, creating a direct utility channel for the digital asset.

Crypto analysts noted the integration positions XRP as a settlement layer within established banking infrastructure. This approach could offset speculative selling pressure by establishing tangible, utility-driven demand from traditional finance.

Meanwhile, Binance confirmed Thursday’s listing of Ripple’s regulated stablecoin RLUSD with an XRP/RLUSD trading pair. Ripple CEO Brad Garlinghouse responded with a post described as “eXtRemely Positive,” which the community interpreted as a deliberate reference to XRP.

XRP Gains Institutional Traction Through DXC Partnership and Evernorth Treasury Plans

The DXC partnership represents a direct path to institutional adoption for XRP. Banks can now utilize the token for cross-border payments and custody without overhauling existing systems.

This integration validates XRP’s utility beyond speculation. Analysts suggest it could create steady demand from traditional finance, supporting long-term price fundamentals for investors holding positions.

In a separate development, digital asset treasury firm Evernorth announced plans to build a $1 billion institutional XRP treasury. The initiative involves collaboration with AI infrastructure provider t54.

The strategy encompasses active lending, liquidity provisioning, and DeFi strategies on the XRP Ledger. Such institutional commitments signal growing confidence in the XRP ecosystem’s expansion.

Trump Tariff Reversal Fuels XRP Rally Amid Broader Market Gains

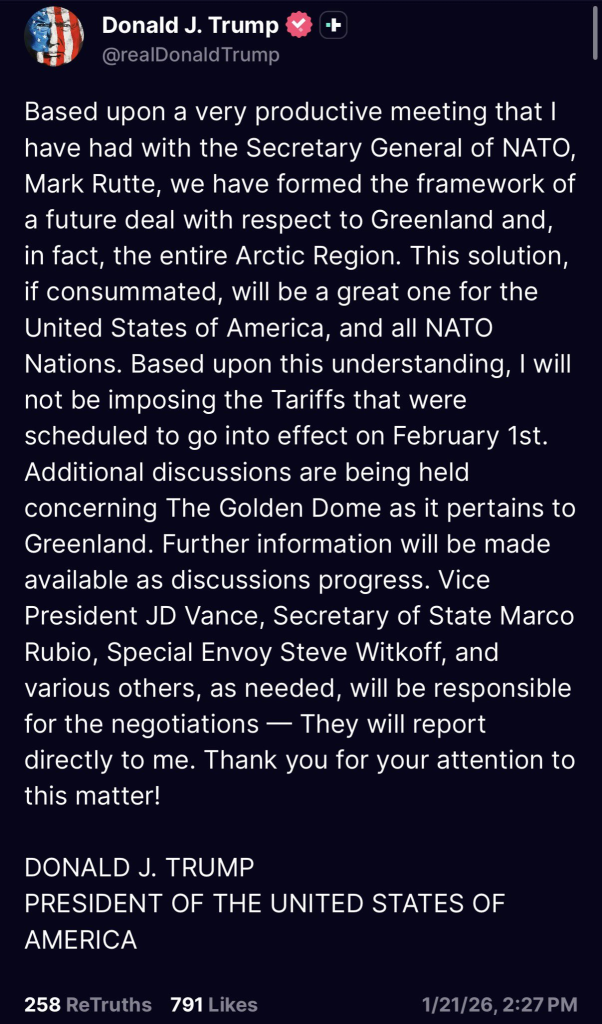

President Donald Trump reversed his decision on 10% tariffs against the European Union that were scheduled for February 1. The announcement followed high-level discussions between U.S. leadership and NATO officials.

Talks with NATO Secretary General Mark Rutte produced a preliminary framework for a broader strategic agreement. The deal involves Greenland and the Arctic region, described as beneficial to both the United States and NATO allies.

The tariff suspension reduced near-term geopolitical and trade uncertainty across global markets. Bitcoin surged over $1,800 within 30 minutes of the announcement as risk-on sentiment returned.

U.S. equity markets added $840 billion following the news. The Nasdaq climbed 1.16%, the S&P 500 rose 1.17%, and the Dow Jones gained 1.22%. The Russell 2000 advanced 1.95% to a new all-time high.

For cryptocurrency markets, easing trade tensions acted as a short-term bullish catalyst. The development supported price recoveries amid previously fragile sentiment across digital assets.

XRP Technical Outlook Shows Price Below Key Moving Averages

XRP trades at $1.93, positioned below all major moving averages. The 9-day EMA stands at $1.99, while the Bollinger Band middle line sits at $2.08. The 50-day SMA near $1.88 provides immediate support.

The token remains within a descending channel that formed since July’s peak of $3.50. A potential inverse head and shoulders pattern is emerging, with neckline resistance around $2.20-$2.30.

Key resistance zones cluster between $2.00 and $2.08, representing both psychological and technical barriers. The RSI ranges between 60-63, indicating healthy momentum without overbought conditions.

Support levels exist at $1.88-$1.90 near the 50-day SMA and at $1.80, where multiple December bounces occurred. A break below $1.75 would invalidate the current recovery thesis.

Bollinger Bands are contracting, signaling an impending volatility expansion. Volume remains below average at 54.49 million, suggesting the recovery lacks conviction for a sustainable breakout.

The short-term outlook is neutral to slightly bullish. A daily close above $2.00 with volume exceeding 70 million would confirm bullish momentum toward $2.15-$2.35 targets.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

TRIA

TRIA

$0.02

Bitcoin

BTC

$76,546.44

Zama

ZAMA

$0.03

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$33.7

Tether Gold

XAUT

$5,064.72

River

RIVER

$15.57

Solana

SOL

$98.21

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft