Bitcoin Jumps Above $96K as U.S. Stocks Lose $650B — Is $100K Next?

Crypto rally accelerates as $700M in shorts liquidate, ETF inflows surge, and regulatory momentum builds toward potential six-figure milestone

6 days ago

Last updated

6 days ago

KEY FACTS

- Bitcoin surged past $96,000 with a 7% weekly gain as U.S. stocks lost $650 billion in market value

- Over $700 million in leveraged shorts were liquidated in 24 hours, with $1 billion more at risk above $97,100

- Analysts assign 75% probability to Bitcoin reaching $100,000 this month, with technical targets at $105,000

Bitcoin surged past $96,000 on January 14, reaching $97,307 as U.S. equities shed more than $650 billion in market value over the past week. The cryptocurrency gained over 3% in 24 hours and 7% on the weekly timeframe. Trading volume spiked 65% to $68.44 billion, pushing Bitcoin’s total market cap to $1.92 trillion.

The rally triggered a wave of short liquidations across derivatives markets. Over $700 million in leveraged short positions was liquidated within 24 hours. An additional $1 billion in shorts faced liquidation risk above the $97,100 level. Bitcoin briefly crossed $97,000 for the first time since November 14.

Meanwhile, major U.S. stock indices recorded significant weekly losses. The Nasdaq fell 1.40%, while the Dow Jones dropped 1.21% and the S&P 500 declined by 1%. The divergence between crypto and traditional markets has drawn increased attention from institutional investors.

The broader cryptocurrency market added $190 billion in 24 hours. Bitcoin led the surge, contributing $130 billion to the total gains. The asset remains 23% below its all-time high of $126,000.

Bitcoin ETF Flows and Regulatory Momentum Shape Near-Term BTC Outlook

According to Lookonchain, Bitcoin ETFs recorded substantial inflows on the daily scale. Net flows reached +8,933 BTC, valued at approximately $849.92 million. BlackRock’s IBIT ETF saw +1,338 BTC in net inflows, while Grayscale added +749 BTC.

However, the seven-day picture showed net outflows of 4,740 BTC, worth roughly $450.93 million. BlackRock recorded -5,946 BTC in weekly outflows. Grayscale posted -1,601 BTC in net outflows over the same period.

Regulatory developments continued to support bullish sentiment. Bitwise listed seven crypto ETPs on Nasdaq Stockholm, expanding regulated Bitcoin access for European investors. U.S. senators released a draft bill to clarify crypto oversight between the SEC and CFTC.

Rhode Island introduced a Bitcoin tax exemption bill. The proposed legislation would eliminate state income and capital gains taxes on Bitcoin transactions up to $20,000 annually.

U.S. Senators expects a Bitcoin and crypto market structure bill to pass soon, with markup scheduled for January 15.

Bitcoin Bullish Momentum Builds as Cooling Inflation, On-Chain Signals, and Breakout Patterns Align

January 13’s U.S. CPI data showed cooling inflation at 2.6% year-over-year. The reading eased concerns about aggressive Federal Reserve rate hikes. CryptoQuant analyst Darkfost noted Bitcoin Net Taker Volume dropped 10x from $489 million to approximately $51 million.

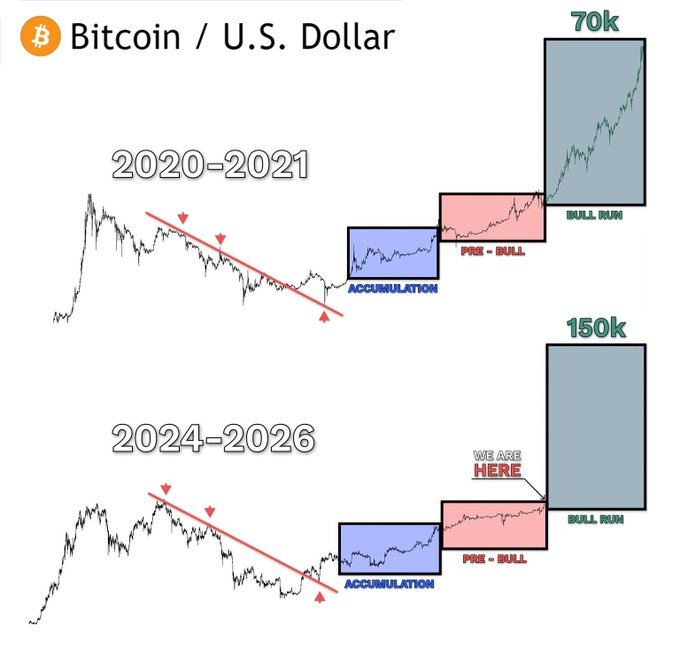

Binance founder CZ’s $200,000 Bitcoin prediction reinforced bullish sentiment across the market. Analysts pointed to Bitcoin following patterns similar to the 2020-2021 bull cycle. If historical patterns repeat, the next leg could push BTC toward $150,000.

Analyst Nebraskangooner identified an ascending triangle breakout pattern. The measured target points to the $105,000 resistance area. Bitcoin must hold the $94,000 breakout level to maintain bullish structure.

Ted Pillows described the move as a classic breakout above a key trendline. According to his analysis, maintaining support above this level could open the path to $100,000 within January. Kalshi data shows a 75% probability of Bitcoin reaching $100,000 this month.

Technical Analysis BTC Momentum Strengthens as Price Breaks Key Bands, Eyes $100K Next

Bitcoin traded at $97,398 on the daily chart, up 2.11%. The price broke above the upper Bollinger Band at $96,082, with the 20-day SMA at $90,635. The lower band sits at $85,189.

The MACD displayed a strong bullish crossover. The MACD line reached 1,243.62 while the signal line stood at 580.83. The histogram printed +662.80, showing accelerating upward momentum with expanding green bars.

The RSI(14) registered 66.49, remaining in bullish territory without entering overbought conditions above 70. This reading suggests room for additional upside of 3-5% before hitting overbought levels.

Key resistance levels include $97,900-$98,000 as the immediate barrier. The $100,000 psychological level represents the next major test. Extended targets sit at $105,000-$108,000.

Support levels have formed at $96,082 (upper Bollinger Band, now support), $93,500 (broken resistance), and $90,635 (20-day SMA). Volume increased during the rally, validating the breakout.

The technical structure remains bullish. Price trades above all major moving averages with momentum accelerating. The short-term trajectory points toward $100,000, with extended targets at $105,000-$110,000 if current momentum sustains.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

ETHGas

GWEI

$0.03

River

RIVER

$46.76

Bitcoin

BTC

$89,521.07

Pudgy Penguins

PENGU

$0.01

Solana

SOL

$129.76

Ondo

ONDO

$0.34

Monad

MON

$0.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft