BTC pushes back above $91K — Eyes now on the $100K level

Bitcoin recovers 8.3% to $91K as institutional adoption accelerates and Fed liquidity floods markets, setting stage for potential $100K breakthrough

December 4, 2025 at 5:42 AM

Last updated

December 4, 2025 at 5:42 AM

KEY FACTS

- Bitcoin surged 8.3% to $91,923 after dipping below $85,000, with market cap recovering to $1.83 trillion as trading volume declined 4%.

- Goldman Sachs acquired Bitcoin ETF issuer for $2B while Vanguard reversed anti-crypto stance, opening ETF access to 50M+ clients despite 24-hour outflows of $103M.

- Fed injected $38.5B liquidity and ended QT, but Japanese tightening caused flash crash; technical analysis shows bullish MACD crossover with resistance at $92K-$98K before potential $100K test.

Bitcoin surged back above $91,000 on December 2, marking an 8.3% gain in 24 hours after dipping below $85,000 the previous day. The rebound lifted its market cap to $1.83 trillion, recovering sharply from yesterday’s drop of $1.6 trillion.

BTC currently trades at $91,923, its trading volume has also declined over 4%, suggesting reduced selling pressure as the asset approaches the psychological $100,000 threshold.

The recovery follows a volatile period triggered by macroeconomic shifts and institutional developments. Traders now watch whether Bitcoin can sustain momentum toward six-figure territory.

Goldman Sachs and Vanguard Push Bitcoin Institutional Adoption Forward

Goldman Sachs acquired Bitcoin ETF issuer Innovator Capital for $2 billion, expanding its cryptocurrency product lineup. The move signals deepening institutional infrastructure around digital assets.

Meanwhile, Vanguard reversed its anti-crypto stance under new leadership. The firm opened access to products that hold Bitcoin, Ether, XRP, Solana, and other regulated cryptocurrencies for over 50 million clients.

With $11 trillion in assets under management, Vanguard’s entry could funnel substantial capital into crypto markets. The shift marks a turning point for mainstream institutional adoption.

However, Bitcoin ETF flows turned negative in the last 24 hours. One-day net outflows reached 1,139 BTC, totaling $103.15 million, according to Lookonchain data.

Seven-day flows remain positive at 1,038 BTC, worth $93.94 million. The mixed signals reflect ongoing volatility in institutional sentiment despite broader adoption trends.

Fed Liquidity Injections Fuel Bitcoin Recovery Amid Japanese Tightening

The Federal Reserve injected $13.5 billion via overnight repos on December 1, plus another $25 billion morning repo. The combined $38.5 billion represents one of the largest liquidity boosts since COVID-19.

Historically, such injections have supported Bitcoin rallies. The 0.78% intraday bounce aligns with past Fed-driven momentum patterns observed in previous market cycles.

The Fed officially ended quantitative tightening on December 1 after more than three years. When QT ended on August 1, 2019, BTC rallied 30% in seven days, climbing from $9,500 to $12,300.

However, Japan’s monetary tightening provides a counterforce. The yen carry trade unwind and rising inflation contributed to Sunday’s 5% flash crash.

The FOMC meeting on December 10 approaches with an 87% priced-in rate cut. The decision could trigger renewed bullish momentum if expectations materialize as anticipated by market participants.

Michaël van de Poppe, CIO of MNFunds, highlighted the crucial $92,000 area. He stated that breaking this level successfully would lead to a new all-time high and test at $100,000.

Jack Caffrey, a JP Morgan equity portfolio manager, emphasized Bitcoin’s role as a leading risk indicator for U.S. markets. His comments reflect growing Wall Street attention to crypto price action.

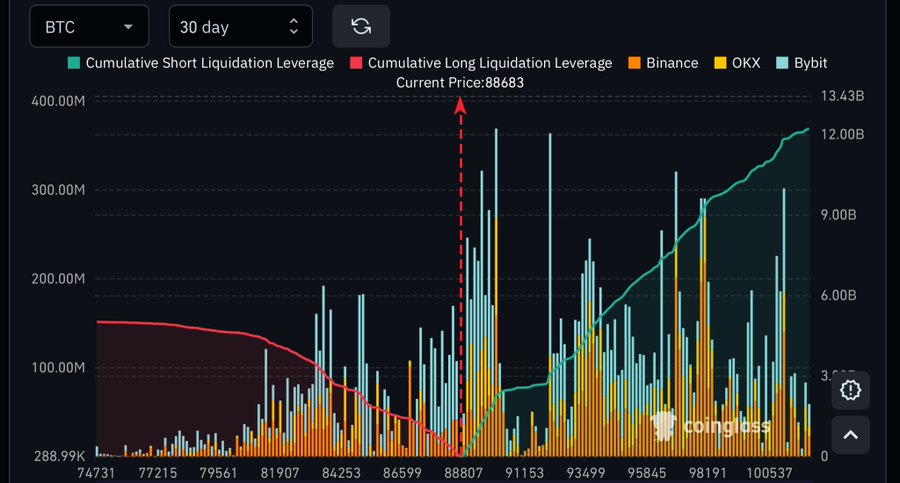

More than $10 billion in short positions face liquidation once BTC hits $100,000. This could accelerate upside movement once that threshold approaches, creating a potential cascade effect.

Despite the bullish sentiments, a trader on X warns Bitcoin may still be completing a Wyckoff Distribution pattern. He predicts a drop to $62,000–$74,000 by next week, potentially aligned with the December 10 Fed meeting.

According to this view, BTC is finishing crash wave three down to $74,000. A temporary bounce for wave four may occur if the Fed sparks short-term optimism.

Afterwards, a final dip for wave five is expected before significant recovery. He anticipates this relief rally in January once the Fed begins jumbo rate cuts.

BTC Technical Indicators Point to Key Resistance Zones

Bitcoin’s daily chart shows a V-shaped recovery from $86,180 support. The MACD histogram turned positive at +810.88, confirming a bullish crossover after the signal line crossed above.

The 20-day simple moving average sits at $97,969, representing major resistance ahead. Price bounced from the lower Bollinger Band at $83,165, now attempting to reclaim the middle band at $90,567.

The RSI14 recovered from oversold conditions at 33.04, providing room to run before overbought territory above 70. Fibonacci support held at $87,188, marking the critical 78.6% retracement level.

Immediate resistance appears at today’s high of $92,335. A break above this level targets the upper Bollinger Band near $98,000, then the psychological $100,000 zone.

Key support remains at $86,860. Failure to hold this pivot point risks retesting the $83,862 lows established during yesterday’s selloff.

The MACD remains in negative territory despite the crossover, indicating early-stage momentum reversal. Full bullish confirmation requires the indicator crossing into positive territory with sustained upward movement.

Price trajectory remains cautiously bullish short-term, contingent on holding above $90,000 and breaking through the $92,000–$98,000 resistance zone. Downtrend structure from October’s $108,000 peak remains intact pending decisive reclaim of six-figure levels.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

ETHGas

GWEI

$0.03

River

RIVER

$46.58

Oasis

ROSE

$0.02

Ondo

ONDO

$0.34

Pudgy Penguins

PENGU

$0.01

Solana

SOL

$130.96

Zcash

ZEC

$369.16

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft