Bitcoin Reclaims $68K Despite $2.3B in Realized Losses, Marking One of the Largest Capitulation Events Since 2021

Short-term holders capitulate as Bitcoin bounces from $60K lows while ETFs post continued outflows and institutions reposition

2 hours ago

Last updated

2 hours ago

KEY FACTS

- Bitcoin reclaims $69K after $2.3B in realized losses—one of the largest capitulation events since 2021.

- Short-term holders who bought between $80K-$110K are selling while long-term holders remain steady.

- Technical indicators remain bearish with resistance at $75,940 and support near $59,000-$65,000.

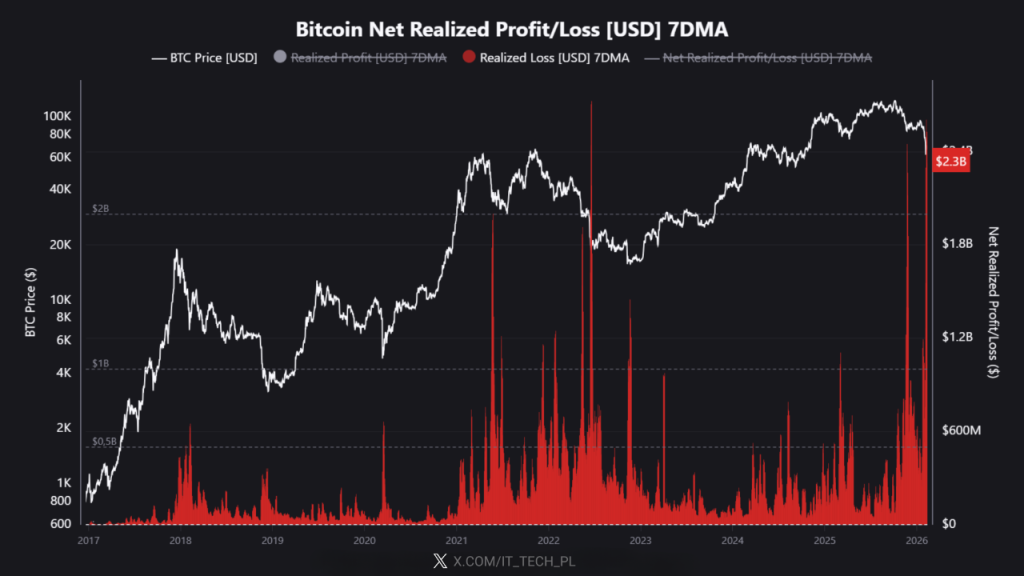

Bitcoin has reclaimed the $69,000 level following one of the largest capitulation events in its history. The cryptocurrency posted $2.3 billion in realized losses, rivaling historic drawdowns from the 2021 crash and the 2022 Luna/FTX collapse.

The leading digital asset trades at $68,929.73, registering a 4.33% increase in the past 24 hours. Despite the recovery, Bitcoin remains down 2.7% over the past week. Its market capitalization has risen to approximately $1.38 trillion.

Net realized profit/loss measures the dollar value of profit or loss locked in when Bitcoin moves on-chain. Red bars on the metric represent coins sold or transferred at a loss relative to their purchase price. The current 7-day average reading stands at $2.3 billion in losses.

This figure places the current capitulation among the top 3-5 loss events ever recorded in Bitcoin’s history.

Short-Term BTC Holders and ETF Outflows Drive Selling Pressure

Data reveals that short-term holders, those holding coins for fewer than 155 days, are the primary sellers. These investors purchased Bitcoin between $80,000 and $110,000 during the recent peak.

Long-term holders remain largely unmoved by the price decline. This cohort typically holds through drawdowns and has not contributed to the current selling spike.

According to Lookonchain data, Bitcoin ETFs posted net outflows across both daily and weekly timeframes. The exchange-traded funds registered a one-day net outflow of 5,042 BTC, valued at $339.68 million. The seven-day net outflow totaled 826 BTC, worth approximately $55.65 million.

Historical patterns show extreme loss spikes often precede rebounds. Bitcoin bounced from $60,000 to $71,000 following this capitulation event, consistent with past cycles.

Bitcoin MVRV Ratio Nears Undervaluation as Long-Term Holders Hold Firm

Following its all-time high in October 2025, Bitcoin has trended downward for approximately four months. The MVRV ratio currently stands at around 1.1, nearing the undervaluation threshold of 1.0.

Realized price support near $55,000 has not yet been tested. Bitcoin currently trades approximately 18% above its realized price. Prior cycle lows saw prices fall 24-30% below this level, followed by 4-6 months of base formation.

Long-term holder behavior does not reflect full capitulation. This cohort currently sells around breakeven, while historical bear market bottoms formed when long-term holders endured 30-40% losses.

CryptoQuant’s Bull-Bear Market Cycle Indicator remains in the Bear Phase, not the Extreme Bear Phase that typically marks bottoming processes.

Meanwhile, Binance has completed converting its SAFU fund into 15,000 BTC. The $1 billion transition finalized within 30 days of its initial announcement. The final tranche included 4,545 BTC.

At a Bitcoin price of $67,000, the fund holds approximately $1.005 billion. Binance has committed to rebalancing if volatility pushes the fund below $800 million.

In related institutional activity, BlackRock deposited 3,402 BTC worth $227.5 million and 15,108 ETH valued at $29.52 million to Coinbase Prime.

Bitcoin Chart Shows Bearish Structure and Key Price Levels

The daily chart confirms a bearish primary trend following the $115,000-$120,000 distribution zone. A clear sequence of lower highs and lower lows has formed since November 2025.

Immediate resistance sits at $75,940, aligned with the 20-day simple moving average. Secondary resistance appears at $92,502, the upper Bollinger Band. The critical psychological barrier remains at $100,000.

Support levels include $65,850 at the recent swing low and $59,379 at the lower Bollinger Band. Major structural support lies in the $52,000-$55,000 zone.

Bollinger Bands are widening significantly, with current width at approximately $33,000. The lower band violation followed by recovery often signals short-term exhaustion.

The MACD reads deeply negative at -5,658.96, with the signal line at -5,249.39. No bullish crossover has formed. The histogram shows slight contraction, suggesting momentum deceleration rather than reversal.

Volume analysis reveals a massive selling climax at the February decline—the largest volume bar on the visible chart. This occurred near the lower Bollinger Band touch, matching classic capitulation signatures.

Bitcoin’s price trajectory remains bearish in the short term. The bounce from extreme oversold conditions may face rejection at the declining 20-day moving average near $75,940. Sustained strength above this level would be required to shift the near-term outlook.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Pudgy Penguins

PENGU

$0.01

Aztec

AZTEC

$0.03

Espresso

ESP

$0.06

Bitcoin

BTC

$68,829.14

Bittensor

TAO

$176.24

Monad

MON

$0.02

Lighter

LIT

$1.61

Hyperliquid

HYPE

$31.43

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft