Ethereum Slides to $1.9K, Falls Below Accumulation Address Realized Price as Whales Keep Buying

Large holders intensify accumulation as ETH erases $13 billion in market cap, with one whale opening a $204.5 million long position

2 hours ago

Last updated

2 hours ago

KEY FACTS

- Ethereum dropped 5.45% to $1,914, falling below accumulation address realized prices for the first time

- A whale linked to Matrixport opened a $204.5M long position while Bitmine staked another $282M in ETH

- Technical indicators show deeply oversold conditions with RSI at 28.27 and key support at $1,800-$1,850

Ethereum has dropped below $2,000 for the first time in months, trading at $1,914.63 after a 5.45% decline in 24 hours. The market cap fell to $231.08 billion, erasing over $13 billion in value within a single day. Despite the sharp correction, large holders continue aggressive accumulation.

The coin now trades below the realized price of accumulation addresses. This marks a critical threshold that historically signals undervaluation for long-term investors. Whale buying activity has intensified since June 2025, with current prices sitting below their average entry points.

The broader crypto market experienced a 4.23% decline in total capitalization. Bitcoin dropped 5.05%, dragging altcoins lower in a correlated sell-off. The CMC Fear & Greed Index registered 9, marking extreme fear across the market.

Whales Double Down on ETH Positions

A whale potentially linked to Matrixport opened a 105,000 ETH long position worth $204.5 million. The position currently sits underwater by more than $10 million. Two wallets, 0x6C85 and 0xa5B0, transferred funds from Tron to Arbitrum before depositing into Hyperliquid.

On-chain analysis suggests both wallets belong to the same entity. Wallet 0xa5B0 received funds from Matrixport multiple times, strengthening the connection. Together, these addresses hold the massive long position on the decentralized exchange.

Tom Lee’s Bitmine continues accumulating and staking ETH. Five hours ago, Bitmine staked another 140,400 ETH valued at $282 million. In total, the firm has staked 2.97 million ETH worth $6.01 billion, representing 68.7% of its holdings.

Meanwhile, BlackRock deposited 30,216 ETH worth $60.83 million to Coinbase Prime. The asset manager also moved 3,402 BTC valued at $234.3 million in the same transaction. According to Lookonchain, ETF flows showed mixed signals with daily inflows of 21,416 ETH against weekly outflows of 74,269 ETH.

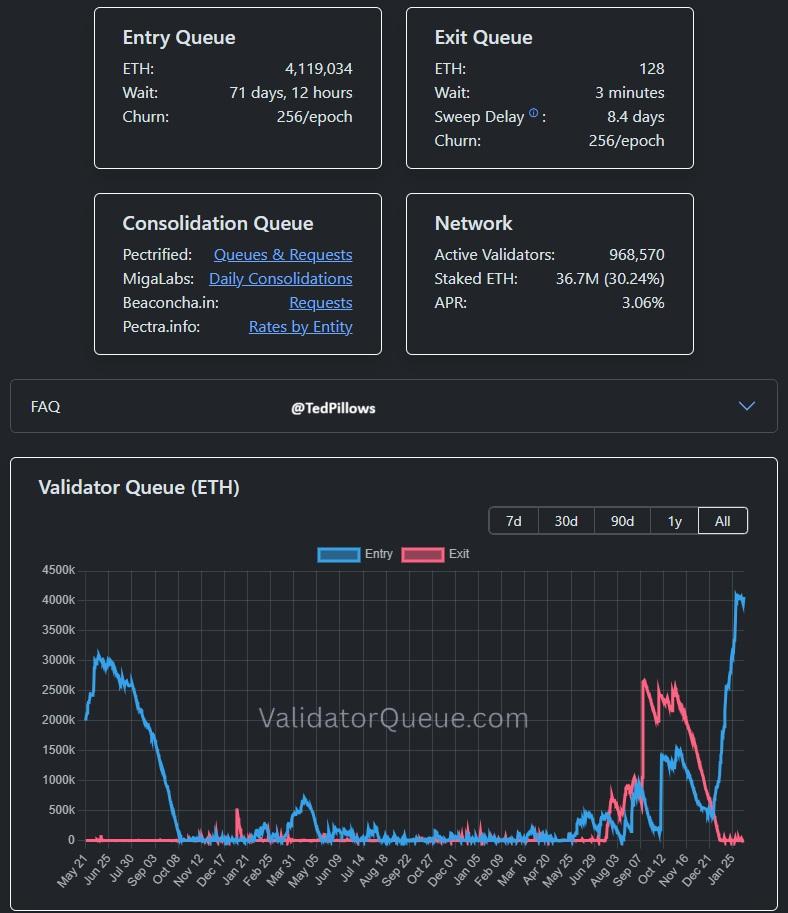

ETH Staking Queue Hits All-Time High

Ethereum’s entry queue reached 4,119,034, the highest level ever recorded. Analyst Ted noted that staking demand remains strong despite price weakness. The metric suggests long-term confidence in the network among validators.

Ted observed that Ethereum failed to hold above $2,000. He identified $1,800–$1,850 as the next key support zone if the asset cannot reclaim the psychological level soon. A prolonged stay below $2,000 could trigger further selling pressure.

Another aggressive buyer, wallet 0x6C85, keeps depositing funds into Hyperliquid. The address has transferred 30.71 million USDC to open a 40,000 ETH long position worth $80.92 million. This buying activity continues despite mounting unrealized losses.

Ethereum Technicals Signal Oversold Conditions

Ethereum broke decisively below its 7-day Simple Moving Average at $2,047. The RSI sits at 28.27, deep in oversold territory below the 30 threshold. However, no bullish divergence has formed yet to suggest an imminent reversal.

The MACD reading at -276.02 remains significantly below its signal line at -244.46. Both lines trend downward with the histogram heavily negative. Momentum continues accelerating to the downside without signs of exhaustion.

Current price action tests the 0.786 Fibonacci retracement level near $1,900. This represents the last major Fibonacci support before a potential full retracement to $1,350. A daily close below $1,900 could trigger acceleration toward $1,800.

Ethereum’s dominance dropped to 10.23% from 10.63%, underperforming Bitcoin during the sell-off. Volume increased on recent red candles without a capitulation spike. The absence of climactic selling suggests more downside remains possible.

Key resistance sits at $2,000–$2,100, with the broken support now acting as a ceiling. Support levels include $1,850, $1,650, and $1,350 in extreme scenarios. The trend remains bearish until price reclaims $2,000 with conviction.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Pudgy Penguins

PENGU

$0.01

Aztec

AZTEC

$0.03

Espresso

ESP

$0.06

Bitcoin

BTC

$68,829.14

Bittensor

TAO

$176.24

Monad

MON

$0.02

Lighter

LIT

$1.61

Hyperliquid

HYPE

$31.43

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft