Ethereum 2026 Bulls Target $7K–$20K as Institutions Turn ETH Into Financial Infrastructure

Fundstrat's Tom Lee and BitMEX's Arthur Hayes outline bullish cases as corporate treasuries accumulate ETH and tokenization adoption accelerates ahead of 2026

January 2, 2026 at 10:32 AM

Last updated

January 2, 2026 at 10:32 AM

Ethereum 2026 Bulls Target $7K–$20K as Institutions Turn ETH Into Financial Infrastructure

KEY FACTS

- Fundstrat's Tom Lee projects ETH could reach $7,000-$20,000 by 2026 as Wall Street accelerates blockchain infrastructure adoption

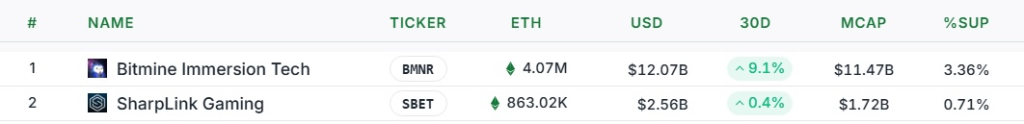

- Corporate treasuries hold over 4.8 million ETH combined, with BitMine leading at 4,066,062 ETH

- Technical analysis shows ETH consolidating near $3,000 with bullish bias pending breakout above $3,100 resistance

Ethereum‘s trajectory toward 2026 centers on its transformation from speculative asset to foundational financial infrastructure. Price forecasts from prominent market participants range between $7,000 and $20,000. Corporate treasuries and institutional investors are expanding exposure to Ethereum-based settlement systems and tokenization frameworks.

At press time, ETH trades at $2,991.85, up 0.82% in 24 hours and 1.23% over seven days. The asset’s market capitalization stands at $360.99 billion. Trading volume has declined 37.47%, reflecting persistent selling pressure despite stabilizing price action.

Ethereum reached an all-time high above $4,946 last year before consolidating between $2,500 and $3,000. The asset recorded a 10.69% annual decline. Meanwhile, Ethereum ETFs posted a one-day net inflow of 1,403 ETH ($4.2 million) but experienced weekly outflows of 50,255 ETH ($150.36 million), according to Lookonchain data.

Analysts Project ETH Rally to $20,000 as Institutions Expand Exposure

Fundstrat Global Advisors co-founder Tom Lee projected ETH could reach $7,000 to $9,000 by early 2026. Lee, who chairs Ethereum treasury company BitMine, outlined potential for prices to climb toward $20,000 over an extended timeframe during a CNBC appearance.

Lee’s thesis positions Ethereum as the settlement layer for tokenized securities, stablecoins, and on-chain financial operations. He cited BlackRock and Robinhood testing tokenized assets and on-chain settlement systems as evidence of broader financial migration to blockchain rails.

BitMEX co-founder Arthur Hayes reaffirmed a $10,000 ETH target on the Bankless podcast. Hayes framed the projection as price discovery following nearly four years of consolidation below 2021 highs. Lee emphasized the potential move would represent structural appreciation rather than speculative excess.

BitMine Immersion Technologies holds 4,066,062 ETH, making it the largest Ethereum-focused corporate treasury. Sharplink Gaming ranks second with 797,704 ETH valued at approximately $2.33 billion.

Ethereum Tokenization Growth and Hegota Upgrade Fuel Institutional Interest

Sharplink CEO Joseph Chalom projected Ethereum’s total value locked could increase tenfold during 2026. He forecast the stablecoin market reaching $500 billion by December 2026, up from approximately $316 billion currently, with Ethereum processing over half of that activity.

Chalom expects tokenized real-world assets to grow toward $300 billion. Ethereum currently processes more than $12 billion in tokenized assets, outpacing competitors including Solana and Arbitrum, according to RWA.xyz data.

Developers confirmed Ethereum’s next major upgrades: Glamsterdam in Mid-2026 and Hegota in late 2026. The upgrade focuses on state management and Verkle Trees. This follows the successful December’s Fusaka upgrade, which expanded data capacity via PeerDAS. Staking activity reached 120.6 million ETH, reflecting confidence in Ethereum’s technical roadmap.

Ethereum co-founder Vitalik Buterin reiterated the network’s mission to build censorship-resistant infrastructure. He cited recent centralized web outages affecting Cloudflare and AWS that disrupted Coinbase and Ledger services. Growing institutional interest in decentralized systems followed 2025’s $2.2 billion hack spree.

Not all analysts share bullish outlooks for 2026. Crypto analyst Benjamin Cowen argued ETH is unlikely to establish new all-time highs next year. Cowen cited prevailing Bitcoin market conditions and broader liquidity dynamics as constraining factors.

ETH Outlook and Technical Indicators

Ethereum displays consolidation with early bullish signals on the daily chart. A symmetrical triangle pattern has developed since mid-December, with rising support near $2,830 and descending resistance around $3,100. The pattern approaches its apex within 7-10 days.

The RSI reads 45.54, positioned in neutral territory below the midpoint. The indicator shows potential higher low structure compared to November readings, suggesting accumulation. The MACD histogram prints positive at +8.09, signaling a bullish momentum shift.

The 20-day SMA at $2,836 provides dynamic support, while the 50-day SMA near $2,961 acts as immediate resistance. All three major moving averages converge within the $2,830-$3,087 range. Volume has declined during consolidation, typical pre-breakout behavior.

Bollinger Bands contract around current price levels, indicating a volatility squeeze. A decisive break above $3,100 with volume confirmation would target $3,200-$3,500. Failure to hold $2,950 support risks retesting $2,750-$2,800. Price trajectory remains neutral with a slight bullish bias pending breakout confirmation.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.05

ETHGas

GWEI

$0.03

Pudgy Penguins

PENGU

$0.01

Axie Infinity

AXS

$2.57

River

RIVER

$48.11

Lighter

LIT

$1.79

Monad

MON

$0.02

Bitcoin

BTC

$89,859.74

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft