Ethereum Holds $1.9K as Over 50% of Total Supply Is Now Staked for the First Time — Reversal Ahead?

Historic staking milestone locks up majority of ETH supply as technical indicators flash mixed signals for the second-largest cryptocurrency.

4 hours ago

Last updated

4 hours ago

KEY FACTS

- Over 50% of Ethereum's total supply is now staked for the first time, reducing liquid supply available for trading.

- Ethereum ETFs saw $54M daily inflows but $190M weekly outflows, while BlackRock bought $22.9M in ETH.

- Technical analysis shows ETH trading below key resistance at $2,114, with a potential relief rally if $2,150 is reclaimed.

Ethereum has reached a historic milestone as more than half of its total supply is now locked in staking contracts. The asset trades near $1,981.79, posting modest weekly gains while the market watches for signs of a potential trend reversal.

According to Santiment data, the Proof-of-Stake contract on Ethereum now holds 50.18% of total historical ETH issuance. This marks a record in the project’s 11-year history. The development has reduced liquid supply available for trading on exchanges.

Ethereum’s market capitalization stands at approximately $238.3 billion following a 0.78% recovery in 24 hours. Weekly performance shows a 3.28% gain, while daily movement reflects a 0.82% increase.

Ethereum ETF Flows Show Mixed Signals Amid Institutional Activity

Ethereum ETF data reveals contrasting short-term and weekly trends. According to Lookonchain, daily net inflows reached 27,096 ETH, valued at $54.14 million. However, the seven-day timeframe recorded net outflows of 95,009 ETH, worth approximately $189.83 million.

BlackRock emerged as a notable buyer, acquiring over $22.9 million in Ethereum during this period. Meanwhile, Tom Lee’s Bitmine purchased 45,759 ETH worth $90.83 million last week. The firm’s total holdings now stand at 4,371,497 ETH valued at $8.68 billion.

Bitmine’s average cost basis sits at approximately $3,821 per ETH. At current prices, the position reflects an unrealized loss exceeding $8.03 billion. The firm reportedly acquired an additional 20,000 ETH worth $39.8 million from BitGo recently.

Peter Thiel’s Founders Fund has fully exited its position in ETHZilla, reducing its roughly 7.5% stake to zero. ETHZilla, an ETH treasury firm, once held over 100,000 ETH. Following October’s market peak, the entity reportedly sold approximately $40 million in ETH for buybacks.

An additional $74.5 million was liquidated to reduce convertible debt obligations. This exit highlights stress on single-asset treasury models during volatile market conditions.

Ethereum Privacy Upgrade and Trader Positioning

Ethereum has introduced ERC-5564, enabling stealth payments that obscure sender-receiver links while maintaining auditability. The upgrade adds programmable privacy capabilities at the infrastructure level within the public blockchain system.

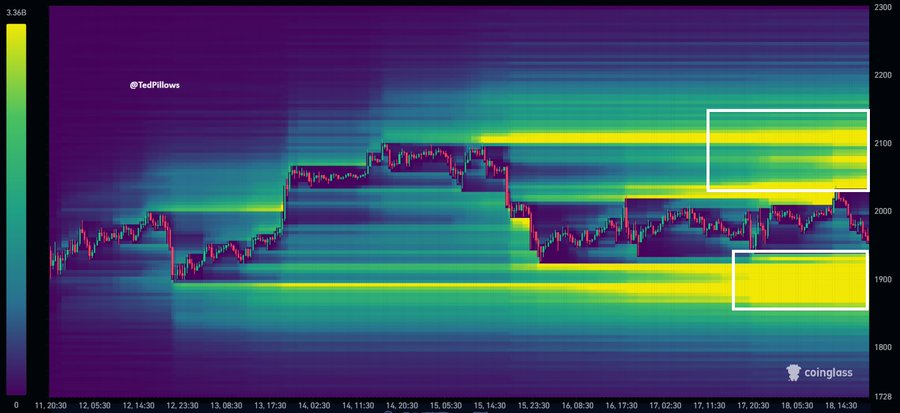

Analyst Ted Pillows noted ETH moved back above the $2,000 level recently. He observed that selling pressure on Binance appeared to be slowing. Pillows stated he was watching for Ethereum to reclaim $2,100 to confirm further upside potential.

Ted Pillows also noted ETH liquidity clusters remained fairly balanced. Both long and short positions appeared aggressive. He suggested amid U.S.-Iran tensions, long positions might face liquidation first, followed by shorts.

Arthur Hayes deposited 1,000 ETH worth $1.99 million into Bybit exchange recently. The movement suggests potential positioning by the prominent trader.

Ethereum Technical Indicators Signal Potential Shift

Ethereum’s price currently sits below the 20-day simple moving average at $2,114.63. Bollinger Bands show contraction from September-October expansion, indicating decreasing volatility.

The MACD indicator displays a bullish crossover forming. The MACD line reads -213.45 while the signal line sits at -235.62. The histogram has turned positive with teal bars after an extended red period. Both lines remain deeply negative below zero.

Volume data shows 14.11K ETH traded with declining activity during the recent bounce. A massive spike occurred during the late January breakdown. No strong accumulation pattern is currently visible on the chart.

Key support levels include $1,900-$1,950 as the immediate floor. The $1,719-$1,750 zone represents critical macro support at the lower Bollinger Band. Resistance zones sit at $2,100-$2,150 and the upper band near $2,500-$2,600.

The primary trend remains bearish with lower highs from $4,900 to $3,200 and lower lows toward $1,950. A potential double bottom could form if $1,900 holds and price reclaims $2,150. The technical outlook suggests a near-term relief rally remains possible, though the broader downtrend structure stays intact pending a break above $2,150 with strong volume.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Bitcoin

BTC

$66,392.46

Espresso

ESP

$0.09

Optimism

OP

$0.17

Hyperliquid

HYPE

$28.51

Pudgy Penguins

PENGU

$0.01

Solana

SOL

$81.44

World Liberty Financial

WLFI

$0.12

Bittensor

TAO

$182.4

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft