Gemini XRP Mastercard Move Boosts $RLUSD Stablecoin Pilot —XRP Targets $3.20 Rally

Mastercard, Ripple, and Gemini pilot RLUSD stablecoin settlements on XRP Ledger as network sees largest wallet growth in eight months

November 6, 2025 at 2:33 PM

Last updated

November 6, 2025 at 2:37 PM

KEY FACTS

- Mastercard, Ripple, Gemini, and WebBank launched a pilot testing RLUSD stablecoin settlements on the XRP Ledger for card transactions

- The XRP network added 21,595 new wallets in 48 hours—the largest spike in eight months—despite trading 38% below all-time highs

- XRP trades at $2.30 with technical analysis targeting $3.20, supported by a $500M Ripple funding round at $40B valuation

Gemini XRP Mastercard move have boosted Ripple’s stablecoin pilot program via the RLUSD stablecoin pilot.

On November 5, Ripple, the issuer of XRP announced that they’re collaborating with Mastercard, Gemini and WebBank to introduce $RLUSD settlement on the XRP Ledger for fiat credit card payments, starting with the Gemini XRP Credit Card

According to an official statement, Mastercard revealed that “Through our partnerships with Ripple, Gemini, and WebBank, we’re using our global payments network to bring regulated, open-loop stablecoin payments into the financial mainstream,” said Sherri Haymond, Global Head of Digital Commercialization at Mastercard.

Gemini XRP Mastercard Push Power RLUSD Stablecoin Settlement on XRP Ledger.

Once implemented, this would be the first instance where a regulated U.S. bank settles traditional card transactions using a regulated stablecoin on a public blockchain.

The partnership also expands on Ripple’s existing work with Gemini and WebBank on the Gemini Credit Card, which launched an XRP edition earlier this year and serves as a model for how digital assets can be integrated into traditional payment programs.

The announcement follows Ripple’s acquisition of Palisade and a $500 million funding round.

Coinwaft reported earlier that the raise pushed the company’s valuation to $40 billion, with backing from Fortress Investment Group, Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

Crypto analysts are now very optimistic that XRP can ride this wave to embark on a rally targeting $3.20

XRP currently trades at $2.30, reflecting a 3.80% increase in the last 24 hours. The asset remains in a consolidation phase following its correction from highs around $3.50.

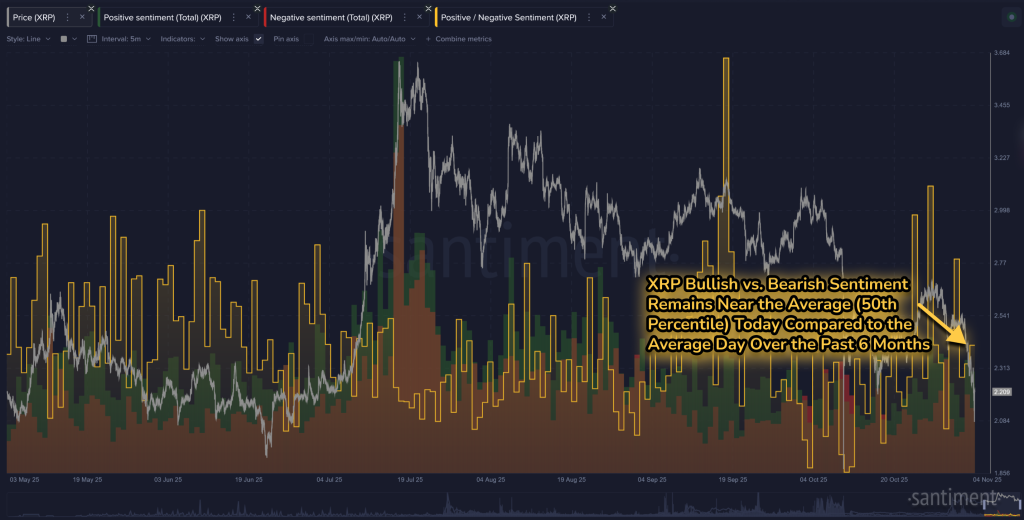

Despite fundamental developments, retail sentiment remains neutral. Data from Santiment reveals a disconnect between on-chain progress and market enthusiasm. The platform noted that the ratio of bullish versus bearish comments remains balanced.

“XRP is showing what most other altcoins are showing… a surprising level of disinterest,” Santiment Analytics reported. Retail focus has shifted primarily toward Bitcoin, with Ethereum receiving slightly less attention.

Similarly, on-chain liquidity data from CoinGlass shows most leveraged positions concentrated between $0.48 and $0.56.

A decisive move above this range could trigger short liquidations, potentially accelerating toward the $3.20 target projected by analysts.

Crypto analyst StephCrypto, also revealed that XRP needs to break above the 200-Day simple-moving-average (SMA) around $2.40 to trigger the bullish reversal.

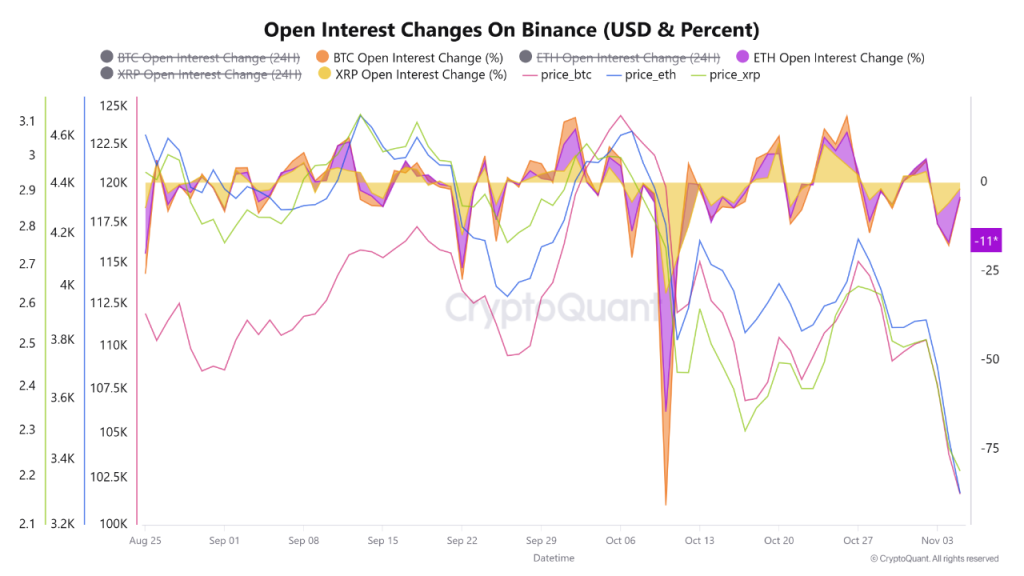

Fresh data from CryptoQuant also shows that traders appear to be trimming positions in Bitcoin and Ethereum while simultaneously ramping up long exposure to XRP, a clear sign of capital rotation into the altcoin.

XRP stands out as the exception amid the broader pullback, showing evidence of steady bullish accumulation.

Despite a modest decline of $8.69 million (-1.71%) in open interest within the last 24 hours, following a sharper $30.89 million (-5.73%) drop earlier, traders seem to be buying into the dip.

This pattern show growing confidence in XRP’s bullish projection, contrasting sharply with the cautious sentiment surrounding Bitcoin and Ethereum.

XRP Consolidates at $2.30 with Key Resistance at $2.65 and Bullish Target at $3.20.

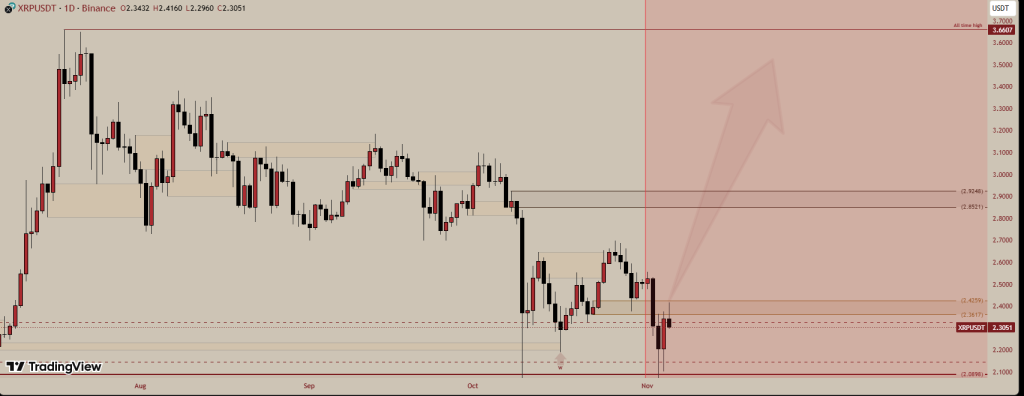

On the technical front, XRP is currently consolidating in a critical accumulation zone.

The asset corrected significantly from September highs around $3.50 and now stabilizes near key support levels.

Primary support sits at $2.30-$2.40, marked by the current consolidation area. Secondary support exists at $2.00-$2.10, representing a psychological level. The critical floor appears at $1.90.

Immediate resistance stands at $2.65-$2.70, where recent rallies failed. Major resistance occupies the $2.90-$3.00 zone. The key target remains at $3.20, with extended targets between $3.50-$3.80 matching previous highs.

A descending channel formed between July and November, creating lower highs and lower lows. Recent price action broke below previous consolidation at $2.90 before stabilizing.

Price currently stabilizes in the $2.30-$2.50 range, with reduced volatility suggesting base building. Long wicks on recent candles indicate buying interest at lower levels. Recent selling pressure shows exhaustion signs.

The bullish scenario targets $2.80-$3.20 if support holds above $2.30. A break above $2.50-$2.65 would confirm accumulation. Reclaiming $2.90 would signal trend reversal.

The current entry zone at $2.30-$2.40 offers a risk-reward ratio of approximately 4:1 with a stop loss below $2.20. Breaking below $2.30 would invalidate the accumulation thesis.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

TRIA

TRIA

$0.02

Bitcoin

BTC

$76,546.44

Zama

ZAMA

$0.03

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$33.7

Tether Gold

XAUT

$5,064.72

River

RIVER

$15.57

Solana

SOL

$98.21

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft