Why Is XRP Dropping? Price Faces Rejection at $2.70 on Bearish Pattern Formation

Ripple-linked token plunges 38% from July peak as rare death cross formation threatens further downside amid $1.33 billion crypto liquidations

November 4, 2025 at 8:36 PM

Last updated

November 4, 2025 at 8:36 PM

KEY FACTS

- XRP has fallen 38% from its July peak of $3.65 to $2.25, with technical indicators showing an impending death cross formation for only the third time in history.

- Crypto markets saw $1.33 billion in liquidations over 24 hours, with bearish MACD crossover and RSI approaching oversold territory signaling continued downward pressure.

- Despite Ripple investing $4 billion in ecosystem expansion and acquiring custody firm Palisade, XRP faces critical $2.00 support test as sellers maintain control.

Many crypto traders are worried and asking Why is XRP dropping hard as the token has dropped nearly 44% from its July peak of $3.84, now trading at $2.25 after a sharp 6.98% drop in the last 24 hours.

The Ripple-linked token is now facing a mounting technical pressure as analysts warn of an impending death cross formation.

Technical Indicators Show Why XRP is Dropping Towards Key $2.20 Support

Analyst says XRP is dropping because the 50-day simple moving average is approaching a cross below the 200-day SMA, forming the first potential death cross since May 2025. This bearish pattern typically signals extended downtrends and weakening short-term momentum.

The Relative Strength Index currently reads 33.41, declining sharply toward oversold territory below 30. The MACD line has crossed below the signal line, confirming fresh sell signals as downward momentum accelerates.

Tony “The Bull” Severino, a Chartered Market Technician, noted XRP’s monthly LMACD has crossed bearish for only the third time in history. Previous bearish crossovers resulted in 87% and 71% drawdowns after the signal fired.

The signal remains unconfirmed, requiring bulls to push prices significantly higher this month to avoid confirmation. Sjuul, founder of AltCryptoGems, confirmed XRP’s pattern shows a lower high with rejection at $2.70.

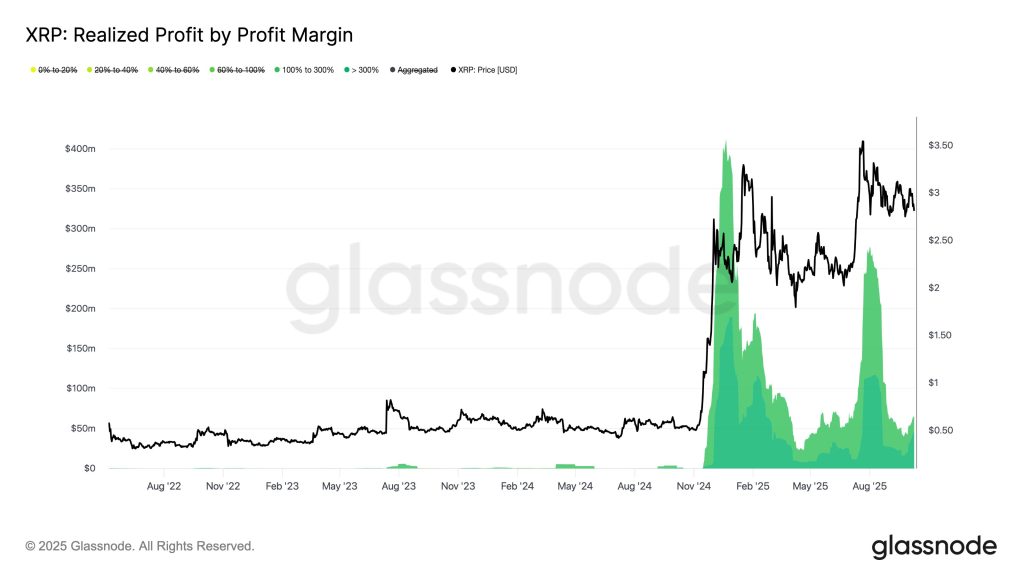

Glassnode data answers the question Why is XRP dropping as it shows that significant profit-taking from investors who accumulated below $1 as price surged above $2.

Source: Glassnode

These two major realization waves in December 2024 and July 2025 exhausted much of the bullish momentum as most of the traders are in over 200% profit.

Ripple Expands Despite Token Pressure

Ripple, the parent company associated with the XRP token completed acquisition of Palisade, a digital asset custody company, aiming to expand custody capabilities for fintechs and corporates. The move follows strategic purchases including prime broker Hidden Road, now Ripple Prime, and treasury provider GTreasury.

Ripple’s investment in the crypto ecosystem has topped $4 billion this year according to Monday’s announcement. The expansion comes as XRP continues see ease from regulators particularly the SEC ending legal case with Ripple and XRP ETF approval underway.

According to DefiLlama, the XRPL ecosystem’s Total Value Locked sits at roughly $74.7 million, a fraction of Ethereum’s $62+ billion TVL. XRPL shows several hundred thousand active addresses daily with 5.3 million funded XRP wallets total.

Network fee and application revenue remain minimal at approximately $1,100 per 24 hours.

The token’s technical outlook remains weak, weighed down by derivatives market pressure.

Why Is XRP Dropping? Analysts Says $2.50 Must Be Reclaimed

XRP currently trades at $2.25, showing significant bearish momentum across multiple timeframes.

Immediate resistance stands at $2.50-$2.60, with secondary resistance at $2.75-$2.85. Major psychological resistance sits at $3.00, while previous highs create strong resistance at $3.50.

Critical support lies at $2.00 as a major psychological level. Next significant support zones appear at $1.90-$1.95 and $1.70-$1.80 from earlier price action.

Volume at 204.65 million shows moderate activity with recent bars displaying red dominance indicating selling pressure. No significant volume spike suggests continued distribution phase without capitulation yet.

Recovery would require RSI forming bullish divergence in oversold territory and MACD histogram contracting above the signal line.

If XRP stops dropping and reclaim the $2.50 level, indicator shows that it can target the $3.00 psychological level next.

However, market structure confirms sellers still remain in control with the $2.00 level representing critical make-or-break support.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

ETHGas

GWEI

$0.03

River

RIVER

$46.58

Oasis

ROSE

$0.02

Ondo

ONDO

$0.34

Pudgy Penguins

PENGU

$0.01

Solana

SOL

$130.96

Zcash

ZEC

$369.16

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft