Zcash Price Prediction: ZEC Surges 1200% YTD as Analysts Target $1,000 Next.

4 Mins

November 8, 2025 at 6:48 PM

Last updated

November 8, 2025 at 6:48 PM

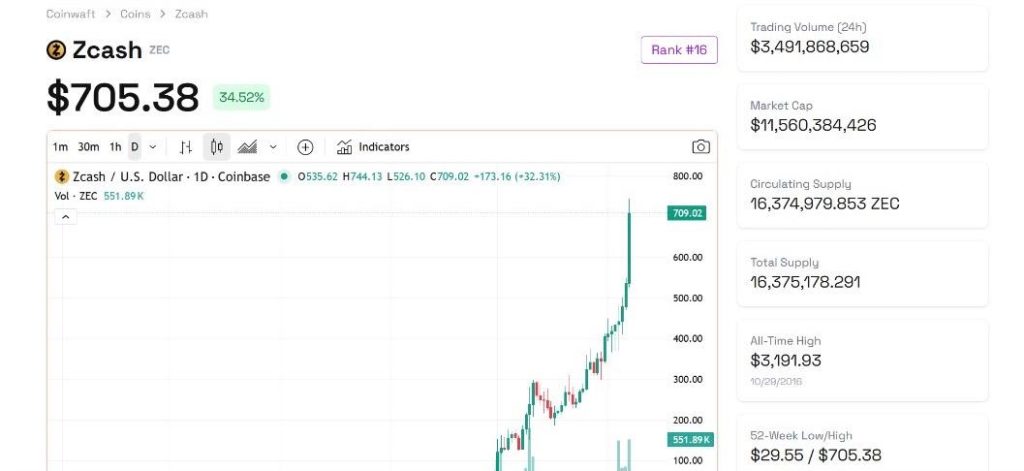

Crypto analysts keep asking about Zcash price prediction, as it has delivered a remarkable 1,200% gain year-to-date, with the privacy-focused cryptocurrency trading at $705.38 at press time. The token recorded a 70% increase over the past seven days, pushing its market capitalization to $11.5 billion.

The rally represents a 350% surge over the past month and a 900% climb since early September. ZEC has outperformed major cryptocurrencies despite broader market volatility throughout the period.

Zcash ($ZEC) is a privacy-focused cryptocurrency that was launched in 2016 as a fork of Bitcoin.

According to Cryptonomics, over 16,000 wallets have integrated tokenized Zcash on platforms such as Solana and BNB Chain. This cross-chain adoption has enhanced ZEC’s utility in decentralized finance protocols, liquidity pools, and lending platforms.

Trading volumes climbed from $560 million to $1.75 billion in October alone.

Key Catalysts Behind Zcash’s Sustained Rally

Zcash’s November 2025 halving will reduce miner rewards by 50%, mirroring Bitcoin’s scarcity mechanics. The event will push ZEC’s inflation rate below 4%, creating supply-side pressure as markets anticipate reduced sell activity from miners.

Privacy adoption has surged substantially, with 30% of ZEC transactions now utilizing shielded pools compared to less than 10% in 2024. This shift follows the Zashi wallet’s implementation of default privacy settings.

Shielded ZEC supply now represents 20-25% of total circulation, tightening liquid availability. Unlike Monero, Zcash offers optional transparency through view-key compliance features, positioning it favorably under regulatory frameworks including the EU’s MiCA rules.

Derivatives Activity Signals Mixed Sentiment

ZEC Open Interest has surged 19.55% to $1.11 billion, and Lookonchain reported a high-profile trader suffered a $2.73 million liquidation on a short position at $727.45.

The 24-hour funding rate of +0.000486% indicates balanced sentiment between long and short positions. However, leveraged long positions currently dominate the derivatives market.

One analyst on X stated the token “looks like it wants to take out that high at $900 before rolling over,” cautioning against late-stage short positions.

Another user cited crypto early adopters’ disinterest in traditional finance commodification of Bitcoin as a supporting factor for ZEC’s momentum.

Weekly chart data shows ZEC broke above a multi-month descending trendline that had constrained price action since early 2024. The breakout from a consolidation range between $20-$60 occurred with strong volume, suggesting institutional participation.

Zcash Price Prediction: ZEC Targets $900 In Parabolic Continuation

Weekly timeframe analysis reveals ZEC trading at $542.67 on the chart, showing a parabolic rally from approximately $100. The price has cleared major Fibonacci resistance levels, with immediate overhead resistance at $2,272 and secondary resistance at $2,818.

The RSI-14 indicator reached 85.03, signaling extreme overbought conditions. Support levels are established at $348-$400, with major historical support in the $108-$162 zone should deeper corrections occur.

The breakout above long-term resistance has not been retested, leaving the $100-$150 zone as potential support during pullbacks. Volume accompanying the rally confirms strong buying pressure behind the move.

Key resistance to monitor includes the $900 level mentioned by analysts and the psychological $1,000 target. The parabolic nature of the current rally suggests potential for sharp corrections, though the primary trend remains decisively bullish.

Price trajectory points to continued upside momentum toward $800-$1,000 in the near term. However, consolidation or healthy pullback to the $350-$400 support zone would provide better risk-reward entry points for new positions.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

Bitcoin

BTC

$89,810.45

ETHGas

GWEI

$0.03

River

RIVER

$46.47

Pudgy Penguins

PENGU

$0.01

XRP

XRP

$1.96

Lighter

LIT

$1.75

Solana

SOL

$130.15

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft