Bitcoin’s $100K Floor Under Siege as Risk Appetite Crumbles

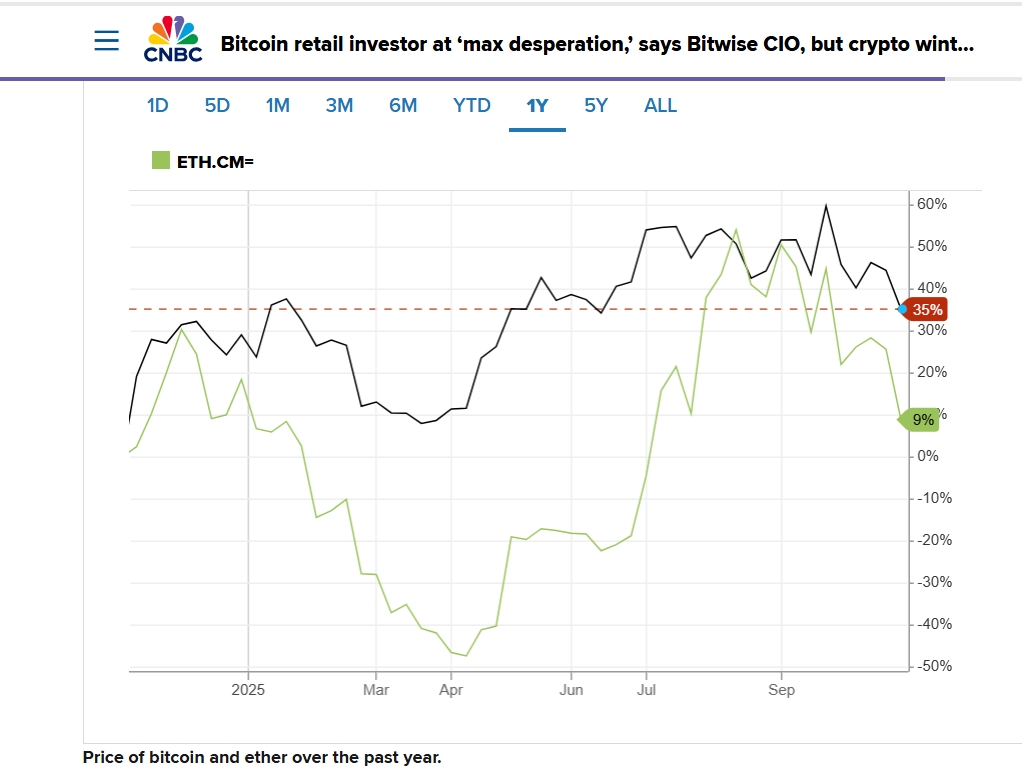

Bitcoin tests critical $100,000 support as ETF outflows and liquidations collide with dollar strength, while top analysts debate whether retail capitulation signals bottom or deeper correction ahead.

By Amoo Jubril

November 5, 2025 at 2:54 PM

Last updated

November 5, 2025 at 2:57 PM

KEY FACTS

- Bitcoin dropped to four-month lows of $100,800, driven by $1.3 billion in ETF outflows over four sessions and over $1 billion in long liquidations.

- Bitwise CIO Matt Hougan views the selloff as peak retail capitulation, projecting Bitcoin could reach $125,000-$130,000 by year-end once institutional demand returns.

- Analysts identify $100,000 as critical support, with failure potentially leading to $72,000-$95,000 downside, while reclaiming $101,000 would restore bullish structure.

Bitcoin dropped to $100,800 on Tuesday, marking a four-month low as the cryptocurrency tested a critical psychological support level.

The selloff coincided with broader risk-off sentiment across global markets, fueled by dollar strength and Federal Reserve policy uncertainty.

According to coinglass More than $1 billion in long liquidations occurred at the lows, briefly breaching intraday support before buyers stepped in.

Options dealers, who remain net short gamma around $100,000 strikes, accelerated hedging activity that amplified volatility near that threshold.

Bitcoin Retail Flush-Out Nears Completion

Bitwise chief investment officer Matt Hougan told CNBC’s Crypto World on Tuesday that the downturn reflects peak retail capitulation rather than structural collapse.

Hougan described the current environment as “crypto retail in max desperation,” noting leverage blowouts across the market.

Hougan stated the sell-off appears to be nearing exhaustion. He pointed to continued institutional and financial adviser enthusiasm for an asset class delivering strong annual returns despite recent volatility.

Once retail flush-out completes, institutional demand could drive prices higher, according to Hougan. He projected Bitcoin could reach new all-time highs by year-end, citing a potential range of $125,000 to $130,000.

Bitcoin Fed Balance Sheet Expansion in Focus

Former BitMEX CEO Arthur Hayes pointed to structural liquidity as the key driver of Bitcoin’s next rally. In a November 4 essay, Hayes argued the U.S. government’s growing debt issuance will force Federal Reserve balance sheet expansion.

Hayes described this mechanism as “stealth QE,” where the Fed supplies cash through its Standing Repo Facility to support Treasury financing.

Quantitative easing involves central banks purchasing financial assets to increase money supply and stimulate economic growth.

If the Fed’s balance sheet grows, that is dollar liquidity positive, and ultimately pumps the price of Bitcoin and other cryptos

Hayes wrote.

He stated this cycle of rising government borrowing and quiet liquidity creation will “reignite the Bitcoin bull market.“

Following Hayes’s analysis, market observers noted the disconnect between short-term technical weakness and longer-term monetary policy implications favoring hard assets like Bitcoin.

The thesis suggests structural forces may override near-term sentiment deterioration.

Dollar strength continued to pressure risk assets across multiple classes.

Bitcoin’s correlation with traditional risk assets remained elevated, compounding selling pressure as equities faced their own headwinds from Fed policy uncertainty.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Amoo Jubril

Writer

Amoo Jubril

Writer

I’m a blockchain-focused content writer helping crypto brands build trust through storytelling that’s simple, authentic, and community-driven

Author profileTrending Today

Seeker

SKR

$0.02

Bitcoin

BTC

$89,901.06

ETHGas

GWEI

$0.03

Pudgy Penguins

PENGU

$0.01

River

RIVER

$46.07

Solana

SOL

$130.34

Ondo

ONDO

$0.34

Monad

MON

$0.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft