Bitcoin Slides to $66K With Short-Term Sharpe Ratio Flashing Historic Bottom Signal — Reversal Ahead?

Short-Term Sharpe Ratio plunges to -38.38, matching levels that preceded major rallies in 2015, 2019, and 2022 as $90 billion exits the market

4 hours ago

Last updated

4 hours ago

KEY FACTS

- Bitcoin fell to $66,359 as $90 billion was wiped from crypto markets in 24 hours with ETF outflows reaching $647 million weekly.

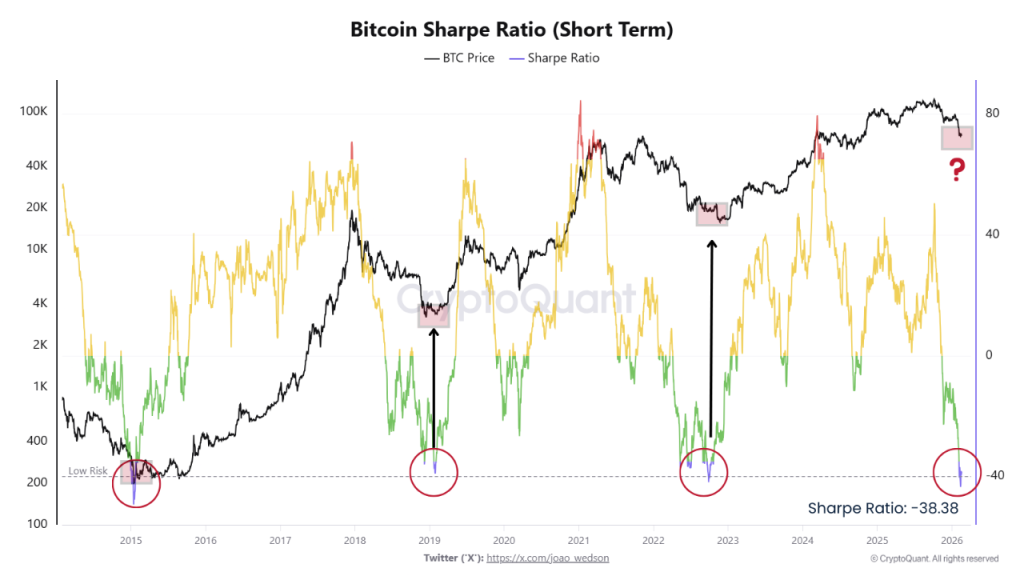

- The Short-Term Sharpe Ratio hit -38.38, matching levels that preceded major rallies in 2015, 2019, and 2022.

- Technical analysis shows bearish structure with $65K support critical and $68.2K resistance needing to break for reversal confirmation.

Bitcoin dropped to $66,359 as a historically significant indicator just flashed a rare signal. The flagship cryptocurrency posted a 1.33% daily decline while its market cap fell to $1.32 trillion. Amid the price drop, $90 billion evaporated from the crypto market in 24 hours

The Short-Term Sharpe Ratio plunged to -38.38, matching levels previously seen only during generational buying zones. This metric measures risk-adjusted returns, and such extreme negative readings have historically aligned with major cyclical bottoms in 2015, 2019, and late 2022.

Each prior instance preceded violent price recoveries to new all-time highs. The current reading now sits at the same threshold that marked those pivotal turning points.

Sharpe Ratio History Points to Asymmetric Opportunity

The deeply negative Sharpe Ratio reading signals maximum pain per unit of volatility. The drawdown from the $120,000 all-time high has been sharp, fast, and emotionally punishing for most participants.

Bitcoin operates as a structurally cyclical asset driven by halving-induced supply shocks and liquidity cycles. Its deepest Sharpe troughs have historically marked selling pressure exhaustion rather than prolonged bear market beginnings.

From a probabilistic standpoint based on prior cycles, the risk-reward appears asymmetrically favorable for medium to long-term positioning. Momentum indicators suggest downside has been largely priced in at current levels.

The primary risk remains a macro liquidity shock that could extend the current trough period. Historically, buying extreme Sharpe lows in Bitcoin has produced some of the highest-conviction setups the market offers.

Bitcoin ETF Outflows Accelerate as Retail Exits

Bitcoin ETFs recorded substantial capital flight across both daily and weekly timeframes. According to Lookonchain, net outflows reached 1,633 BTC worth $107.63 million in a single day. The seven-day picture painted an even grimmer scenario with 9,822 BTC or $647.46 million leaving these investment vehicles.

Retail participation has collapsed to levels matching the 2022 bear market lows. The 30-day retail demand change sits in deep negative territory. Transfer volumes for transactions between $0 and $10,000 are collapsing rapidly.

Small wallet activity last reached these depressed levels when Bitcoin traded between $15,000 and $20,000 in 2022. Similar readings appeared at the $25,000 level in mid-2023. No accumulation or FOMO behavior is present among smaller investors.

Historical data points to retail capitulation at this scale marking late-stage corrections. However, retail typically remains absent longer than most market participants expect.

Bitcoin Price Structure Shows Key Support and Resistance Levels

Bitcoin currently trades at $66,874.70 on the daily timeframe after touching a session low of $65,621.02. The price structure reveals a clear two-legged correction pattern from the $120,000 peak. The first leg brought prices from $120,000 to $90,000 before consolidation. The second leg accelerated the breakdown from $95,000 to current levels.

Critical support sits at the $65,000-$66,000 zone representing the current test area. Secondary support levels exist at $60,000-$62,000 and $52,000-$55,000. Immediate resistance appears at $68,183 where the 9 EMA provides dynamic resistance.

The 9 EMA slopes downward sharply, confirming bearish momentum. Price remains approximately $1,300 below this key moving average. Every recent bounce attempt has faced rejection at this level.

MACD readings show the indicator deeply in negative territory with the line at 381.83 against a signal line of -4,527.23. Histogram bars are turning lighter red, suggesting weakening selling pressure. A potential bullish crossover setup is forming.

Volume analysis reveals declining activity on the current bounce, raising questions about conviction. The bearish scenario targets $62,000 initially with potential extension to $55,000. The bullish case requires a daily close above $68,200 with volume expansion targeting $72,000-$78,000.

Price trajectory remains bearish until the 9 EMA is reclaimed on a closing basis. A MACD bullish crossover confirmation would signal a potential relief rally toward the $72,000-$78,000 resistance cluster.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Optimism

OP

$0.14

パンチ (Punch)

PUNCH

$0.03

Pudgy Penguins

PENGU

$0.01

Ethereum

ETH

$1,943.59

Bitcoin

BTC

$66,904.92

Arbitrum

ARB

$0.1

Bittensor

TAO

$177.39

Canton

CC

$0.16

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft