Bitcoin Dips to $67K While Altcoin Activity Halves — Could Rotation Fuel a BTC Rally?

Altcoin trading volumes contract by 50% on Binance as whales accumulate over 200,000 BTC during the correction phase

4 hours ago

Last updated

4 hours ago

KEY FACTS

- Bitcoin drops to $67,469 as altcoin trading volumes on Binance shrink by nearly 50% since November

- Whale holdings increased by over 200,000 BTC in the past month, with Strategy adding 2,486 BTC last week

- Technical analysis shows bearish bias until price reclaims $71,000 resistance with key support at $61,000-$62,000

Bitcoin has retreated to $67,469, posting a 1.2% decline over 24 hours after failing to hold the $68,000 level. Meanwhile, altcoin trading volumes on Binance have contracted by nearly 50% since November. This capital rotation pattern has historically appeared during late-stage bear market corrections.

The leading cryptocurrency now trades within a consolidation range between $65,000 and $72,000. Significant activity from whales, long-term holders, and institutional investors continues at these levels. The total market capitalization stands at approximately $1.34 trillion following a 1.01% daily decline.

Despite the recent price weakness, Bitcoin has posted a modest 0.97% gain over the past week. The current pullback follows an immediate rejection at the $68,000 resistance level. Market participants are now watching whether this consolidation phase will support a broader recovery.

Binance Data Reveals Dramatic Shift in Trading Volumes

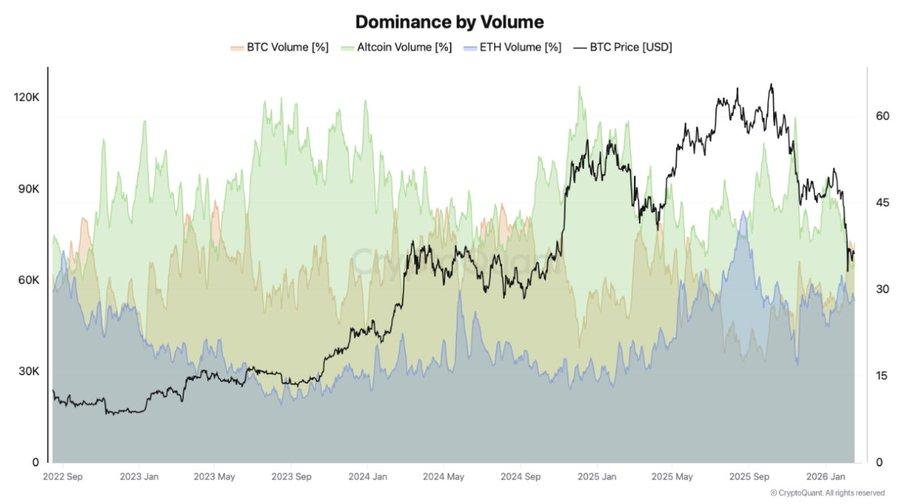

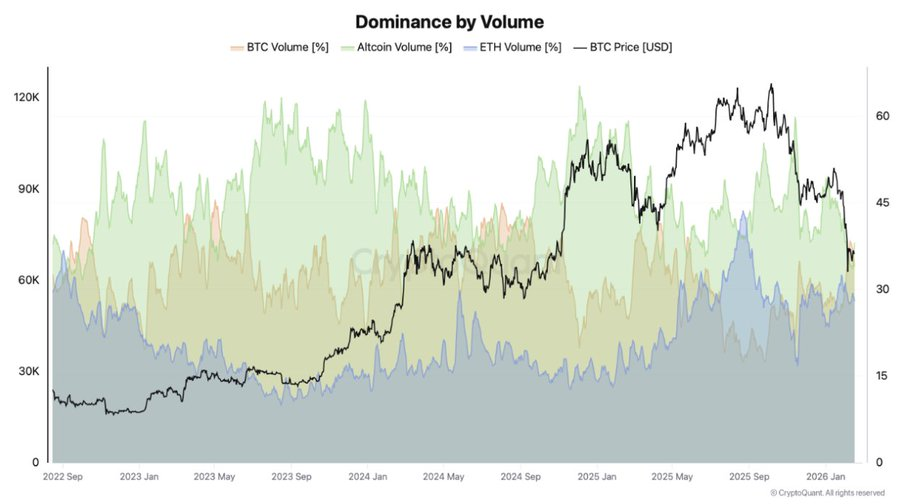

Trading volume distribution on Binance has shifted notably in recent weeks. On February 7, Bitcoin reclaimed dominance with 36.8% of total exchange volume. That dominance has persisted through the present day.

Altcoins now represent just 35.3% of Binance trading activity, while Ethereum accounts for 27.8%. In November, altcoins commanded 59.2% of trading volumes on the exchange. By February 13, that share had fallen to 33.6%.

This pattern has repeated during previous corrective phases, including April 2025, August 2024, and October 2022. The October 2022 instance occurred near the end of that bear market cycle. Binance, recording among the highest trading volumes globally, provides a relevant benchmark for tracking these behavioral shifts.

During periods of uncertainty and market stress, investors consistently gravitate toward Bitcoin. This behavior reinforces its role as the primary asset for capital preservation within the cryptocurrency market.

Whale Accumulation Reaches 200,000 BTC Amid Selling Pressure

Whale holdings have increased by 3.4% over the past month despite elevated inflows to exchanges. Total supply held by whales rose from 2.9 million BTC to over 3.1 million BTC. This represents accumulation exceeding 200,000 BTC.

The last whale accumulation of this magnitude occurred during the April 2025 correction. That wave of buying helped absorb selling pressure and supported a rally from $76,000 to $126,000. With Bitcoin consolidating approximately 46% below its all-time high, current levels present an attractive accumulation zone.

Michael Saylor’s Strategy acquired another 2,486 BTC at $67,710 last week for $168.4 million. The company now holds 717,131 BTC valued at $48.76 billion with an average purchase price of $76,027. Strategy currently carries an unrealized loss of $5.76 billion, representing a 10.56% decline from cost basis.

Selling pressure remains significant across the market. Current demand may not yet be sufficient to fully offset distribution from other market participants.

Bitcoin Price Tests Critical Support as Technical Indicators Signal Relief

Bitcoin has declined approximately 44% from its cycle peak near $120,000 to the current $67K level. The price is testing the critical $66,800-$67,000 support zone, which coincides with the lower Bollinger Band.

Major support exists at $61,000-$62,000, representing a historical demand accumulation area. The psychological $60,000 level marks the next significant threshold below that zone. A break under $60,000 would likely trigger additional capitulation selling.

Resistance levels include $71,150 at the 20-day SMA and Bollinger mid-band. The 23.6% Fibonacci retracement at $78,000 represents the first meaningful recovery test. The $86,000-$90,000 zone marks the breakdown area requiring reclamation for trend reversal confirmation.

The MACD has produced a bullish crossover, though it remains deep in negative territory. Crossovers below the zero line typically signal relief rallies rather than confirmed trend reversals. The histogram has begun turning from red to green.

Volume analysis reveals distribution phase characteristics with strong selling and weak buying on bounce attempts. No climactic volume spike has occurred, which typically marks definitive bottoms. The bearish scenario carries higher probability until price reclaims the $71,000 resistance level with conviction.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Optimism

OP

$0.14

パンチ (Punch)

PUNCH

$0.03

Pudgy Penguins

PENGU

$0.01

Ethereum

ETH

$1,943.59

Bitcoin

BTC

$66,904.92

Arbitrum

ARB

$0.1

Bittensor

TAO

$177.39

Canton

CC

$0.16

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft