BTC, ETH Jump Sharply as Markets Price In a 95% Fed Cut — BlackRock Predicts U.S. Debt Will Drive 2026 Crypto Boom

Federal Reserve rate cut expectations and BlackRock's debt crisis warning trigger crypto market rally as institutional adoption signals strengthen heading into 2026.

December 4, 2025 at 5:54 AM

Last updated

December 4, 2025 at 5:57 AM

KEY FACTS

- Bitcoin and Ethereum rallied as markets assigned 95% odds to a December Fed rate cut, with BTC up 3.2% weekly to $92,707 and ETH gaining 4.3% to $3,148.

- BlackRock projects U.S. national debt breaching $38 trillion will drive institutional crypto adoption through 2026 as traditional hedges fail.

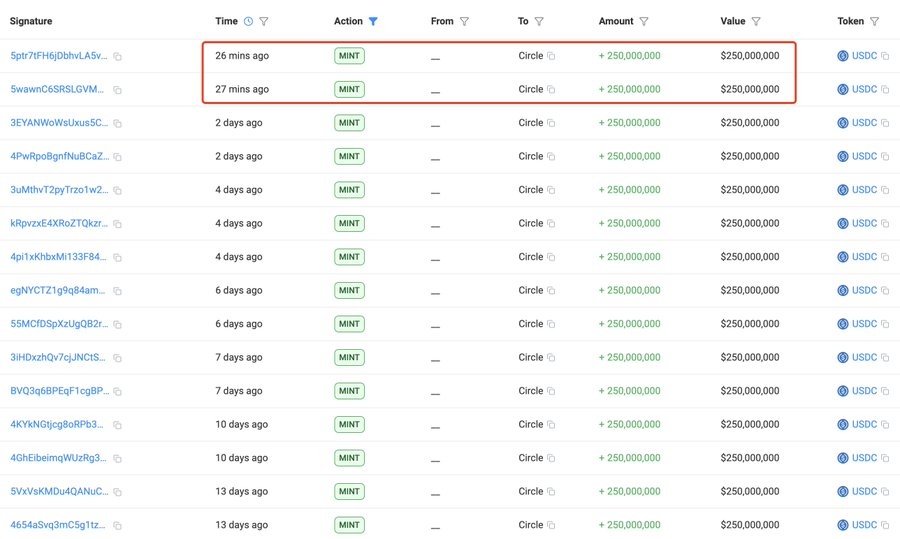

- Technical indicators show bullish reversal signs with positive MACD, RSI rebounding from oversold levels, and $20B in fresh stablecoin minting since October.

Bitcoin and Ethereum surged as markets assigned a 95% probability to a December Federal Reserve rate cut. BlackRock, the world’s largest asset manager, projected that rising U.S. national debt will accelerate institutional crypto adoption through 2026.

With one week until the December 9-10 FOMC meeting, CME FedWatch, Polymarket, and Kalshi all showed near-90% odds for a 25 basis point cut. Bitcoin traded at $92,707.27, up 0.7% in 24 hours and 3.2% weekly, while Ethereum reached $3,148.90, gaining 5.45% daily and 4.3% for the week.

The repricing followed softening labor data and muted inflation readings. A government shutdown delayed October CPI and jobs reports, creating what analysts called a “data fog” that amplified market expectations. Historically, Fed easing cycles have supported high-beta assets like cryptocurrencies.

BlackRock Warns Debt Crisis Will Push Institutions Toward Digital Assets

BlackRock released an AI-driven report projecting U.S. national debt will breach $38 trillion. The asset manager warned that traditional financial hedges are failing, prompting institutions to shift toward Bitcoin and digital assets as alternative investments.

“Government borrowing creates vulnerabilities to shocks such as bond yield spikes tied to fiscal concerns,” the report stated. It highlighted tensions between managing inflation and debt servicing costs as key drivers of market fragility.

Institutional interest in Bitcoin reached record levels in 2025, pushing BTC to all-time highs before reversing. BlackRock maintained the trend will resume as U.S. debt increases and traditional portfolio protections weaken.

Meanwhile, Bank of America advised wealth clients to allocate 1-4% portfolios to crypto. Vanguard reversed its anti-crypto stance to allow ETF trading starting January 5, 2026. These moves validated Bitcoin’s institutional role and widened retail capital access.

Stablecoin Minting and Ethereum Upgrade Signal Fresh Momentum

Tether and Circle minted over $20 billion in stablecoins since October’s market crash. They added $1 billion on December 2 alone. Historically, such liquidity injections preceded Bitcoin rallies within 10-30 days.

New stablecoins typically flow into Bitcoin as investors seek higher returns, tightening BTC supply. Current prices near $92,000 mirrored post-mint rally zones that delivered 8-12% gains in 2024-2025.

Ethereum’s Fusaka hard fork activated December 3, introducing EIP-7918 to set minimum blob fee floors. The upgrade prevents fees from collapsing during low activity, stabilizing ETH burn rates. Fidelity projected 8x higher blob fee revenue if EIP-7918 had been active since June.

The gas limit increased from 45 million to 60 million. PeerDAS technology reduced validator load by 85%, enabling 14 blobs per block by January 2026 versus six currently. Bitwise noted this cements Ethereum’s role as an institutional settlement layer.

ETHZilla, the sixth-largest ETH holder, acquired 20% of AI underwriting firm Karus to launch tokenized auto loans in 2026. The move links Ethereum to the $1.6 trillion auto-loan market. Tokenized private credit reached $19 billion and Treasuries hit $9.21 billion onchain in 2025.

Ethereum exchange reserves dropped 2.64% weekly as Bitmine acquired 18,345 ETH worth $54.9 million. A linked wallet withdrew 30,278 ETH valued at $91 million from Kraken, tightening available supply.

Bitcoin Technical Indicators Show Bullish Reversal Formation at $92,700

Bitcoin’s Fear and Greed Index registered 28, while Ethereum’s stood at 34. Both signaled fear, showing markets exited extreme panic territory. Bitcoin’s 20-day simple moving average sat at $90,214, with price trading above in bullish formation.

The cryptocurrency tested upper Bollinger Bands near $96,439, suggesting short-term overbought conditions. However, RSI rebounded from oversold levels near 30-34, historically preceding significant rallies. The indicator showed room for upside before reaching overbought territory above 70.

MACD histogram turned positive at +591.89, confirming bullish momentum shift. The crossover from negative to positive provided a strong buy signal. Volume spiked to 375 BTC during the recovery, confirming buyer interest.

Key resistance levels include $103,967 at the 23.6% Fibonacci retracement, followed by $108,000 and $112,000-$116,000. Support holds at $93,041 middle Bollinger Band, $90,214 at the 20 SMA, and $83,988 lower band.

The chart pattern shows early bullish reversal signs with price above the 20 SMA and positive MACD. Confirmation requires sustained closes above $103,967 and RSI crossing 50. Current risk-reward favors long positions with stops below $90,000, targeting $103,967-$108,000 initially.

Ethereum Technical Overview: Early Reversal Signs but Key Resistance Ahead

Ethereum on the daily chart is showing early signs of a potential trend reversal after a multi-week downtrend, with price rebounding strongly from the lower Bollinger Band and breaking above the 20-day SMA (middle band), which signals improving bullish momentum.

The short-term trend has shifted positive, supported by increasing buy volume and a bullish engulfing pattern near the recent bottom.

However, ETH is now approaching a major resistance zone at $3,200–$3,250, which aligns with the upper Bollinger Band and previous consolidation; a breakout above this level would confirm a stronger reversal and open the way toward $3,450.

Failure to break this zone could result in a rejection back toward $2,980 or even $2,750. Overall, the structure is improving but still needs a clear higher high to fully invalidate the broader downtrend.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.04

ETHGas

GWEI

$0.03

River

RIVER

$48.16

Axie Infinity

AXS

$2.59

Canton

CC

$0.15

Pudgy Penguins

PENGU

$0.01

Lighter

LIT

$1.8

Monad

MON

$0.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft