Circle Reports Strong Q3 2025 Results as USDC Circulation and Revenue Surge

Stablecoin issuer posts 97% circulation growth and $214M net income while maintaining IPO commitment amid acquisition talks.

By Amoo Jubril

November 12, 2025 at 5:17 PM

Last updated

November 13, 2025 at 6:41 AM

KEY FACTS

- Circle reported $711 million in reserve income for Q3 2025, up 60% year-over-year, driven by 97% growth in average USDC circulation.

- Net income surged 202% to $214 million, while adjusted EBITDA increased 78% to $166 million, reflecting strong operating leverage.

- Circle remains committed to its planned IPO targeting $5 billion valuation despite acquisition interest from Coinbase and Ripple.

Circle has posted robust third-quarter 2025 results, with reserve income reaching $711 million and USDC circulation growing 97% year-over-year.

The strong performance comes as the stablecoin issuer continues its IPO preparations while fielding acquisition interest.

CEO Jeremy Allaire attributed the growth to accelerating USDC adoption across traditional and digital finance. The launch of Circle’s Arc public testnet generated significant partner enthusiasm, demonstrating the expanding ecosystem around programmable money.

Reserve income increased 60% year-over-year, driven primarily by the 97% growth in average USDC circulation. This gain was partially offset by a 96 basis point decline in the reserve return rate.

Other revenue climbed to $29 million, up $28 million from the previous year. The increase came from strong growth in subscription, services, and transaction revenue streams.

Circle’s Financial Performance and Operating Metrics

Total distribution, transaction, and other costs reached $448 million, representing a 74% year-over-year increase. The rise reflected higher distribution payments tied to elevated USDC circulation balances and Coinbase’s growing on-platform USDC holdings.

Operating expenses totaled $211 million, up 70% from the prior year. Higher compensation expenses accounted for most of this increase, including $59 million in stock-based compensation during the quarter.

Adjusted operating expenses rose 35% to $131 million. This increase stemmed from higher cash compensation tied to a 14% rise in average headcount and increased general administrative expenses.

Net income surged 202% year-over-year to $214 million. The figure included a $61 million income tax benefit from stock-based compensation, research and development tax credits, and recently enacted U.S. tax legislation.

A $48 million benefit from decreased convertible debt fair value also contributed to net income. The decrease resulted from a lower stock price during the third quarter.

Adjusted EBITDA increased 78% year-over-year to $166 million. The growth reflected revenue expansion from higher USDC circulation and operating leverage within Circle’s business model.

Circle Updated Guidance and IPO Developments

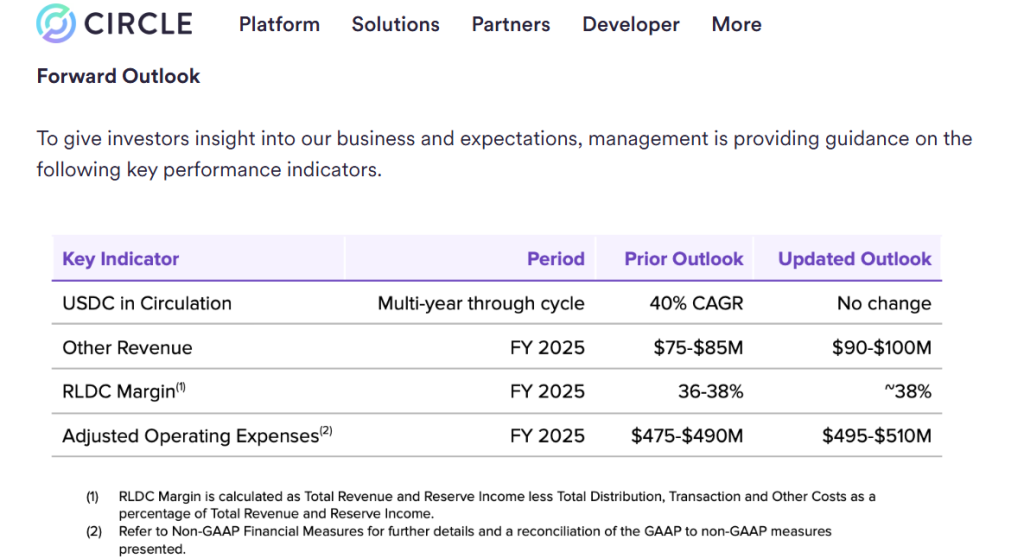

Circle raised its other revenue guidance range to $90-$100 million. The adjustment reflects higher subscription and services revenue in the third quarter and underlying transaction revenue growth dynamics.

The company now anticipates an RLDC margin of approximately 38%, reaching the upper end of its prior outlook. Adjusted operating expenses guidance increased to $495-$510 million.

The higher expense range reflects growing platform investments, capability development, and global partnerships. Additional payroll taxes from anticipated option exercises also contributed to the adjustment.

Meanwhile, Circle remains committed to its IPO plans despite ongoing acquisition discussions. In May 2025, Fortune reported that Coinbase and Ripple have expressed interest in acquiring the stablecoin issuer.

Circle seeks at least $5 billion for any potential sale, matching its targeted IPO valuation. In April 2025, the company rejected Ripple’s $4-$5 billion acquisition bid as too low.

Banking sources indicated Circle would be more receptive to a Coinbase acquisition. However, the situation remains fluid, with circumstances changing frequently according to industry insiders.

Circle filed for its initial public offering in early April 2025. The company issued a statement Monday reiterating its position that it is not for sale.

“Circle is not for sale. Our long-term goals remain the same,”

The Company stated

The firm emphasized its commitment to proceeding with the planned IPO.

Allaire highlighted Circle’s infrastructure role in helping global finance move with greater trust, transparency, and velocity.

Growing circulation, commercial partnerships, and cross-industry collaboration demonstrate progress toward a more efficient global financial system.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Amoo Jubril

Writer

Amoo Jubril

Writer

I’m a blockchain-focused content writer helping crypto brands build trust through storytelling that’s simple, authentic, and community-driven

Author profileTrending Today

Seeker

SKR

$0.05

ETHGas

GWEI

$0.03

Pudgy Penguins

PENGU

$0.01

River

RIVER

$47.92

Axie Infinity

AXS

$2.58

Lighter

LIT

$1.78

Monad

MON

$0.02

Bitcoin

BTC

$89,857.44

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft