Crypto Fundraising Surges 21% in October as 75 Startups Bag Deals Worth $4.56B

October 2025 recorded 75 funding rounds totaling $4.56 billion, driven by mega-deals from Polymarket, Tempo, and Galaxy Digital, as CeFi and DeFi sectors capture nearly half of all venture capital activity.

By Amoo Jubril

November 4, 2025 at 4:23 PM

Last updated

November 4, 2025 at 4:49 PM

KEY FACTS

- October 2025 recorded 75 crypto VC funding rounds totaling $4.556 billion, representing a 21% month-over-month increase in deal volume and 484% year-over-year growth in capital raised.

- ICE invested $2 billion in Polymarket at an $8 billion valuation, while Tempo raised $500 million for stablecoin infrastructure and Galaxy Digital secured $460 million for data center operations.

- CeFi projects dominated with 26.7% of deals, followed by DeFi at 18.7% and AI-focused ventures at 20%, as the crypto fundraising landscape continues its 2024 recovery trajectory.

Crypto Fundraising saw a significant uptick in October 2025 as venture capital funds pour over $4.56B into crypto startups.

According to Rootdata statistics, seventy-five startups secured funding across 75 publicly disclosed rounds, totaling $4.556 billion. This marked a 21% increase in deal volume compared to September’s 62 rounds.

The month-over-month fundraising amount decreased 11% from September’s $5.122 billion. However, year-on-year comparisons revealed dramatic growth. October 2025’s total represented a 484% surge over October 2024’s $780 million.

Deal volume told a different story when viewed annually. The 75 rounds represented a 25% decline from October 2024’s 100 transactions. RootData, which compiled the statistics, noted that figures may increase as delayed announcements emerge.

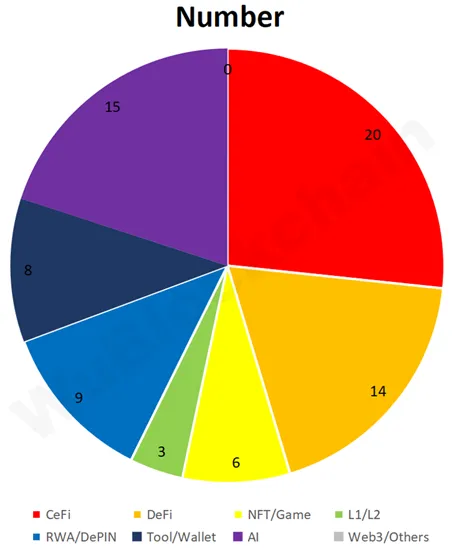

CeFi and DeFi Dominate Crypto Fundraising Allocation

Centralized finance platforms captured the largest share of October crypto fundraising. CeFi projects accounted for approximately 26.7% of all deals. Decentralized finance followed with 18.7% of the total.

Artificial intelligence-focused crypto projects secured roughly 20% of October’s funding rounds. Real-world assets and decentralized physical infrastructure networks combined for approximately 12% of deals.

Tool and wallet development projects comprised 10.7% of the funding landscape. NFT and GameFi initiatives represented about 8%, while Layer 1 and Layer 2 blockchain solutions secured just 4%.

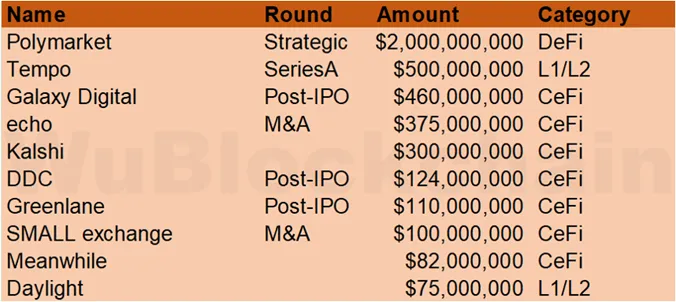

Meanwhile, ICE, the parent company of the New York Stock Exchange, deployed $2 billion into prediction market platform Polymarket. The investment valued Polymarket at $8 billion and established ICE as its global data distributor.

Tempo, backed by Stripe, raised $500 million in a Series A round at a $5 billion valuation. The blockchain startup focuses on building stablecoin payment infrastructure.

Galaxy Digital secured $460 million to finance its Texas-based Helios data center operations. Meanwhile, major exchange Coinbase acquired Echo for $375 million, marking its eighth acquisition of 2025.

Prediction market platform Kalshi closed a round exceeding $300 million at a $5 billion valuation. Sequoia Capital and Andreessen Horowitz led the investment.

DDC Enterprise raised $124 million, expanding its Bitcoin treasury to 1,058 BTC. Greenlane Holdings completed a $110 million round led by Polychain Capital for BERA liquidity operations.

Source: WuBlockchain

Kraken’s parent company Payward acquired Small Exchange from IG Group for $100 million. Meanwhile, a bitcoin life insurer regulated by the Bermuda Monetary Authority raised $82 million for its Bitcoin-backed life insurance business.

Daylight Energy secured $75 million to expand its cryptocurrency-powered solar energy network. These ten deals collectively represented the majority of October’s total capital raised.

Crypto fundraising Recovery kicked off in 2024

The crypto fundraising landscape has shown consistent recovery throughout 2024. By July 30, 2024, $2.2 billion had been raised across 24 funds, positioning the year to surpass 2023’s total.

The broader crypto market reached 93% of its previous cycle’s peak market capitalization in March 2024. Traditional financial institutions including BlackRock, Fidelity Investments, and Franklin Templeton increased crypto adoption.

Projects funded during the 2020-2022 boom period have entered more advanced development stages. This maturation created more attractive investment opportunities for venture capital firms.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Amoo Jubril

Writer

Amoo Jubril

Writer

I’m a blockchain-focused content writer helping crypto brands build trust through storytelling that’s simple, authentic, and community-driven

Author profileTrending Today

Seeker

SKR

$0.05

ETHGas

GWEI

$0.03

Pudgy Penguins

PENGU

$0.01

River

RIVER

$47.92

Axie Infinity

AXS

$2.58

Lighter

LIT

$1.78

Monad

MON

$0.02

Bitcoin

BTC

$89,857.44

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft