Ethereum Tests $2,000 Support While Vitalik Buterin Highlights AI’s Role in Ethereum’s Future

Co-founder outlines human-centered AI integration as derivatives data reveals extreme funding levels and technical indicators point to continued downside pressure

8 hours ago

Last updated

8 hours ago

KEY FACTS

- Ethereum trades at $2,029 while testing critical $2,000 psychological support after an 11.61% weekly decline.

- Vitalik Buterin outlined Ethereum's potential role in AI integration, emphasizing human-centered development and decentralized coordination.

- Technical indicators remain bearish with RSI oversold at 29.81 and MACD deeply negative, suggesting downside toward $1,850-$1,750.

Ethereum trades at $2,029.16 as the second-largest cryptocurrency tests the critical $2,000 psychological support level. The asset posted a modest 0.76% gain in the past 24 hours but remains down 11.61% over the past week. Its market capitalization now stands at approximately $244.32 billion.

According to Lookonchain, Ethereum exchange-traded funds recorded a net daily outflow of 54,718 ETH, equivalent to $112.28 million. On a weekly basis, ETFs also registered a net outflow of 93,712 ETH, valued at $192.3 million.

Meanwhile, Ethereum co-founder Vitalik Buterin released an updated perspective on integrating Ethereum with artificial intelligence. He emphasized pursuing a positive path that prioritizes human freedom and security in an AI-driven future.

The timing of Buterin’s commentary arrives as ETH faces mounting technical pressure. Derivatives data from major exchanges reveals significant shifts in market positioning that could influence near-term price direction.

Buterin Outlines Vision for Ethereum-AI Integration

Buterin revisited his two-year-old thesis on potential Ethereum and AI intersections. He noted that while excitement around the topic runs high, the two fields often operate from completely different philosophical frameworks.

He argued that framing AI progress as simply “working on AGI” is flawed. This approach encourages undifferentiated acceleration rather than intentional direction, similar to vaguely describing Ethereum as “working in finance.”

Both Ethereum and his vision for AI focus on choosing a human-centered path, Buterin explained. This path preserves human freedom, avoids centralization of power, and reduces existential and systemic risks.

He outlined several concrete areas where Ethereum could contribute. These include building tools for trustless and private AI interaction, such as local LLMs, zero-knowledge payments for AI APIs, and cryptographic privacy for AI usage.

Buterin also described Ethereum’s potential role as an economic coordination layer for AI. This would enable API payments, bot-to-bot interactions, reputation systems, and decentralized dispute resolution.

AI could make the cypherpunk vision of “don’t trust, verify” practical, he added. Local models could interact with Ethereum apps, propose and verify transactions, audit smart contracts, and evaluate trust assumptions.

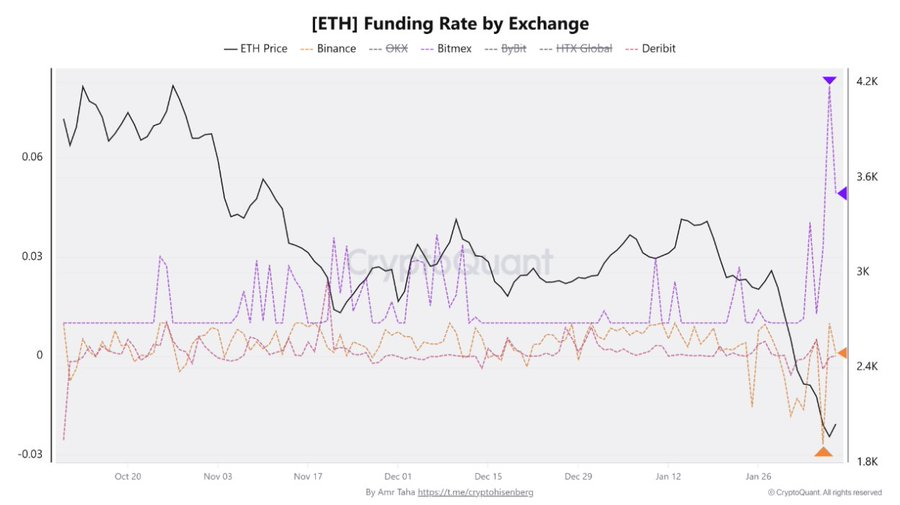

ETH Funding Rates Reveal Shifting Market Sentiment

The funding rate across major exchanges presents a mixed picture for Ethereum’s near-term outlook. BitMEX funding rate surged to an extreme positive level of 0.049%, a level not observed since October.

This value exceeded the late-October peak near 0.03%, marking escalation in leverage on the long side. Historically, strongly positive funding driven by leverage expansion has increased the probability of sharp corrective moves.

At Binance, the largest derivatives venue by volume, ETH funding moved from deep negative levels of -0.025% on February 5. It has since returned toward neutral territory at the time of writing.

This transition suggests long positions now dominate new open interest. Short exposure that previously controlled the market has been replaced with bullish positioning.

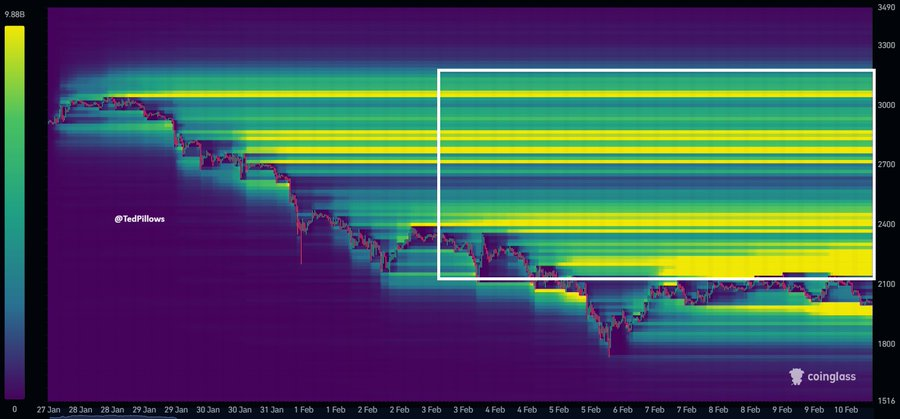

Analyst Ted Pillows noted that Ethereum currently has significant liquidity stacked above its price. The largest concentration sits between $2,200 and $2,400, which could be targeted if ETH reclaims $2,150.

ETH Price Trajectory and Key Levels

ETH/USD maintains a confirmed macro downtrend with a clear pattern of lower highs and lower lows since the mid-2025 peak above $4,000. The asset failed to hold the critical $2,800-$3,000 demand zone, which now serves as resistance.

The Relative Strength Index reads 29.81, placing Ethereum in deeply oversold territory. However, the RSI has remained below the 50 midline since October 2025, and oversold conditions can persist in strong downtrends.

MACD readings remain extremely bearish at -36.87 against a signal line of -236.85. The histogram continues expanding red, with both lines far below the zero baseline. No bullish crossover attempt appears visible on current charts.

Immediate support sits at $2,000, with a minor demand pocket at $1,980-$1,950. Major support targets range from $1,850 to $1,750 if the current level breaks. Resistance clusters at $2,150-$2,200 and $2,400-$2,600.

Volume analysis reveals elevated activity on the recent decline, confirming distribution rather than panic selling. Volume spikes at the $2,000 test suggest institutional participation, with higher volume on down days throughout the decline.

The path of least resistance remains downward toward $1,850-$1,750 until proven otherwise. Any relief rally to $2,150-$2,250 would likely face strong supply. A reclaim and hold above $2,400 with conviction would be required to signal a potential reversal. The current outlook remains bearish.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Berachain

BERA

$1.23

LayerZero

ZRO

$2.29

Uniswap

UNI

$3.49

Pudgy Penguins

PENGU

$0.01

Hyperliquid

HYPE

$29.84

Bittensor

TAO

$148.53

Bitcoin

BTC

$67,597.56

Aave

AAVE

$108.89

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft