JPMorgan Strategist Says Bitcoin Undervalued After 20% Correction — BTC to $170K?

Banking giant's strategist projects $170K target as Bitcoin's volatility ratio versus gold drops below 2.0, creating significant upside potential over next 6-12 months

November 6, 2025 at 9:59 PM

Last updated

November 6, 2025 at 10:02 PM

KEY FACTS

- JPMorgan strategist declares Bitcoin undervalued by $68,000 compared to gold after 20% correction from $126,000 peak, with futures markets now stabilized.

- Bank's volatility-adjusted analysis projects Bitcoin could reach $170,000 within 6-12 months, requiring 67% increase from current $2.1 trillion market cap.

- Technical analysis shows BTC trading at $101,757 within $100K-$117K range, with breakout above resistance potentially targeting $140K despite bearish scenarios.

JPMorgan’s Global Market Strategist Nikolaos Panigirtzoglou has declared Bitcoin undervalued compared to gold following its 20% correction from recent highs. The banking giant estimates a theoretical price target of $170,000 based on volatility-adjusted comparison to private-sector gold investment.

According to a report from The Block, Panigirtzoglou noted that Bitcoin futures markets have stabilized after the roughly 20% drop from BTC’s peak at $126,000. The decline resulted from perpetual futures liquidations in October and November, including a $120 million Balancer DeFi exploit that temporarily worsened market sentiment.

Bitcoin recently recovered above the critical $102,000 support level, after the cryptocurrency briefly fell below the psychological $100,000 mark yesterday for the first time since June.

At press time, Bitcoin trades at $101,757, reflecting a 2.48% decline over 24 hours and a 4.81% drop across seven days.

JPMorgan’s $170K Price Model Based on Gold Comparison

Panigirtzoglou stated that most futures unwinding is likely complete, creating a more stable near-term outlook. Rising gold volatility has simultaneously made Bitcoin more attractive on a volatility-adjusted basis.

With Bitcoin’s volatility ratio versus gold now below 2.0, JPMorgan calculates that its current $2.1 trillion market cap would need to increase by approximately 67%. This adjustment would bring Bitcoin’s theoretical price to around $170,000 to match private-sector gold investment on a risk-adjusted basis.

JPMorgan analysts wrote that the gap between Bitcoin’s price and their volatility-adjusted gold comparison shifted from highly positive territory at end-2024 to negative territory currently. Bitcoin’s price is now $68,000 too low compared to gold, having been $36,000 too high at year-end 2024.

The analysts added that this mechanical exercise implies significant upside for Bitcoin over the next six to twelve months.

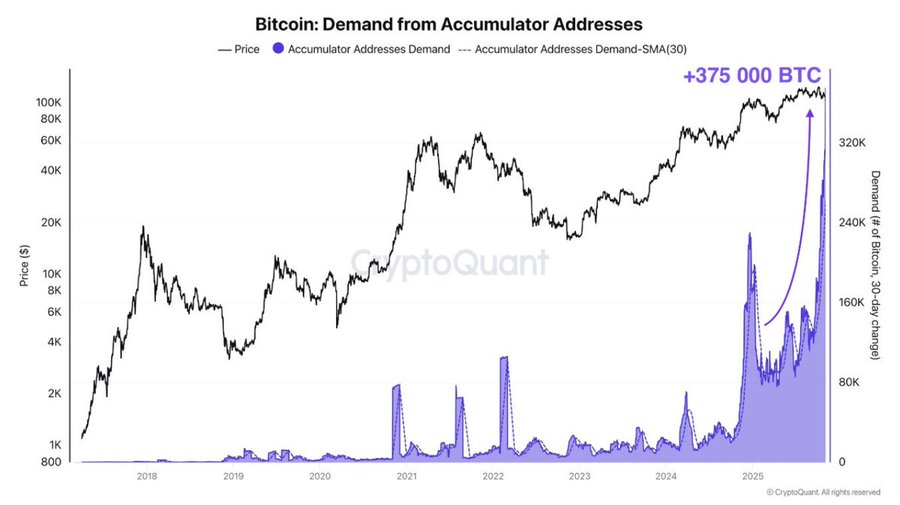

Also, data from CryptoQuant shows that Bitcoin accumulation has surged to record levels, from 130K to 262K $BTC showing whales are accelerating their buys.

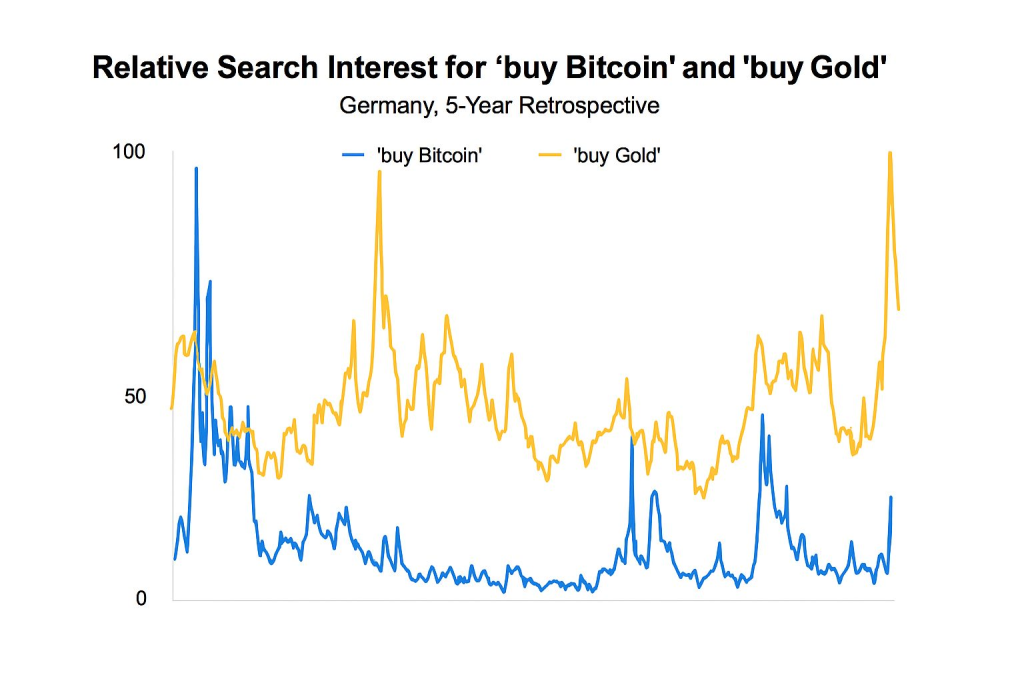

Meanwhile, public interest data shows gold still dominates mainstream attention. Google Trends data from Germany reveals the search term “buy gold” reached a five-year high of 100 several weeks ago and currently stands at 64.

In contrast, “buy Bitcoin” rose only from 11 to 27 points during the same period, highlighting Bitcoin’s growth potential among retail investors.

Bearish Scenarios Remain in Play

Despite JPMorgan’s bullish forecast, bearish technical indicators persist. Yesterday, BTC broke down through the support zone near $103,500, triggering an aggressive decline to $99,480.

Analysts warn that if Bitcoin fails to reclaim the $103,500 support zone, further declines toward $94,300 and potentially $89,000 could materialize.

Technical analysts noted that Bitcoin recently formed a symmetrical triangle with bulls making a false breakout above it. This pattern has transformed into a bearish flag, considered a very bearish technical formation.

Source: TradingView

The price has consolidated within this pattern for multiple weeks, with a significant move anticipated soon, most likely to the downside according to bearish analysis.

Technical Analysis: BTC Tests Critical $100K Floor With Breakout Above $117K Needed for Rally.

Bitcoin currently trades within a defined range between $100,000 support and $117,000 resistance. The cryptocurrency maintains position just above the critical psychological $100,000 level, which has shown strong buying interest during multiple tests.

Chart analysis identifies a “Whale Buy Zone” around $105,000-$110,000, representing institutional accumulation territory. A “Strong Buy Zone” exists near current price levels, indicating favorable risk-reward entry positioning.

The compression pattern shows narrowing range action over time with decreasing volatility, typical before significant expansion moves. Volume has decreased during consolidation, suggesting an accumulation phase with mixed signals indicating market indecision.

If Bitcoin breaks above $117,000 resistance with volume confirmation, the measured move projects targets toward $140,000, representing approximately 20% upside. An intermediate target sits at $120,000 before further advancement.

However, a decisive break below $100,000 would invalidate the bullish setup and potentially trigger downside targets at $94,300 and $89,000 as bearish analysts suggest.

The current technical structure presents a neutral-to-bullish bias pending breakout confirmation, with the $117,000 level serving as the critical trigger for projected rally continuation.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.04

ETHGas

GWEI

$0.03

River

RIVER

$48.16

Axie Infinity

AXS

$2.59

Canton

CC

$0.15

Pudgy Penguins

PENGU

$0.01

Lighter

LIT

$1.8

Monad

MON

$0.02

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft