U.S SEC TO APPROVE FIRST SPOT XRP ETF SOON — XRP To $3 Next?

4 Mins

November 11, 2025 at 3:42 PM

Last updated

November 11, 2025 at 3:42 PM

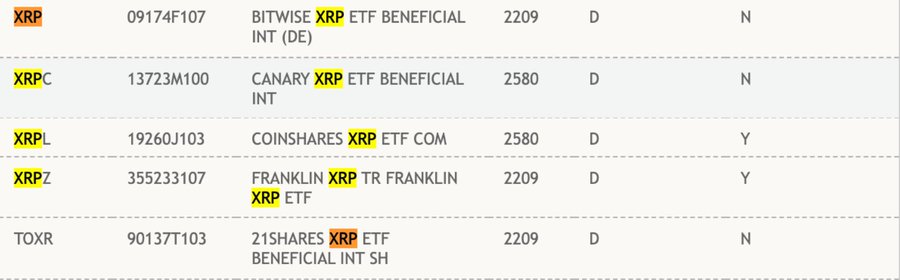

The Depository Trust & Clearing Corporation has listed five spot XRP exchange-traded funds (ETFs) from major asset managers as active and pre-launch. The move advances preparations for potential U.S. trading upon SEC approval.

Franklin Templeton, 21Shares, Bitwise, Canary Capital, and CoinShares have their XRP ETFs now listed on DTCC systems. The listings follow Ripple’s recent legal victory clarifying XRP’s non-security status in secondary sales.

XRP’s price climbed 9.39% in the last 24 hours to $2.55. Trading volume jumped 55% to $4.3 billion. The token’s market capitalization reached $153.68 billion.

Over the past week, XRP gained 9.12%. The rally comes as the U.S. government shutdown approaches resolution, potentially clearing the path for regulatory approvals.

ETF Launches Break Records as Institutional Interest Grows

Recent XRP ETF launches have already set trading records. Rex Shares-Osprey XRPR ETF recorded $38 million in initial trade volume on its first day.

ProShares Ultra XRP (UXRP) and Teucrium XRP ETF (XXRP) attracted institutional investment flows. The products provide investors with additional avenues to access XRP in regulated markets.

The potential ETF approvals parallel previous launches of Bitcoin and Ethereum ETFs. These could draw institutional investment to XRP for cross-border payment applications.

Over six months, XRP climbed from approximately $0.85 to around $2.55. The steep rise was driven by ETF speculation and growing market confidence. A gain of over 160% makes XRP one of the best-performing major altcoins.

Meanwhile, President Trump announced Sunday that most Americans will receive a $2,000 “dividend” from tariff revenue. The payment excludes high-income individuals.

This measure is expected to inject approximately $400 billion into the economy by early 2026. Crypto markets reacted instantly, with total market cap rising 4.7% to $3.58 trillion.

XRP Leads Altcoin Rally.

Bitcoin led the gains, up 4% to trade at $106,200. Ether gained 5.8% to $3,600. XRP gained the most among top 10 cryptocurrencies.

The token rose from a low of $2.23 on Sunday to an intra-day high of $2.47 on Monday. The movement reinforced the intensity of sell-side activity.

Bitcoin dominance closed another weekly candle below the EMA-50. Historically, when BTC dominance loses this level, it marks capital rotation into altcoins.

Crypto researcher @RipBullWinkle stated XRP is in the early stages of a major breakout, with its volume spiking and resistance is flipping.

Sistine Research, a digital asset analysis platform, has also confirmed by saying that XRP is poised to lead market as Government reopens with catalyst of banking charter, clarity act & ETF approvals on the horizon.

XRP recently dropped nearly 44% from its July peak of $3.84. The decline occurred around the time of major institutional and ETF-related announcements. The current trend shows consistent growth as traders buy in anticipation of potential ETF approvals.

XRP Tests Key Resistance at $2.55 with Bullish Indicators Strengthening.

XRP trades at $2.55, testing a descending trendline from October highs around $2.80. The price currently sits above the 50 EMA at $2.3587 and 100 EMA at $2.4053.

However, XRP remains below the 200 EMA at $2.4975, which provides immediate dynamic resistance. The crossover of shorter EMAs above longer ones suggests emerging bullish momentum.

The RSI is nearly at 53.68, approaching overbought territory but maintaining a healthy and neutral position. The RSI remains well above the 50 midpoint.

The MACD line sits at 0.0482 above the signal line at 0.0309. The histogram shows positive at 0.0174. A bullish crossover has been maintained since last Wednesday with expanding histogram bars.

Critical resistance levels stand at $2.6920, $2.5700, and the 200 EMA at $2.4975. Key support zones include $2.4900, $2.3587, and $2.1888.

A daily close above $2.57 would confirm bullish momentum, targeting $2.6920 first, then $2.80-$2.85. Failure to hold $2.49 could trigger a retest of $2.35-$2.36 or deeper correction to $2.32.

XRP sits at a critical juncture near the apex of a compression pattern. The $2.49-$2.50 zone is crucial support for maintaining the $3.0 bullish structure.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

ETHGas

GWEI

$0.03

River

RIVER

$46.58

Oasis

ROSE

$0.02

Ondo

ONDO

$0.34

Pudgy Penguins

PENGU

$0.01

Solana

SOL

$130.96

Zcash

ZEC

$369.16

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft