Whales Accumulate Bitcoin as Binance Sees Record Outflows — Bulls Target $108K Breakout

4 Mins

November 12, 2025 at 10:25 PM

Last updated

November 13, 2025 at 12:07 PM

KEY FACTS

- Whales are accumulating Bitcoin, pulling massive amounts off Binance.

- ETFs added over $524M this week despite recent price dips.

- Bitcoin faces key resistance at $108K, with a death cross hinting at a dip to $96k.

Bitcoin is quietly heating up again as whales pull massive amounts of BTC off Binance, one of the biggest exchange outflows of the year.

The sudden spike in outflow transactions marks a significant shift in investor behavior across the cryptocurrency market. That kind of movement usually means accumulation, not panic.

Big players seem to be banking on the next leg higher, with everyone’s eyes now on the $108K level, a key resistance that, if broken, could set the stage for a push toward $111K and beyond.

Investors move their holdings off exchanges into cold wallets. The timing coincides with October’s consolidation phase around $103,000.

At press time, Bitcoin trades at $101,312.52, down 1.81% in 24 hours. The cryptocurrency has declined 2.68% over the past seven days. Earlier, Bitcoin briefly touched $107,000, marking its highest level in recent weeks.

Whales Accumulate as ETF Inflows Return

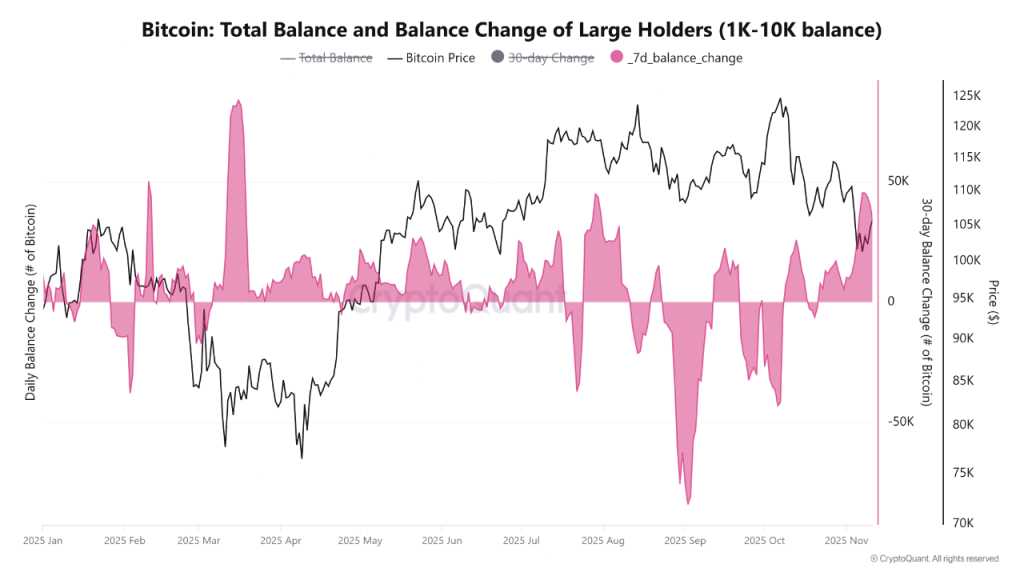

CryptoQuant Data shows that whales accumulated more than 45,000 BTC last week. This marks the second-largest weekly accumulation process recorded in these wallet categories.

Meanwhile, U.S. spot Bitcoin exchange-traded funds added $524 million in net inflows on Tuesday, according to data from SosoValue. This represents the largest daily figure since the cryptocurrency reached all-time highs around $126,000 on October 6.

Since launching in January 2024, Bitcoin ETFs have attracted total net inflows of $60.8 billion. Cumulative trading volume now approaches the $1.5 trillion milestone. The inflows occurred despite Bitcoin dropping roughly 3% to around $103,000.

K33 Head of Research Vetle Lunde noted that 30-day flows stood at -29,008 BTC. This marks the worst 30-day flow since March 2025 and weaker flows than any period in 2024.

“We view the recent sale pressure from ETF owners as a temporary reflection of derisking,” Lunde stated. He expects 30-day flows to trend higher, with the current level marking the bottom for H2 2025.

Binance Inflows Signal Distribution Phase

Following the early October liquidation event, some investors have secured profits and reduced exposure. Daily BTC inflows into Binance accelerated significantly throughout October.

On average, around 7,500 BTC are being sent to Binance each day. The market has not witnessed such inflow levels since the March correction.

These flows reflect intensified selling pressure. Yet despite sizeable inflows, Bitcoin continues consolidating around the $100,000 level. Current demand appears strong enough to absorb the selling.

Short-term holders have contributed to this selling pressure. These investors, typically more reactive to price fluctuations, are participating in the distribution phase. With a realized price around $112,000, short-term holders have been underwater for a month.

In contrast, a Satoshi-era whale sold 10,000 BTC worth $1 billion. The transaction contributed to a 2% price dump. Additionally, Matador Technologies raised $100 million to buy more Bitcoin. The company plans to acquire 1,000 BTC by 2026 and 6,000 BTC by 2027.

Technical Analysis: Bitcoin Tests Key Resistance as Death Cross Looms.

Bitcoin currently trades at $105,979, down 1.53% for the session. The chart reveals a critical rejection zone forming near the 200-day EMA.

Primary resistance sits at $108,000-$110,021, where the 200-day EMA confluence creates a formidable barrier. Secondary resistance stands at $128,000, representing previous October highs.

Immediate support holds at $100,000-$104,000, with critical support at $96,000. The death cross configuration indicates bearish momentum in the near term.

Multiple attempts to reclaim the $108,000 level have been rejected. Since the October peak near $128,000, price has been making lower highs.

Elevated volume during the recent decline suggests strong selling pressure. Previous support zone breakdowns also showed increased volume. The current selling wave appears to have institutional participation.

The $108,000 level represents a convergence of the 200-day EMA, previous support turned resistance, and psychological significance. A strong daily close above $108,000 with sustained trading above the 200-day EMA would improve the technical picture.

Bitcoin faces bearish structure below $108,000. A break below $100,000 would likely trigger cascade selling toward $96,000. The repeated rejection at the 200-day EMA combined with negative slope of both moving averages suggests bears maintain control.

Disclaimer: Coinwaft is a crypto media platform providing cryptocurrency news, analysis, and trading information. The content of this article is for informational purposes only and should not be considered as financial, legal, or investment advice. Readers are advised once again to research or consult a financial expert before making any financial decision.

© 2026 Coinwaft. All Rights Reserved.

Abdul-Raqeeb Hussayn

Abdul-Raqeeb Hussayn

I'm a Web3 content writer with a Web2 marketing background. I create blogs, reports, and market analysis that make complex blockchain concepts clear for readers and credible for investors.

Author profileTrending Today

Seeker

SKR

$0.02

Bitcoin

BTC

$89,810.45

ETHGas

GWEI

$0.03

River

RIVER

$46.47

Pudgy Penguins

PENGU

$0.01

XRP

XRP

$1.96

Lighter

LIT

$1.75

Solana

SOL

$130.15

newsletter

Busy Wealth

Join the Busy Wealth newsletter that helps thousands of investors get early alpha and understand the crypto market.

By pressing the "Subscribe button" you agree with our Privacy Policy.

Crypto Today

Coinwaft

Coinwaft